A Phone Call With the Guy Behind the Move

Hey!

Matt Saincome, CEO of Unusual Whales, here.

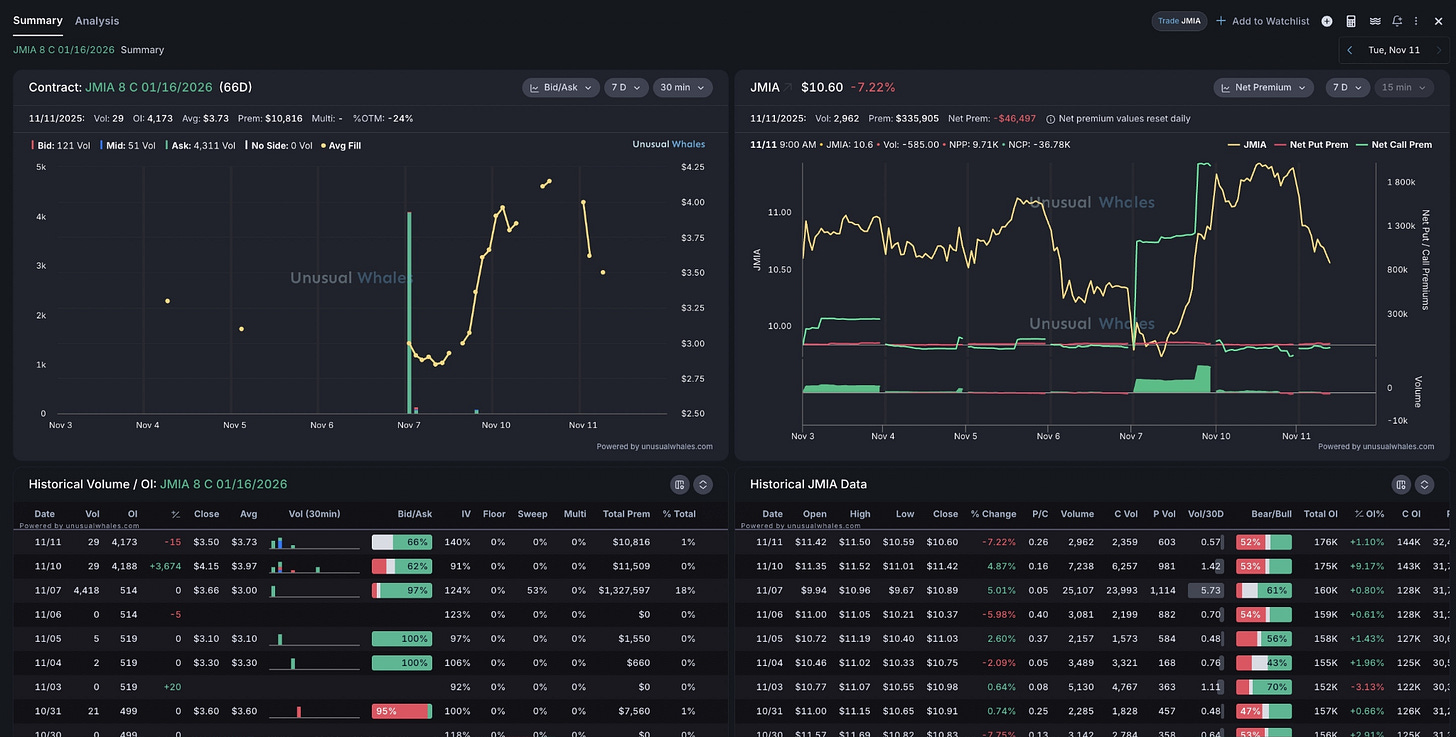

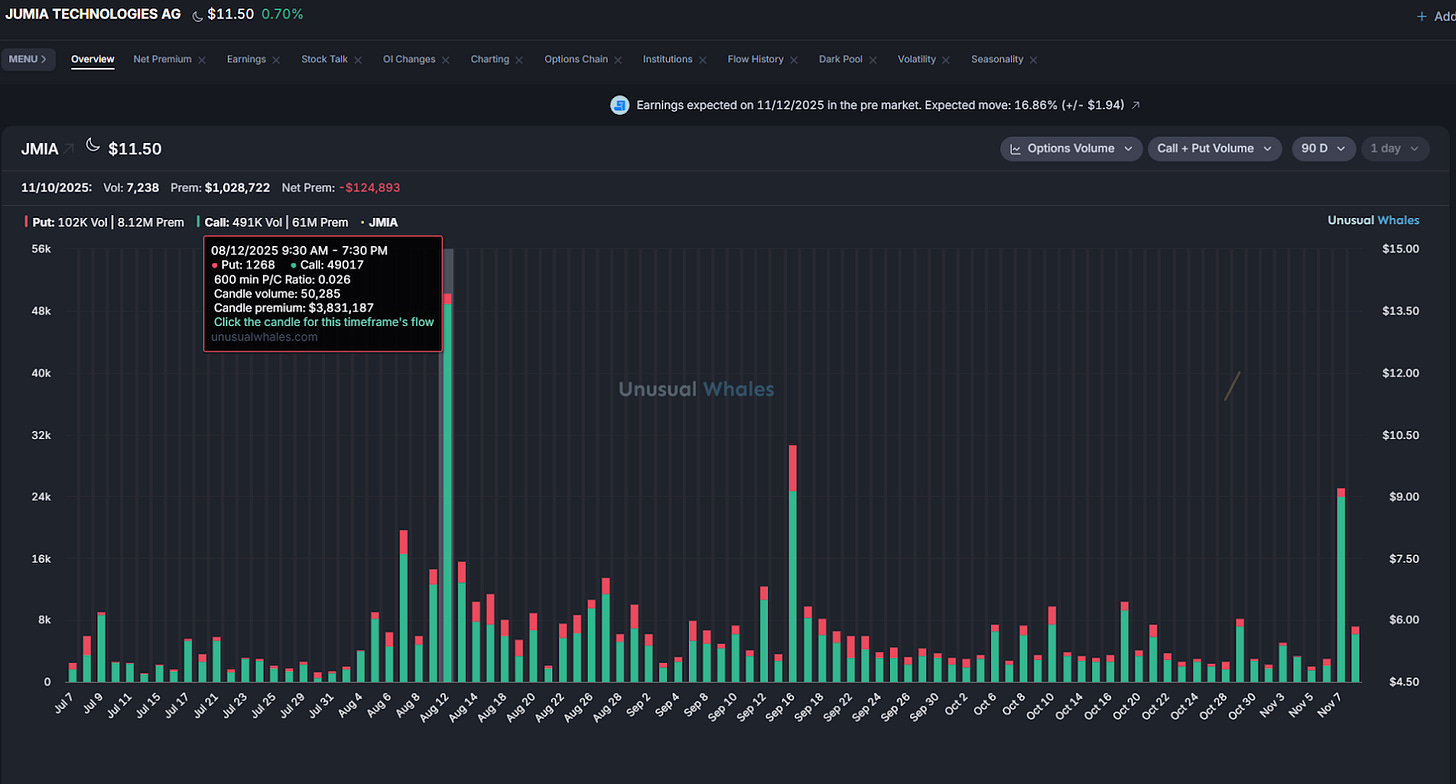

I spotted some unusual options activity via the Unusual Whales platform last week that really caught my attention. There was a big jump in bullish options flow on Jumia Technologies ($JMIA), an African e-commerce platform with earnings coming up.

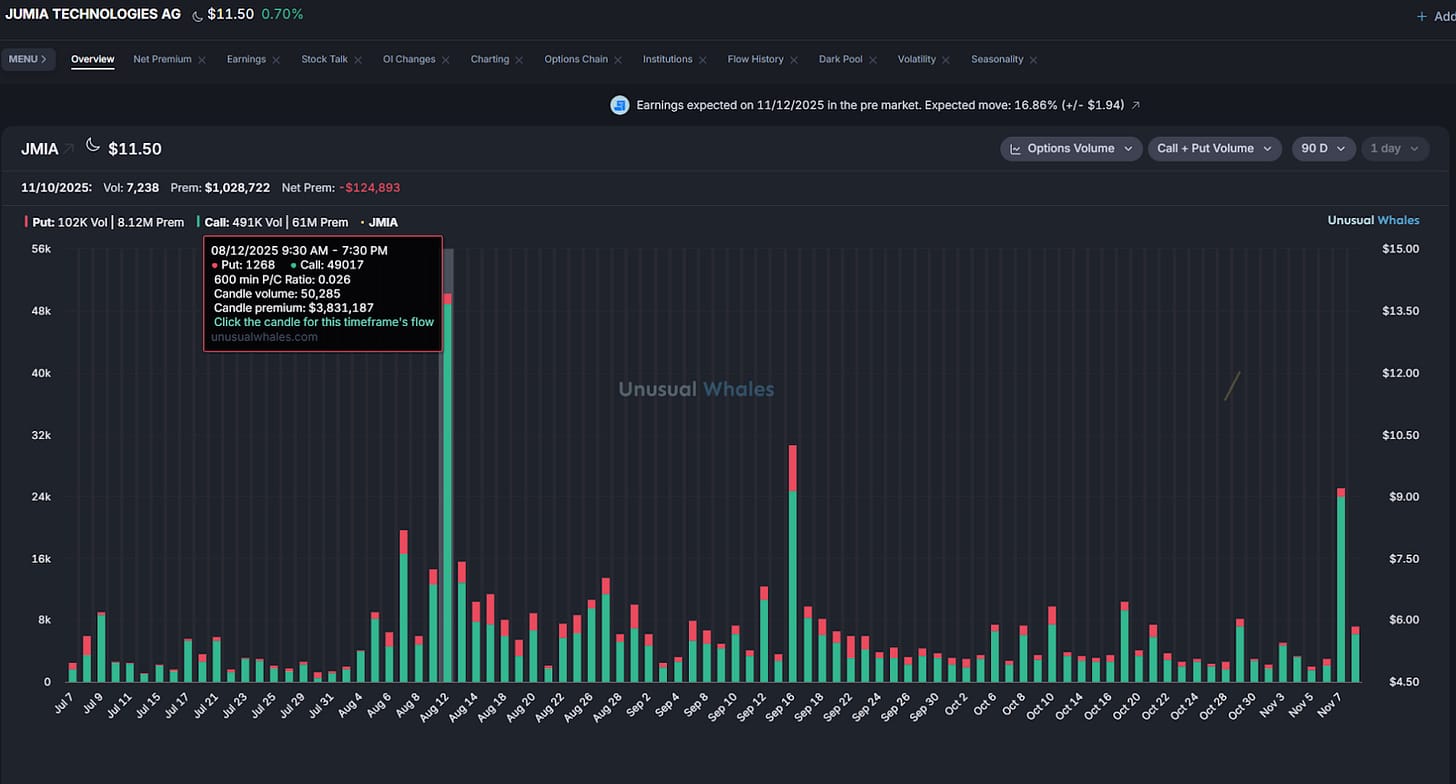

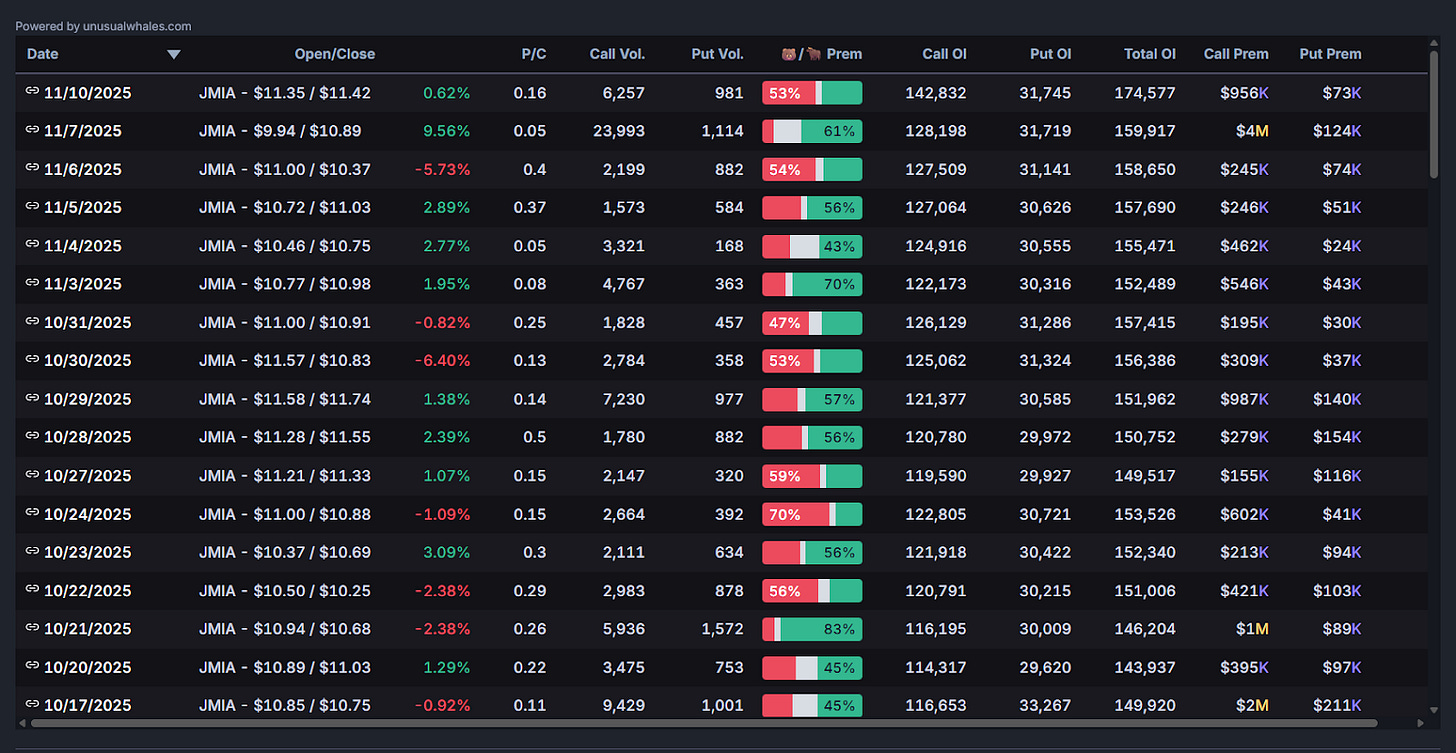

The volume spike on call options on Friday 11/7/2025, as seen in the screenshot below, was hard to miss.

It looked like a whale had developed serious conviction in Jumia ahead of earnings on 11/12/25, so I decided to follow their lead and picked up a few call options myself. I make trades like this regularly. Sometimes they work, sometimes they don’t, and I’m comfortable with that.

Then, I actually got a chance to talk to the whale.

The Whale Behind the Flow

After I built my position, I asked friends and Unusual Whales team members what they made of my trade and the flow I was seeing on the platform.

That’s when one of my old investors responded with, “Wait, I might know the guy. Let me see if he’ll talk to you.”

I couldn’t believe it, but after a series of connections and hand-offs, last night I found myself talking to the whale.

The data on my screen had come to life. The person I thought I spotted in the data was now on the other end of the phone, happy to answer any questions – At least so I thought… more on that later.

The whale was humble and generous with his time. He explained he manages a few billion dollars (just ever so slightly above my assets under management) and previously lived and worked in Africa. He has invested in private companies in the country that should be correlated to Jumia, in part to better understand the market and gain insights. He and his team had recently visited Jumia pickup stations in Africa and interviewed the CEOs of the correlated private assets. He had a lot of information for me, and pointed me in the direction of many key data points, but the short version of his pitch was: this is an inflection point for African ecom as a whole, and Jumia had a chance to win it all.

And if Jumia has even a slightly higher chance of becoming a “Mercado Libre for Africa” than the market currently expects, there could be a repricing of the stock.

Many traders online want to believe “someone always knows” – and I am definitely guilty of that at times too – but the whale, who I had originally intended to blindly follow based on data on my screen, didn’t speak in those terms. He sounded more like my old online poker friends, thinking through a game of incomplete information. He didn’t delude himself into thinking he knew something he couldn’t (a stock price’s future movement). He just did all the work to know what was possibly knowable, liked his odds, built conviction, then built his position.

“In my business I really only need to be right something like 52% of the time,” he explained. He thinks this is one of those times that proves his edge.

I then pestered him with questions for over an hour.

After the call, then doing more of my own research… His conviction was contagious.

Here’s what he pointed out to me:

New Leadership

The new CEO of Jumia, Francis Dufay, was previously the head of the company’s Ivory Coast efforts – which quickly became its biggest success. Can this new CEO replicate his success across other markets like Nigeria? His moves so far are looking good.

He has refocused the company towards lower price point goods. Previous management too often sold brands that were simply out of the price range for most consumers in the region. The whale notes he is particularly happy to see there is a Black Friday deal that has a smart TV for $60.

In an interview, Dufay, the new CEO, explained for his business that consistent supply at appropriate price points is actually the hard part of the equation, not demand.

The new CEO also cut costs on unprofitable divisions, and instead of figuring out last mile delivery (which can be expensive and logistically complicated in the region) has continued a successful push into pick up stations which have become community watering holes and a part of people’s daily or weekly rituals. Nigeria alone now has 350+ pickup stations.

Dufay says his customers are more willing to deal with the inconvenience as long as the price point and supply is correct. So the pickup stations – which also accept cash at delivery – work.

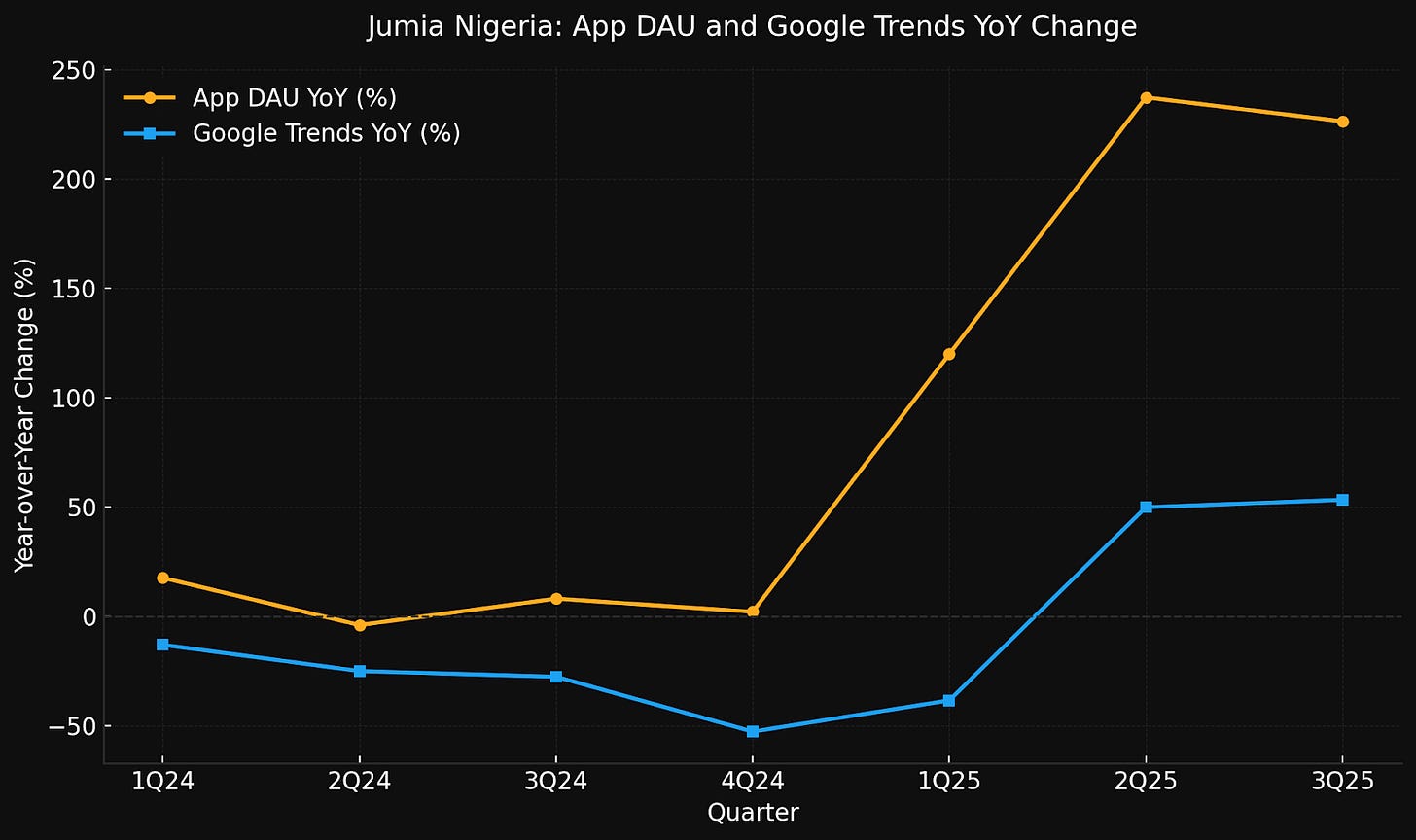

DAU data from third party sources shows it may all be working: +237% YoY app users in Nigeria in 2Q25 (Apptopia) and web traffic still 2–3× Temu’s (which has made a push into the country, but seems to maybe be faltering).

Structural and Macro Tailwinds

For the first time in a decade, Nigeria’s macro environment is starting to work in Jumia’s favor.

Inflation, which was over 23% in 2024, has dropped to around 18%. The naira has stabilized, and Nigeria’s foreign exchange reserves have climbed from $33 billion to over $43 billion. GDP growth has accelerated from 2.9% to 4.2%. And perhaps most importantly, the country has flipped from a current account deficit to a 6–7% surplus.

These shifts matter. A stronger currency, lower inflation, and pro-business reforms ahead of the 2027 elections all make it easier for Nigerian consumers to spend and for companies like Jumia to manage their operations.

The whale I spoke with also pointed out something interesting: he believes the U.S. and China trade war forced Chinese manufacturers to look elsewhere for customers. Africa became the fallback market, and gained some negotiating power. At first it may have been desperation on the part of Chinese suppliers, but once they tested the African demand and volume started flowing, the relationship became more entrenched. His take matches Dufay’s: Africa didn’t have a demand problem, it had a consistent supply (at the right price) problem.

New, Stable Investors

In May, AXIAN Telecom, one of Africa’s largest telco/fintech operators disclosed a 9.97% stake and took a board seat. AXIAN’s CEO Hassanein Hiridjee personally joined Jumia’s board.

A Series of Upcoming Catalysts

Jumia has earnings on Weds 11/12/25. After that the company will hold its first ever “Investor Day” on Thursday 11/13/25 in London. Then, it is likely, based on past publishing schedules, on Dec 6 the company will announce the results of its Black Friday sale (which lasts a month in Africa and is already running).

So, it’s a volatile stock, heading into some big catalysts. But the biggest catalyst of all will still loom large after these events: The company becoming profitable.

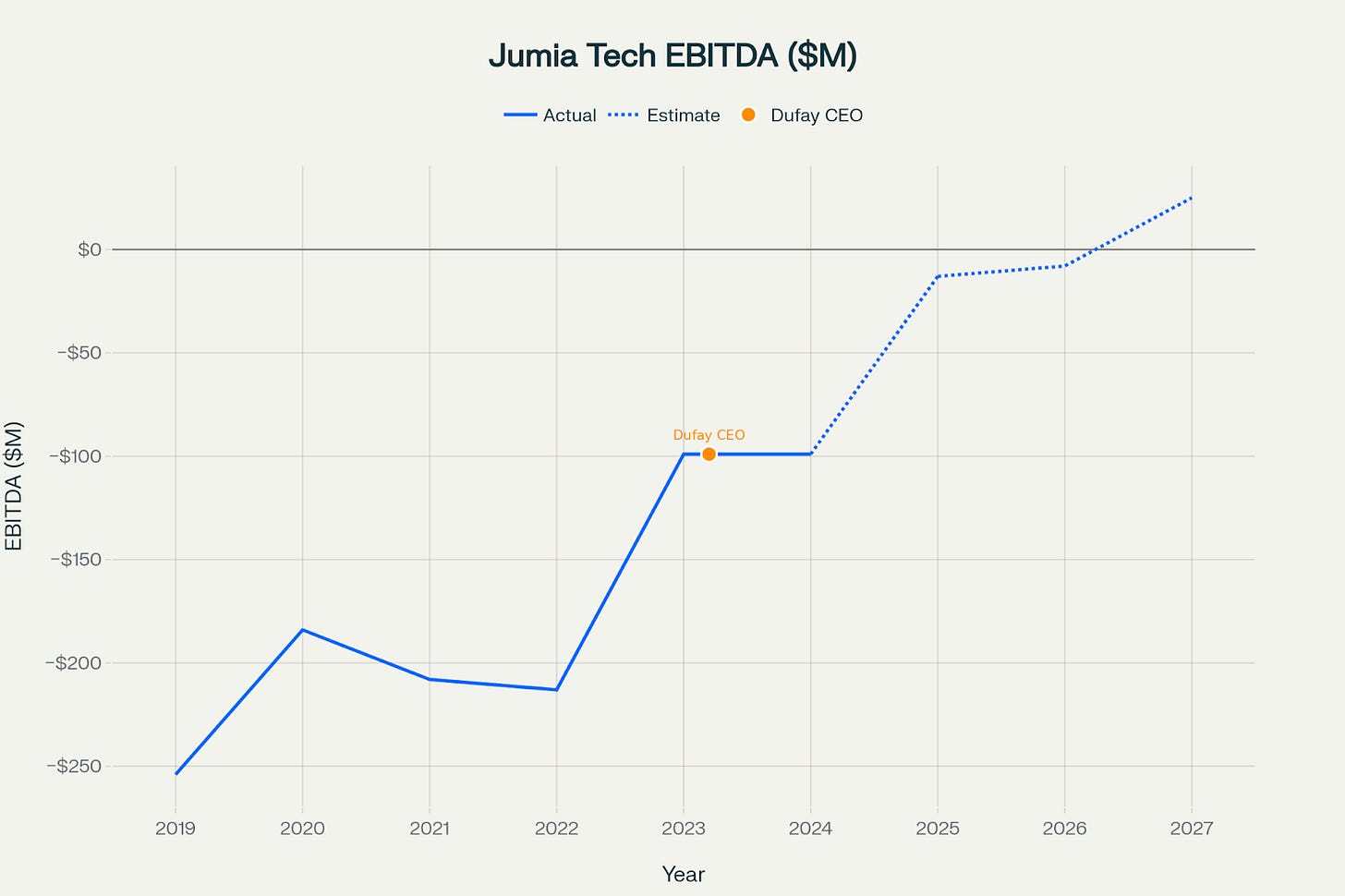

Management guides to FY-2027 profitability, but The Whale thinks maybe 4Q-2026 is achievable.

So… how much do they have to grow to become profitable, and is it realistic? Let’s take a look.

According to management and some independent analysts, revenue needs to grow about 13-15% per year (Q2’25 YoY growth was ~25%), along with continued cost/expense discipline in order for the company to become profitable.

To illustrate the point, here’s a graph made by our partners at Perplexity.

Investors want to see sustainable, accelerating top-line growth paired with operating leverage on sales and marketing. One thing helping here, according to Dufay, is that marketing becomes much more effective on a per-dollar basis when his supply is right. The way he puts it: when price sensitivity is this high, advertising a $7 sneaker is a lot less cost effective than advertising a $6 sneaker. Because of the changes with the Chinese suppliers, he now has the required supply of $6 sneakers worth advertising.

After restructuring in late 2024, GMV and revenue have been on an accelerating path, with GMV growth at ~20% in the most recent period. If the trend continues, or especially if it accelerates further, the path to profitability is more clear. As that path becomes more concrete and more understood by market participants, The Whale sees a change in how the company is valued.

“I could see a 5x move by 2029,” he says, granted the trend continues to play out.

One Last Twist

Although we’re just getting to know each other, and he doesn’t have to tell me, I decided I’m going to ask the whale some direct questions about his personal holdings.

I started this journey because I saw 25,000 options contracts trade hands. The Whale clearly has a large position, including options, and has spent a lot of time, money, and energy building insights and conviction around his position. But he hasn’t told me he was the exact volume spike I saw at the start of my journey.

“Are those 25,000 contracts you?”

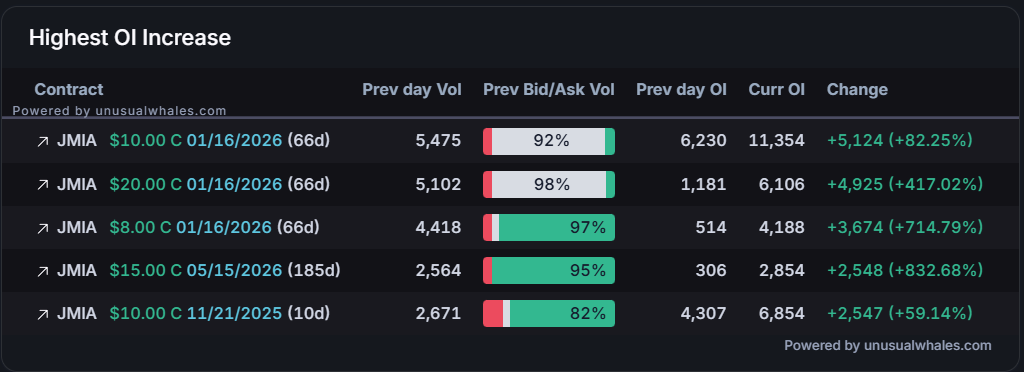

No, he says. It wasn’t him, and he hadn’t seen the flow pop off on Friday, but finds it interesting. He asks me a couple times to confirm, “are you sure it was 25,000 and not 2,500?” He sounds a little excited by it. He explains he built his position before that and thinks the other guy, who is buying in the money calls, might be better off going outside the money.

“The market could be mispricing those more than in the money contracts,” he says.

So, it turns out I was speaking to a different whale… but I’m not mad about that. To me, that means we have at least two high-conviction whales out there betting in the same direction. At least one of them seems to have really done his homework. So, I’m going to join them.

Also, zooming out a bit on the options volume, I notice something peculiar. There are three spikes. The most recent one which caught my attention was ~25,000 calls.

A previous one on Sep 16? Right around 25,000 calls. And a bigger one on Aug 12th… 50,000 calls.

All together that equals 100,000 calls.

Could that be one person who wanted a nice round 100,000 call options? I have no real way to know, I suppose, but I just think that’s an interesting round number for all of the spikes to add up to – almost like someone is averaging into a position.

My Take

I took a small trade. I just don’t have the time to learn enough about African ecom logistics, the discretionary spending in all the different countries they need to expand into, and other elements of this very interesting business to build deep conviction. I bought a couple outside the money calls for my personal trading account and am going to track some of the specific options positions others have built up via the contract look up feature on the Unusual Whales platform. That will tell me when some of these whales start to exit their positions.

It looks like I’m not alone out there on the higher end of the options chain, at least.

Think this is a bad trade? Got a better idea? Let me know (@MattSaincome on X).

Either way, this is why I love what we build at Unusual Whales. Options flow can be such an interesting place to begin or add to your research.

Especially when paired with a phone call with one of the guys behind the move.

If you want to check out other unusual options activity we’re currently tracking on different companies check out the Unusual Whales platform. Once you use it to find something interesting, ping me so I can follow along.

— Matt

P.s. If you’re like me and enjoy going down YouTube rabbit holes, a while back I began watching documentaries about the “World’s Most Dangerous Roads” – and one episode about the Ivory Coast was particularly interesting. I’m pretty uninformed on the region, and understand this documentary mostly focuses on the more rural parts of the country but… doesn’t look like the easiest place to run an ecom business.

And now, a word from our lawyers:

This is for informational and educational purposes only and should not be construed as investment, financial, legal, or tax advice. Nothing in this material constitutes a recommendation to buy, sell, or hold any security, or to pursue any particular investment strategy. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. You should conduct your own research or consult a qualified financial advisor before making any investment decisions.