Abbott Laboratories (ABT) Stock Price Hovers Around All-Time Highs; Options Flow Reflect Forward-Looking Bullish Expectations

Just ten days ago on September 3, 2021, Abbott Laboratories (ABT) tagged an all time high of $129.40. In a Nasdaq article published on September 7, the author describes a few factors that potentially drove price movement for ABT, pointing to the fact that Abbott reported more than 100% adjusted earnings per share growth and 35% growth in organic sales for Quarter 2, 2021. Shortly following that article, ABT hit yet another all time high of $129.52, as shown by the historical price data from Nasdaq.

During this time frame, Abbott has seen a substantial amount of bullish Options activity. Friday’s flow, however, is particularly interesting, as the vast majority of orders placed Friday, across all premiums, have been placed on the ask side.

Below are the metrics for orders across three premium price-points; $5k, $15k, and $30k.

Ask side orders make up 91.1% of all orders placed with a minimum premium of $5k. Of these orders, 54.3% are bullish. These metrics seem to rise slightly as we raise the minimum premiums spent.

For flow with a minimum of $15k in premium, 97.2% of orders placed are done so on the ask side. Bullish premiums make up 55% of $15k+ orders. This demonstrates a slightly higher bullish sentiment than that of orders as low as $5k in premium, and slightly higher ask side order percentage.

Moving up to orders with a minimum of $30k in premium, we see the trend continue, with 55.7% of orders reflecting bullish expectations. Ask side orders at this premium level make up an astounding 100% of all orders. Let’s take a closer look at the flow for Friday.

We can see here that the bullish flow definitely outweighs the bearish flow at these premium levels. Most of the options orders over $10k in premium are bullish, demonstrated by the call option order placement on the ask side, indicating a sense of urgency in getting a fill on those orders.

There is a heavy focus on the $100 call strike expiring in January 2022, as well as the $135 call strike expiring February 18, 2022. This shows a heavy expectation that ABT will continue the upward trend it has followed for the last year (ABT is up 18.42% year to date).

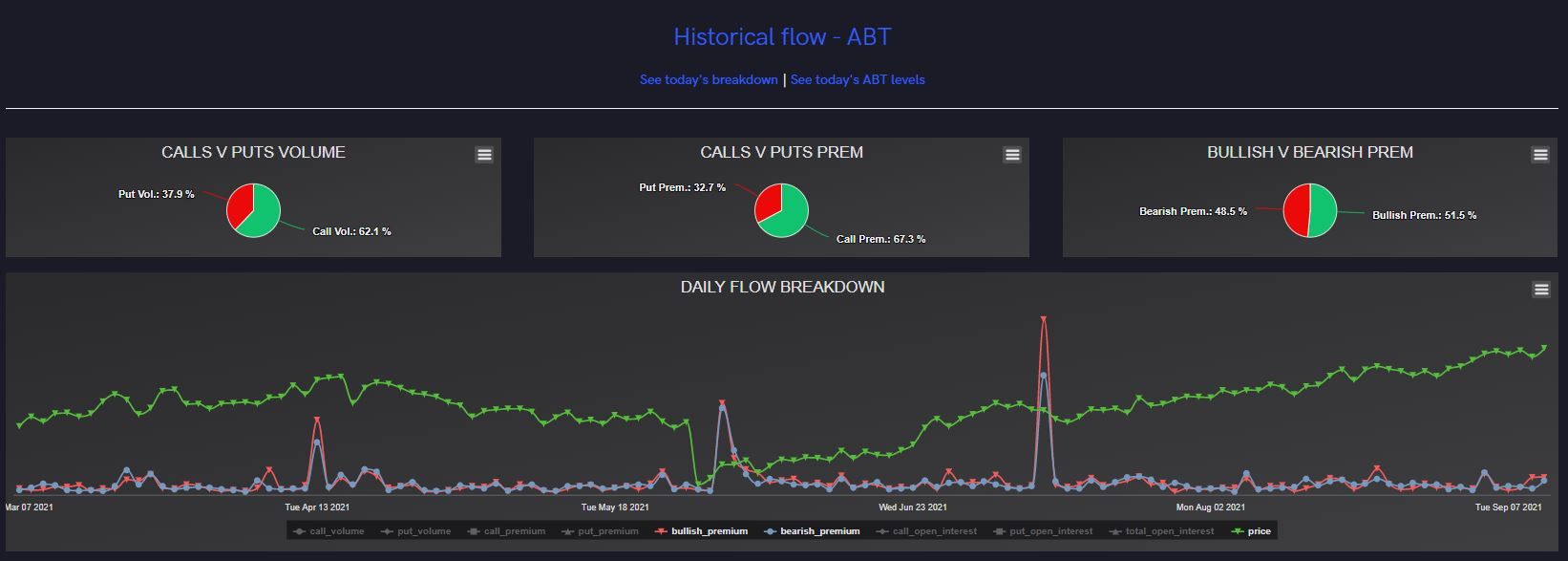

Historically, Abbott has demonstrated a strong bullish sentiment as well, with calls making up 67.5% of all orders, and bullish premium accounting for 51.5% of all orders.