Apple Inc. (AAPL) Hosts Event Today; Unusual Whales Options Flow Indicates Positive Outlook

9/14/2021, 10:15 ET: In just a few hours, Apple Inc. (AAPL) will host an event, broadcast live from Apple Park in Cupertino, California. The event has sent the internet buzzing, as AAPL is expected to unveil the newest iPhone; the iPhone 13. There are also hopes that AAPL will unveil other new and improved products, such as the AirPods 3 and Apple Watch 7.

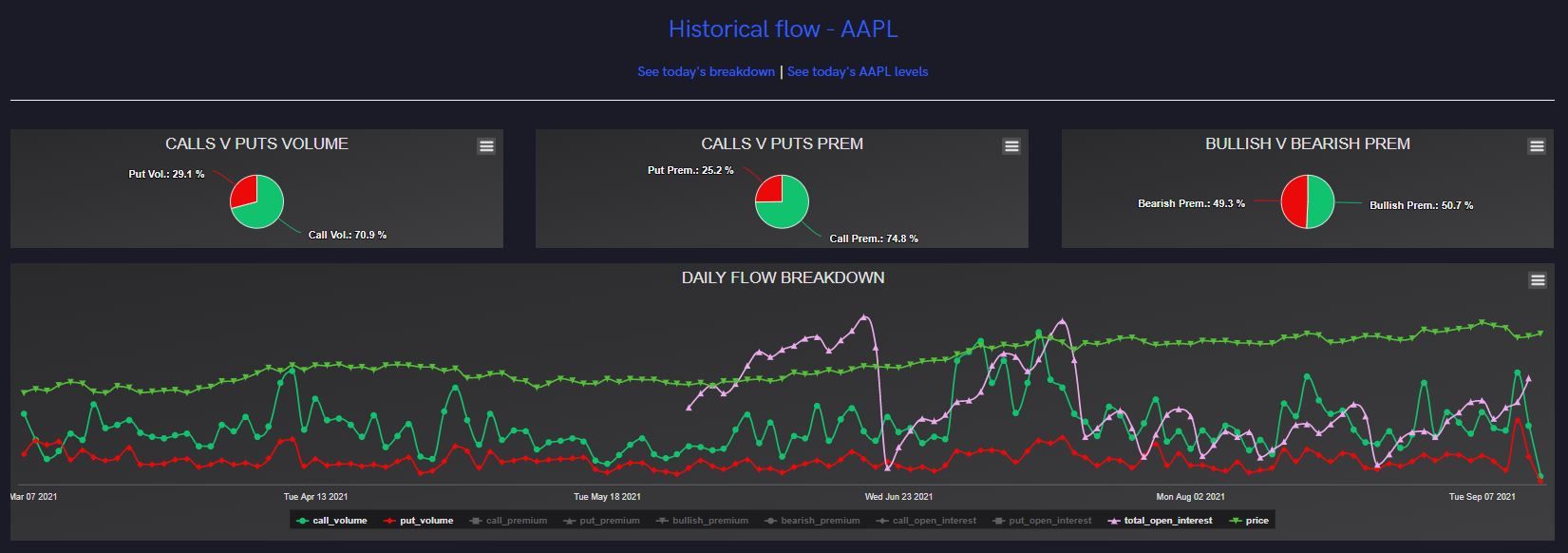

During the seven trading days leading up to Apple’s anticipated event, unusual options activity captured by the Unusual Whales Flow tool, shows possible expectations of a successful event. Looking back at the flow for last Tuesday, September 7, 2021, we can see that ask-side orders over $50k in premium reflect this sentiment.

Last Tuesday, there was a heavy focus on the $155 call strike, mainly for the November 19 expiration date; though there are some orders for October, as well. This shows that as of last week, flow maintained a bullish outlook for AAPL, which is already up 21.5% in the last 6 months.

Fastforwarding to Friday, September 10, the flow continued to trigger bullish signals, despite the fact that AAPL saw a drop in share price from the $155 range back down to the $150 range. This time, big ask-side orders targeted the December 17 expiration, with a focus on the $150 strike, all still with a filter of $50k minimum premium paid.

Yesterday, Monday, September 13, AAPL stock hovered around that $149 to $150 range. Meanwhile, the flow maintained a bullish edge. Keying in on the in-the-money $140 strike for October 22, it seems that some of this flow could possibly be “buying the dip” in anticipation for a pop in AAPL’s share price for their event today.

Now, for the morning of the event. This morning’s flow shows heavy favoritism for the September 17 weekly expiration, namely on the $140 strike. This shows anticipation of movement today in the short term; perhaps to scalp the calls, or to exercise them to obtain shares at $140, should AAPL’s share price move dramatically during or after the event. As we can see in the next image below, ask-side orders above $30k in premium make up 67.9% of all flow, and 61.8% of premiums spent are bullish. Again; we can see very clearly how heavily orders favor the $140 strike.

Apple’s events are generally very bullish for the stock. As mentioned, AAPL is up over 21.5% in the last 6 months alone; and if the flow is any indicator, it seems investors believe AAPL has more up-side in the short-to-mid term.