AUG 24, 2021: Chinese Tech Stocks Continue Their Morning Bull-Run Rally; Unusual Whales Options Flow Shows Sentiment is Mixed

As the S&P 500 continues its stampede forward, Chinese tech led the charge Tuesday morning with an enormous rally. Chinese tech has been beaten down week after week in the last few months as the Chinese government ramps up regulatory restrictions, pushing out a whirlwind of new laws directed at fairness within the technology and e-Commerce sectors. Some tech giants such as Baidu (BIDU), Alibaba (BABA), and JD.com (JD) have seen declines as severe as -30% since their 52-week highs in January and February.

Last week, the Chinese government passed a new data privacy law(the Personal Information Privacy Law--or PIPL); the first law in China that provides rules regarding how companies collect and utilize information about their users and customers. Today’s rally is potentially due in part to this law, as it provides a much clearer picture of the regulatory climate surrounding Chinese tech, which is focused on anti-monopoly and fairness.

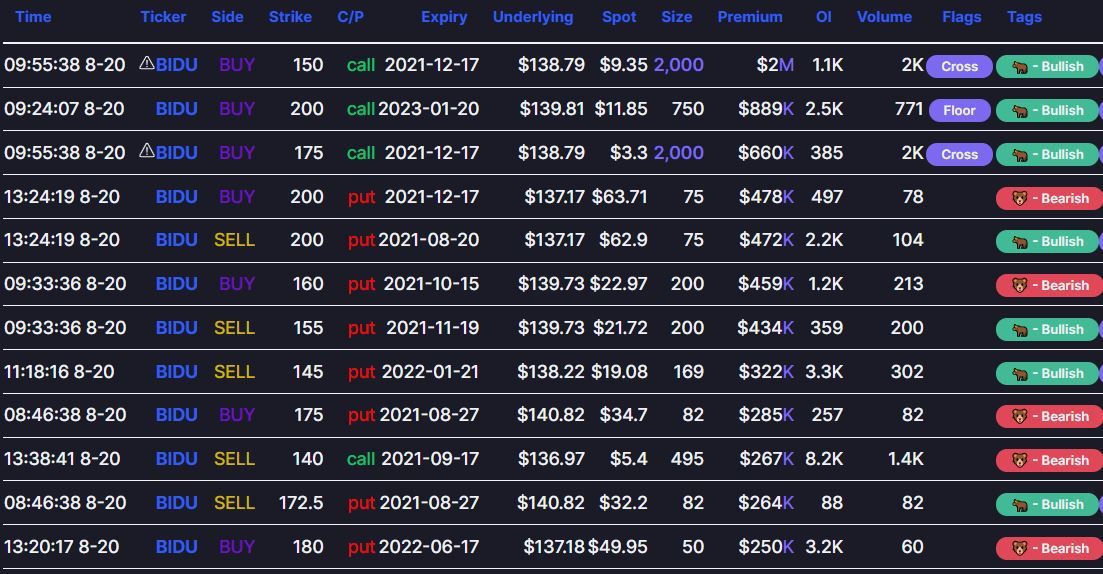

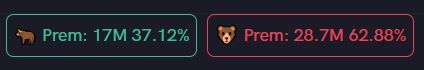

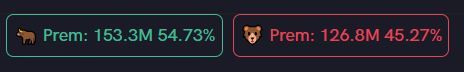

Following the news last week, BIDU and BABA experienced heavy options flow, with a mixed sentiment. As you can see in the UnusualWhales Flow images below, both BABA and BIDU were stacked with Options premium on Friday (8/20), with a slight nod to the bulls.

Today’s BIDU whales seem to be betting on a pullback:

BABA flow is more mixed, still giving bull sentiment the edge.

The rally has continued throughout the morning, with BIDU up 8.6% to $155.04 (52-week high of $354.82) and BABA up 7.5% to $173.10 (52-week high of $319.32). Although they are still far from those February and January highs, time will tell if the sweeping regulatory changes will reinvigorate investors’ trust in these Chinese Tech and e-Commerce giants.

See breaking market news when it happens with Unusual Whales Live News Flow.