BofA’s Hartnett Says Commodities Set to Shine Like Gold — 2026 Themes & Market Signals

Bank of America’s chief investment strategist, Michael Hartnett, is calling for a broad commodity rally in 2026, predicting that price action across raw materials will resemble the strong uptrend seen in gold. This view comes as part of BofA’s macro outlook published through MarketWatch and captured by multiple market commentators.

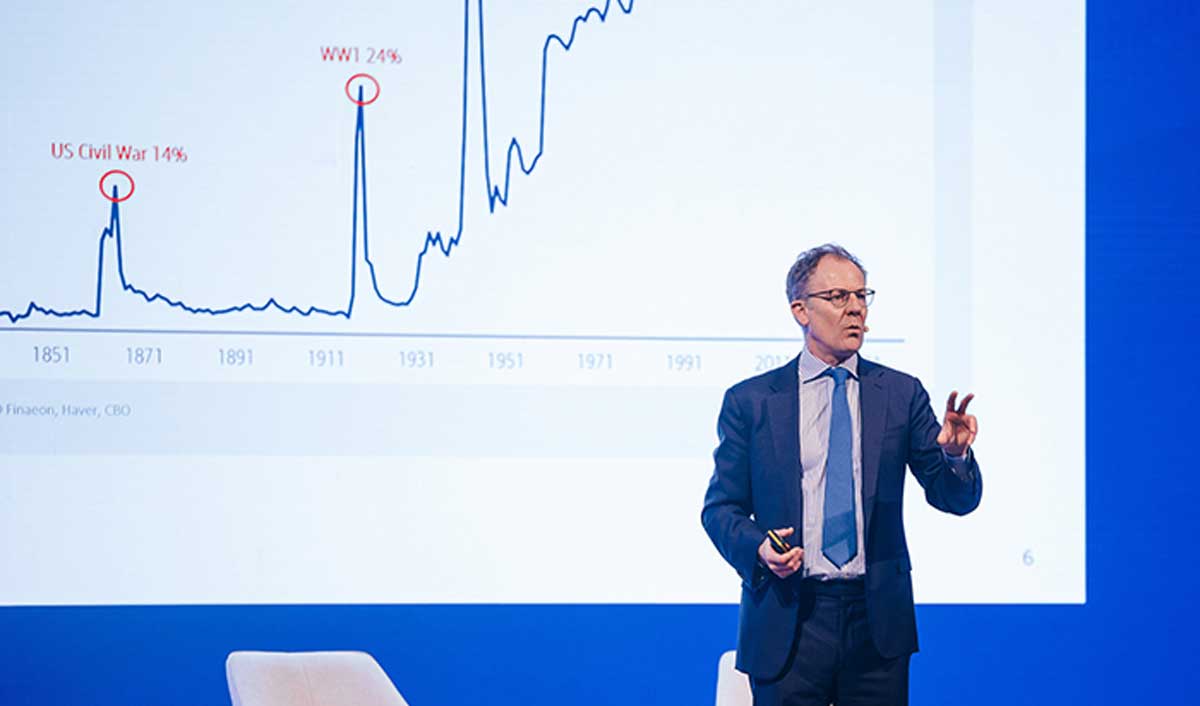

Hartnett’s argument is rooted in a shift from the post-2008 era of monetary easing and fiscal restraint to a post-pandemic regime of fiscal expansion, populist measures, and de-globalization. In this new paradigm, commodities — long out of favor with bond-centric strategies — are poised to outperform in 2026.

What Hartnett Is Predicting

According to the BofA strategist:

- Commodity charts will begin to look like gold — a metaphor for broad, sustained price appreciation

- Under the current fiscal and geopolitical backdrop, metals, natural resources, and energy prices are beginning to break out technically and may continue to strengthen.

- Hartnett suggests that the combined effect of inflationary growth, fiscal populism, and shifting global trade dynamics favors real assets like commodities over bonds and certain equity themes

Why This Matters Now

Commodities have often lagged broader markets since the post-2008 recovery, especially amid long periods of low interest rates and strong equity performance. Hartnett’s commentary suggests that shift may be ending:

- Commodities vs Bonds: Hartnett notes that long-term rolling returns of commodities relative to bonds are the highest seen since at least 2008, implying a structural opportunity.

- Energy Revival: Segments like oil and energy stocks — which saw significant underperformance in recent years — are singled out as key contrarian positions for 2026. Tiger Brokers

This reflects a macro regime change thesis that traders should take seriously.

Broader Market Dynamics

Hartnett frames his commodity outlook against broader trends that include:

- The end of an era of monetary easing + fiscal restraint

- A shift toward fiscal expansion + geopolitical populism

- Rising yields globally as central banks adjust to inflation and growth realities

This context matters because it influences risk assets differently. In an environment where fiscal deficits are large and monetary policy less accommodative, real assets like commodities can gain appeal as an inflation hedge.

Verified Evidence and Related Forecasts

Several other reputable sources reinforce the backdrop:

- Bank of America’s past forecasts have been bullish on gold prices, projecting higher averages for 2025–26 driven by macro risk.

- BofA’s broader research shows that periods following Fed leadership nominations historically coincide with higher Treasury yields, potentially weakening bond performance relative to commodities.

These lend context to Hartnett’s argument that commodities may outperform traditional defensive assets.

What Traders Should Watch

Hartnett’s call — if it materializes — has specific implications for equity and options markets:

Energy Sector

Energy commodities and equities are expected to play a central role in the rally thesis. Names that may benefit include:

Watch for bullish options flow, rising implied volatility, and sector rotation into these names.

Metals & Materials

Precious and industrial metals could also be part of this broader commodity trend. A meaningful breakout in gold and related metals often signals real-asset repricing across markets.

Defense and Construction Cyclicals

A commodity cycle often supports cyclicals tied to infrastructure, materials, and energy. Traders should monitor sector correlations and unusual options activity for signals of rotation away from growth and into cyclical exposure.

Risk Themes to Monitor

Hartnett’s commodity thesis rests on key macro risks:

- Sustained inflationary pressures

- Fiscal stimulus continuation

- Trade realignment or de-globalization trends

- Rising yields and changing central bank policy

Markets that are long commodities or hedged against rising inflation and yields may benefit if these themes take shape.

Bottom Line

Bank of America strategist Michael Hartnett is signaling a potential commodity supercycle for 2026, with all major commodity price charts eventually resembling the strong performance seen in gold. As fiscal policy adapts and inflation signals persist, real assets like metals and energy may gain renewed investment interest.

Traders should watch commodity prices, energy equities, and volatility patterns for early signs that this macro narrative is taking hold.

CTA: Stay Ahead of Market Flow

To track how geopolitical and macro themes like this affect options flow, volatility, and sector rotation in real time, sign up for Unusual Whales.

Create a free Unusual Whales account to start conquering the market.