Clintons Refuse to Testify in House Epstein Probe — Market & Options Risk Signals

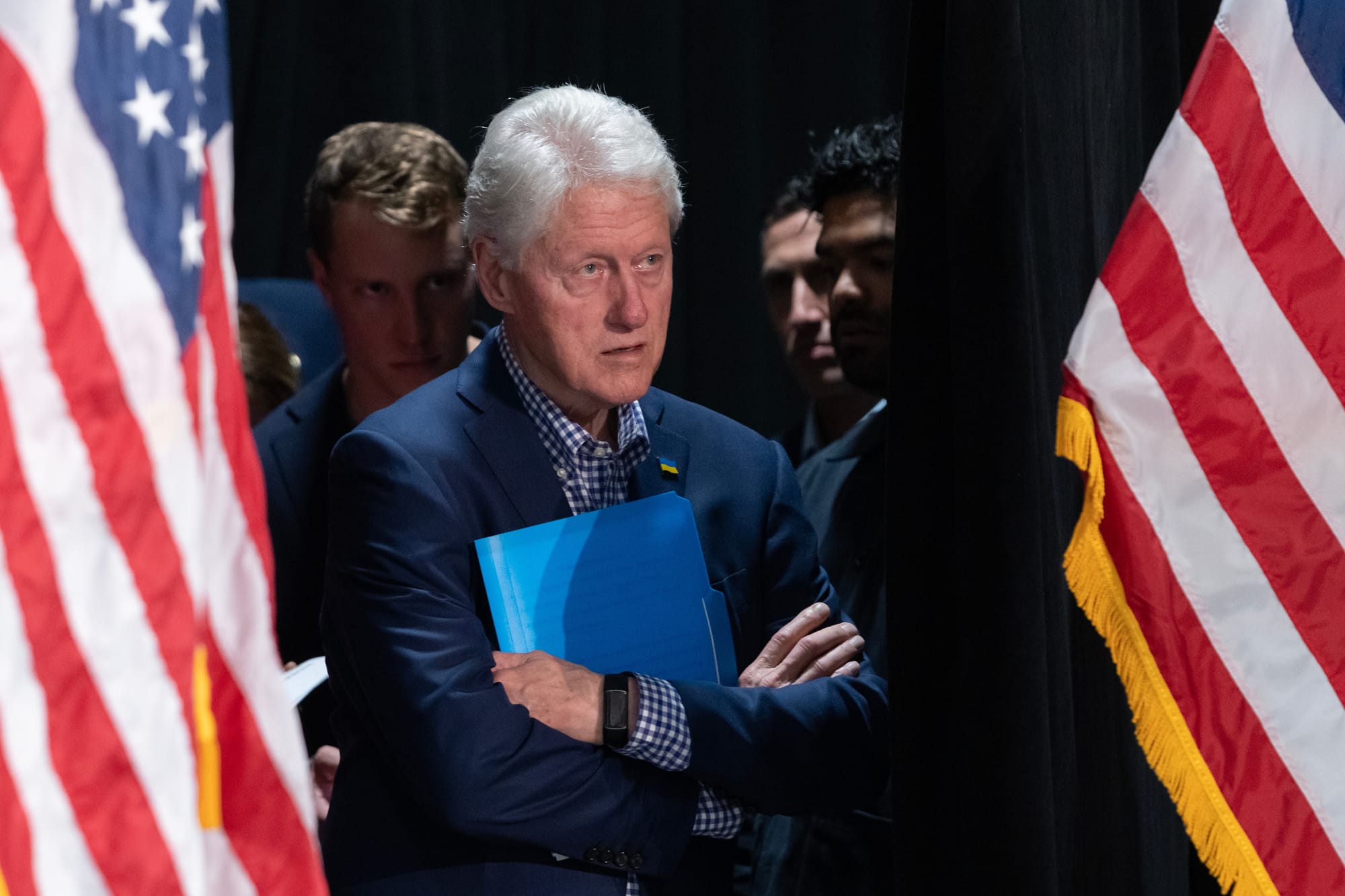

Former President and Secretary of State Decline to Testify in Epstein Inquiry

Former President Bill Clinton and former Secretary of State Hillary Clinton have refused to comply with congressional subpoenas to testify before the House Oversight Committee in its investigation tied to the late financier Jeffrey Epstein and related questions about how law enforcement handled the case.

In formal letters to House Oversight Committee Chair Rep. James Comer, the Clintons called the subpoenas legally invalid, politically motivated, and lacking a legitimate legislative purpose — even as Republicans prepare contempt of Congress proceedings if they continue to decline appearances.

What the Refusal Means

The Clintons’ refusal isn’t an accusation of wrongdoing — the House has not alleged any crimes — but it escalates a high-profile political standoff that adds to ongoing debates about congressional subpoena power and executive/state cooperation with oversight inquiries.

- Bill Clinton did not appear for a scheduled deposition.

- Hillary Clinton similarly declined her appearance.

- Committee leadership says it will proceed with contempt actions.

This clash comes amid broader political tension around accountability in the Epstein case and disputes over selective enforcement of congressional oversight powers.

Divider

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free account here to start conquering the market with Unusual Whales.

https://unusualwhales.com/login?ref=blubber

Why This Political Conflict Can Matter to Markets

At first glance, a debate over subpoenas and testimony may seem political theater, but these standoffs can trend into market risk pricing and sentiment, which often show up in options activity and volatility expectations before they become visible in equity prices.

Here’s how:

1. Political Risk Premiums

Heightened political uncertainty — especially involving well-known political figures — can feed increased risk aversion among investors.

2. Sentiment Shift in Risk Assets

When investors see rising gridlock or institutional conflict, they often reduce exposure to cyclicals and growth names, pushing volatility wider.

3. Behavioral Impact on Spending & Confidence

Consumer sentiment tied to political stability can ripple into markets that depend on discretionary spending expectations.

Political headlines may elevate implied volatility in selections of equities and indexes before substantive macro data shifts occur.

Market Barometers to Watch on Unusual Whales

When political risk headlines errupt, certain names and sectors often reflect early options flow changes and sentiment repositioning:

Macro Leaders & Market Risk Indicators

- Nvidia ($NVDA) — broad market beta & risk sentiment indicator

https://unusualwhales.com/stock/nvda/overview - Microsoft ($MSFT) — defensive tech with sensitivity to sentiment shifts

https://unusualwhales.com/stock/msft/overview - Amazon ($AMZN) — consumer & spending behavior proxy

https://unusualwhales.com/stock/amzn/overview

Large-cap names often show put flow increases or volatility shifts when political risk rises.

Financials & Credit Sensitivity

- JPMorgan Chase ($JPM) — bank sentiment proxy

https://unusualwhales.com/stock/jpm/overview - Bank of America ($BAC) — credit exposure & macro confidence indicator

https://unusualwhales.com/stock/bac/overview

Financial names can act as early detectors of risk-off positioning tied to political event risk.

Options Flow Signals to Track

When political standoffs intensify, derivatives markets often reflect sentiment before price:

Put Skew Expansion

Rising political uncertainty frequently triggers greater relative demand for puts in major indexes and macro leaders.

Volatility Term Structure Changes

Implied volatility curves can steepen, showing traders hedging across weeks of escalating headlines.

Hedging/Spread Activity

Calendar spreads and collars may see increased flow as traders bracket election cycles or key political milestone dates.

Unusual Whales historical flow tools can pick up these dynamics well before cash markets adjust.

Broader Macro & Political Implications

The refusal by such highly visible figures to testify raises questions that go beyond the Epstein probe:

- Subpoena Authority Limits — Congressional power to compel testimony from former executives.

- Partisan Fractures & Institutional Credibility — Risk markets are sensitive to uncertainty about governance.

- Selective Enforcement Narratives — Mixed signals on oversight credibility can widen risk premiums.

Political gridlock and institutional conflict rarely cause market crashes — but they often raise risk premia and implied volatility.

Final Thoughts

The Clintons’ refusal to testify isn’t just a splashy political headline — it’s a political risk event that can alter sentiment, risk pricing, and trader positioning.

For options traders and risk managers, *watching flow and volatility response to these headlines can provide an early edge before equity price shifts appear.

Call to Action

Want to track political risk, sector rotation, and options flow before the market reacts?

Unusual Whales gives you historical and real-time options data, implied volatility analytics, GEX insights, and market tide signals — tools traders use to anticipate changes ahead of cash moves.

Create your free Unusual Whales account and start uncovering opportunities:

https://unusualwhales.com/login?ref=blubber