Unusual Options Activity in Hycroft Mining Holding Corporation (HYMC), Cinemark Holdings, Inc. (CNK), and Blackstone Mortgage Trust Inc (BXMT)

Unusual Options Activity in Hycroft Mining Holding Corporation (HYMC), Cinemark Holdings, Inc. (CNK), and Blackstone Mortgage Trust Inc (BXMT)

Unusual Options Activity in Blackstone Mortgage Trust Inc. (BXMT)

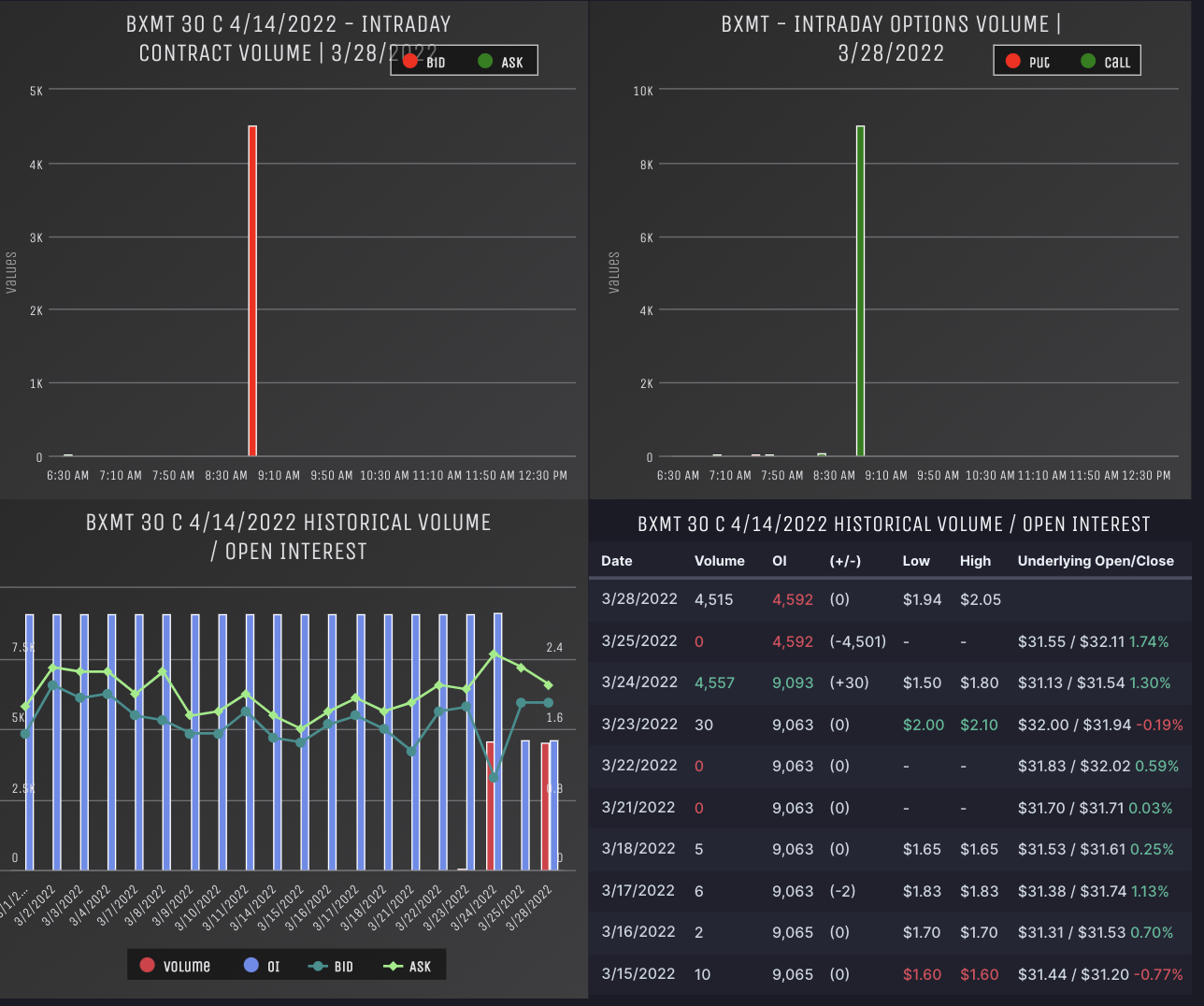

Today, March 28, 2022, in the NasdaqCM, there was unusual or noteworthy options trading activity in Blackstone Mortgage Trust Inc (BXMT), which opened at $31.31.

- There was repeated trading activity on the $30 strike call options dated for April 14th, 2022, traded at a spot price of $2 with a bid-ask spread of $1.90 to $2.20.

- The volume on these chains happened mainly on the bid (sold) and all on the call side in the morning. You can see in the image the volume and OI change from Friday to Monday.

Image: https://gyazo.com/4d4bec71c59e759f4b2033323f98f5f4

As stated, these orders significant sizes have not yet overtaken the open interest on the chain:

Image: https://gyazo.com/9032fc9d0f748b97ca0c6475a5233a54

Seen above is the aforementioned chain’s historical volume, in red, and open interest, in blue, as bar charts behind the requisite bid and ask, in a light blue and darker shade, respectively.

In conclusion, the red volume is less than the blue open interest, and the volumes today are similar to those yesterday; therefore, intuition can tell us that these orders might be getting closed today. This shows how the flow can be used to follow a trade from beginning to end, tracking orders as they are sold to open and bought to close, or any variant therein.

N.B., there is always the possibility this volume is in fact new volume on the chain being opened--only by observing the open interest tomorrow following these steps can we be completely certain.

To view more information about BXMT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Hycroft Mining Holding Corporation (HYMC)

In the NasdaqGS, there was unusual or noteworthy options trading activity in Hycroft Mining Holding Corporation. (HYMC), which opened today at $1.64, and traded up nearly 50%.

- There were a series of orders, including sweeps, traded above the ask on the $2.50 strike put options dated for April 14th, 2022.

- The bid-ask on this chain was $0.35 to $0.4 and these trades were at a spot price of $0.4.

- The volume on this chain was 45.9k as of today and the overall open interest is now 33k.

- Additionally, these orders come after the AMC investment into the miner

Imgur: https://gyazo.com/2e673fccde9a616819a35c839b6cc553

Seen above are the noteworthy options in HYMC using the intraday volume analyser at unusualwhales.com.

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

Many of these HYMC orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

- These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

- Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

To view more information about HYMC's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Cinemark. (CNK)

Finally in the NasdaqGS, there was unusual or noteworthy options trading activity in CNK:

- There was a significant or noteworthy increase in call volume on Cinemark today, particularly on the $25 strike call options dated for June 16th.

- Additionally, these orders come after a large meme stock rally in GME and AMC

Seen above, the noteworthy options in CNK from the Unusual Whale flow dashboard feature.

Imgur: https://gyazo.com/2f028af116b00ecbd91d60a808301c97

A tip from the flow: Trades appended with the ↕ and 🔃 emojis are trades that have potentially came in together as a part of a strategy, and are coded accordingly (such as MLET or TLCT) under the codes column. Clicking on these emojis will open all of the trades that came in together so that the holistic strategy may be investigated.

To view more information about CNK’s flow breakdown, click here to visit unusualwhales.com.