Congressional Trading in 2021

Congress likes to trade.

That being noted, last week marked the end of President Joe Biden’s first year. The Biden Administration has continued to fund pandemic aid, rolled out vaccines, promoted infrastructure, and insists on Build Back Better.

Our congressional members have been privy to the conversations and negotiations that have formed Biden’s legislative agenda. These have been taking place throughout the year in meetings behind closed doors. All the while, our elected officials have also been actively trading stocks, options and other financial assets.

UnusualWhales.com is the go to place for retail tooling in options, equities, and crypto markets. It helps retail traders, expose market wide corruption, does deep market research and also has cool memes. I have previously highlighted unusual political trading. This report aims to summarize all political trading from the past year. There was a lot.

I looked at all financial disclosures from December 1, 2020 to December 22, 2021 (Note: as the remaining trades from 2021 come in, I’ll update this report).

Here’s the TL;DR just in case, but I encourage you to read through, check out my other posts on the topic (all linked below) and to share your thoughts with me on Twitter or the Discord community.

TL;DR

- Hundreds of millions of dollars have been exchanged on the stock market by our elected officials in 2021 alone

- In just equities, Congress bought and sold nearly $290 million throughout the year.

- In 2021, Congress beat the market!

- This report shows which sectors were preferred by each party and branch, oftentimes huge trade amounts could be attributed to one or two members.

- Big legislative events (such as the Infrastructure Bill getting passed by the Senate) were often preceded by politicians trading in the sectors affected. There were tons of unusual trades where politicians made millions of dollars.

- Congress has 45 days to disclose trades to the public, sometimes they are late and you can see a list of late disclosures here!

- Some politicians held securities in the sectors they vocally expressed support for (such as Senators holding cryptocurrencies while drafting crypto regulations).

- This report highlights many of these and other unusual instances!

Total value ($) of assets traded in 2021

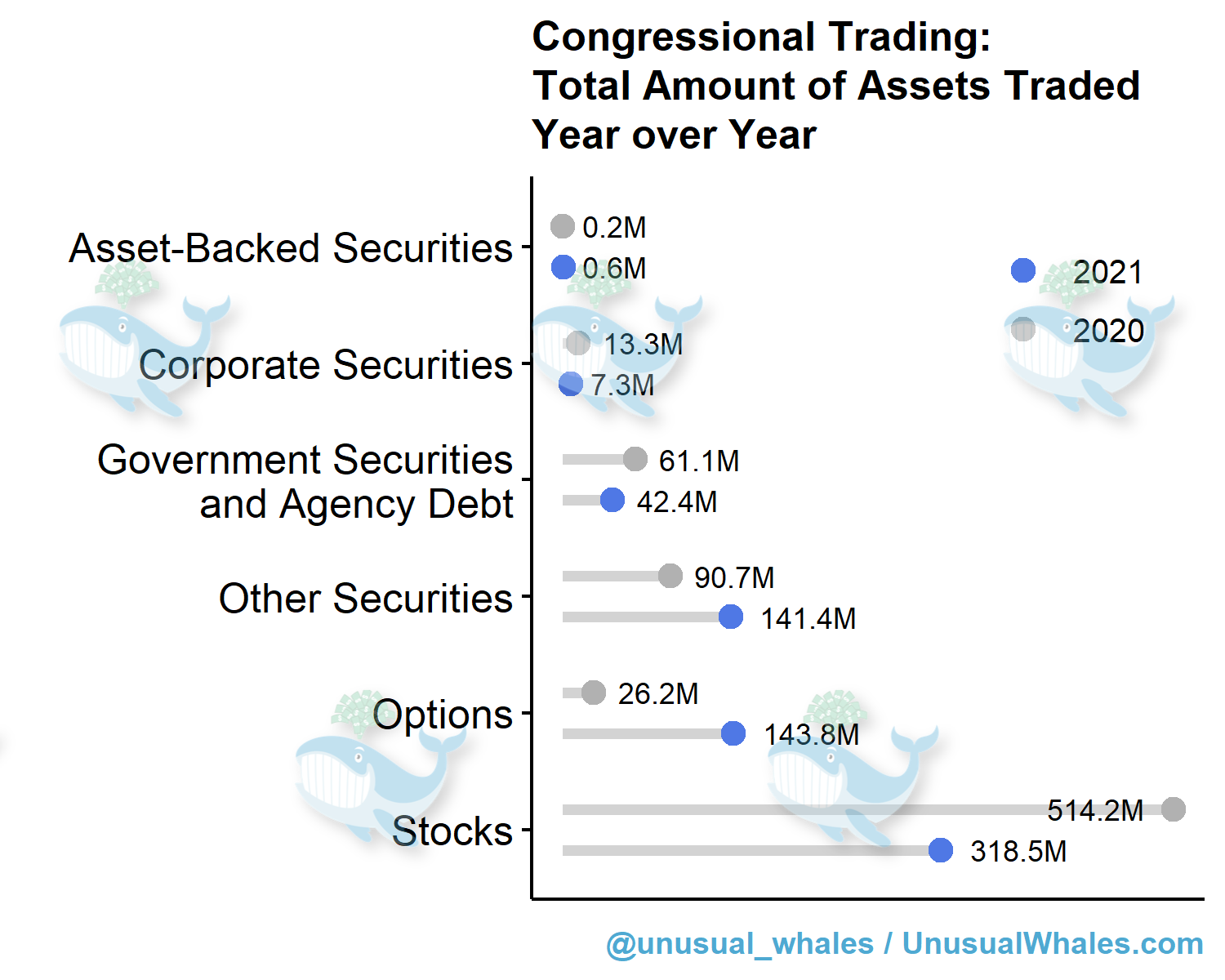

Last year, Congress bought and sold nearly $290 million in stocks (corresponding to 3,500+ transactions by 105 members of Congress), $140 million in options contracts (270+ transactions by 6 members), $124 million in other securities like private equity funds (200+ transactions by 19 members), and $500k in cryptocurrencies (25 transactions by 6 members). Other assets were also bought and sold, you can see total amounts below:

Compared to 2020, the total amount of options trading exploded in 2021 by over 5x, meanwhile trading in other notable asset classes decreased. We see that stock trading decreased by nearly $200M. However, we should remember that former Georgia Senators David Perdue and Kelly Loeffler traded a ton in 2020 and actually account for ~$200M in those stock transactions! When we exclude these two Senators, stock trading in both years were comparable.

Total value of stocks traded in 2021

The total value of stocks traded were nearly identical in the House, with House Democrats selling slightly more than Republicans in 2021. Meanwhile, Senators were selling nearly 3x more than buying stocks.

Monthly amounts traded throughout the year

Looking at total amounts traded per month, we see that Senate Republicans did some major buying at the beginning of the year, coinciding with the start of Biden’s term. Meanwhile, August was a big month for House Democrat stock purchases. This can be mainly attributed to huge $MSFT buys disclosed by Rep. Suzan DelBene (FYI her spouse is a top Microsoft exec).

On the other hand, September to November saw huge stock sales in Congress. Again, the majority can be attributed to Rep. Suzan DelBene’s family selling off up to $25 million in $MSFT in both September and October. In the Senate, November saw Senator Bill Hagerty sell up to $5 million in tech company Datadog ($DDOG) and Senator John Hickenlooper sell millions in other tech stocks (such as $PYPL, $NVDA, $MSFT, $FB, $AAPL, $AMZN, $GOOGL).

Total value traded per sector

By breaking out these trades into their sector, Congress mostly traded tech, finance, industrials (oil and gas), non-energy materials and miscellaneous stocks. Miscellaneous stocks are mostly broad sector index funds and ETFs.

Some observations:

- Senate Republicans traded misc. stocks more than Senate Democrats, along with finance stocks (ex. banks, SPACs and REITs). They also sold off a bunch of tech stocks in 2021.

- Notably, Senator Tommy Tuberville bought up to $1.84 million in non-energy mineral stocks. These included copper ($SCCO, $FCX), steel ($X, $CLF), aluminum ($AA) and other infrastructure-related stocks ($EXP, $BHP) before Biden signed his Big Infrastructure Bill. Tuberville later sold up to a third ($660k) of these stocks.

- Senate Democrats sold off tech stocks like $AAPL, $NVDA and $KLAC in large quantities.

- Even ignoring Rep. DelBene’s $MSFT trades, House Democrats also stuck to tech stocks and out-traded their Republican colleagues in this sector throughout the year.

- House Republicans (read: Rep. Mark Green) preferred industrial service stocks related to oil and gas.

BRB busy trading

Who’s been busy trading in 2021? The heat maps below show the number of stock trades and total amounts traded per sector by House and Senate members.

By number of trades

Here are some observations from the number of trades made by our politicians:

The busiest traders in Congress this year were:

- House Representatives Josh Gottheimer, Marie Newman, Susie Lee and Zoe Lofgren

- Senators John Boozman and Tommy Tuberville

- In the House, Rep. Mark Green made the most number of purchases in oil and gas, while Rep. Josh Gottheimer made the most number of sales in tech

- In the Senate, Senator John Boozman made the most number of purchases and sales in a single sector (in broad sector ETFs)

- Reps. Josh Gottheimer, Lois Frankel, Marjorie Taylor Greene, Susie Lee, William Keating and Zoe Lofgren appear to have made stock trades in varying sectors throughout the year. While in the Senate, Senators Tommy Tuberville and Thomas Carper have made the most diverse trades.

House

Senate

By total amounts

It’s a different story when looking at the total amount of money traded:

- Rep. Mark Green spent a lot of money trading in oil and gas stocks

- Rep. Suzan DelBene’s huge $MSFT trades obviously show up hot in these heat maps

- Senator Tommy Tuberville’s infrastructure stock purchases show up here, out-purchasing everyone else

- Senator Bill Hagerty’s $5M Datadog trade was the highest sales transaction in the Senate

House

Senate

Congress’ favorite companies

Let’s look at the top 10 tickers per sector that were bought and sold by Congress in 2021. The total amounts spent by Congress on each company’s stock in 2021 are represented by the size of the rectangle. We see that tech and industrials (oil and gas) reign supreme.

When we look specifically at the top 10 stocks preferred by the House, we see notable tech companies, as well as oil and gas stocks.

Meanwhile in the Senate, the top 10 stocks bought were infrastructure and tech related. While the top 10 sold stocks were mostly just tech.

Average returns

This section aims to show what the majority of returns on these political trades look like.

To approximate returns, the following assumptions were made:

- For any stock purchase in 2021, the next sales date disclosed was used to calculate the percent change in closing prices.

- For any stock purchase in 2021 that did not have a corresponding sales date in 2021, the closing price on December 30, 2021 to calculate the percent change.

- For any stock sales in 2021 that did not have a corresponding purchase earlier in 2021, the most recent purchase date in 2020 was used to calculate the percent change.

- Any stock sales in 2021 that did not have a corresponding purchase in 2020 or earlier in 2021 was excluded from this analysis.

Let’s quickly address some limitations to this approximation method:

- Data is limited to 2020 onward

- It doesn’t account for longer held assets since we are taking the most recent buy or sell dates, therefore these calculations are conservative estimates and can’t accurately paint a picture of each member’s full financial portfolio

- It doesn’t account for options executions and assumes stocks are bought and sold at the close price

With that out of the way, let’s talk about visualizing data distributions. Box plots are a great way to show what the distribution of data looks like. In a box plot, 50% of data points are contained within the “box”, while the upper and lower vertical lines running out of the box show the top and bottom quartiles (ie. 25% of the data points). The dots above and below the box and lines indicate outliers (in this context, trades that resulted in insane gains or really bad losses). The box plot below shows that the majority of trades had returns in between 0-15% across both parties and branches.

If we zoom in on just the boxes, we can show the distribution of data in a different way using a histogram. Histograms show the number of data points across a range (in this case percent returns). We see that the majority of trades hover above 0% but below the average (indicated as a dotted line in each group).

Here’s a summary table on average amounts by party and branch, as well as the number of trades included (n), the standard deviation (sd), the variance in percent change (var), and maximum and minimum returns observed:

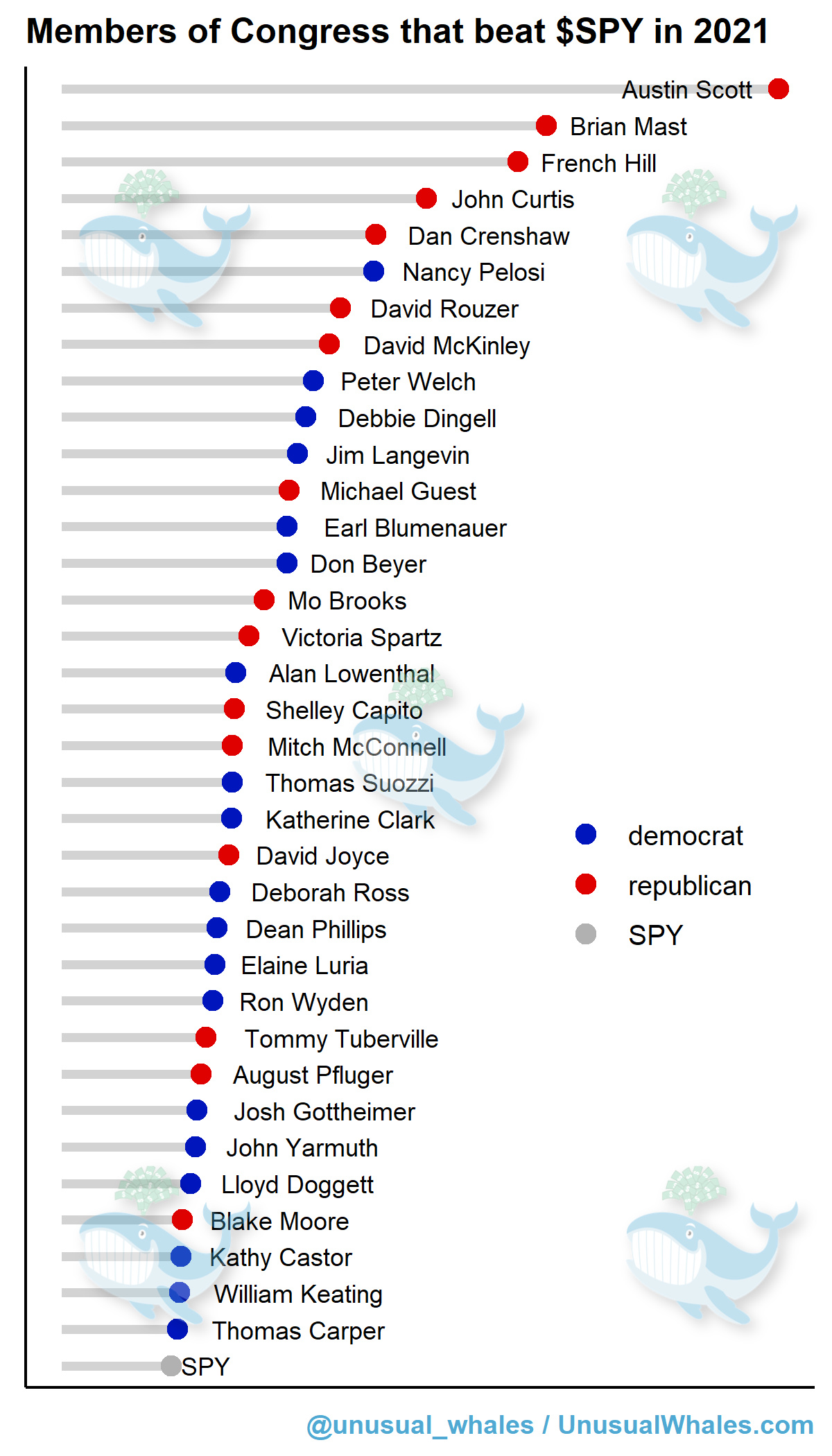

On average, House Democrats and Republicans had returns at +14.7%. Meanwhile, Senate Democrats were at +15.4% and Senate Republicans just under +13%. Independent Senator Angus King’s two trades yielded a +16.5% return rate (excluded from the charts above).

To compare, we can take the same transaction periods and estimate $SPY returns (ie. instead of trading those tickers, we trade SPY instead). Using this method, SPY returns were found to be only +13.6%.

This means that in 2021, on average, Congress beat the market.

Using these estimates, we can provide a "visual list" of politicians that beat SPY last year.

Best individual trades

How about those outliers that had insane returns? This section will highlight the Top 10 in each branch.

House

We can see that Rep. Austin Scott had the biggest returns with a bet on FuelCell Energy Inc, followed by Rep. Brian Mast’s convenient Tilray sale at its ATH last year, and then Rep. Thomas Suozzi’s United Rentals sale after picking it up at its lowest price in 5 years following the stock market crash in 2020.

Senate

Returns in the Senate look modest compared to their House colleagues. The top trades in the Senate could be attributed to Senator Tuberville and his Alcoa Corp sales in late 2021 which was when intense negotiations were happening on Biden’s Infrastructure Bill. Ranking second was Senator Pat Toomey’s post-split Tesla purchase and sale in early 2021.

Average HODL

These estimates also provide a look into the average amount of the time stocks were held before selling. For the ~1400 transactions with buy and sell dates (ie. not held past the end of 2021), the average amount of time for the House was 134days between buy-sell dates and 128 days for the Senate.

Unusual trades

Aligning the data with events that took place throughout the year, we have compiled a list of unusually timed trades by Congress (we’ll continue to update this as we notice things):

- House Republican Brian Mast’s Tilray purchase and subsequent sale at its ATH in early 2021 (for returns of +563%) gets even sketchier when we remember that he bought $TLRY before voting in support of the Marijuana Opportunity Reinvestment and Expungement (MORE) Act in late 2020.

- In November, Lockheed Martin won a $10.9B contract to modernize the Air Force's F-22s. House Republican Kevin Hern, who sits on the House Committee on the Budget, bought Lockheed Martin stocks back in August. He bought another round, this time up to $100k, in $LMT just 2 weeks before this news.

- House Democrat Kathy Manning, who sits on the House Committee on Foreign Affairs, bought up to $30k in $LMT stocks on October 22. Just 2 weeks before the news!

- House Democrat Zoe Lofgren bought up to $15k in $LCID on October 13. Now up 71%. In the past, Rep. Lofgren has co-sponsored legislative proposals for EV tax credits.

- The US Army first announced a $22B augmented reality deal with Microsoft on March 31, 2021 and reiterated its commitment to this partnership in October. Speaker Nancy Pelosi disclosed exercising 150 calls on March 19, 2021 at a strike price of $130. She's up 160%.

- Senator Cynthia Lummis bought up to $100k in Bitcoin on August 16. This was during when the Senate was actively drafting crypto regulations.

- Also during that time, Senator Pat Toomey drafted amendments to those crypto tax regulations while he held crypto…

- In July, when Senate Republican Tuberville finally released his late financial disclosures, we found that he had sold up to $15k in Microsoft stocks in late June. This was 2 weeks before the $10B JEDI contract between MSFT-DOD was cancelled. Tuberville sat on the Senate Armed Services Committee privy to defense contracts.

- Related: House Republican Pat Fallon, who sits on the House subcommittee responsible for reviewing DOD software contracts, sold up to $250,000 in $MSFT right before JEDI contract cancellation.

- In July, House Republican Blake Moore disclosed buying up to $60K in $RTX while sitting on the House Committee on Armed Services. Specifically, he was making these trades while sitting on the subcommittee directly responsible for reviewing defense tech contracts.

(We'll continue to update this list as trades get disclosed)

Hot topics in trading

Trade like Pelosi

Speaker Nancy Pelosi’s financial disclosures are arguably the most followed in Congress. The perception is that she is the best trader on the Hill. I took a look into her financial portfolio here. After reading that post, our community demanded a live Pelosi ETF. So I made one! Check out the UW Pelosi ETF.

Joe Manchin, King of coal and conflicts

Earlier in this post, I stated that President Biden “kinda” had control in the Senate. He has the majority with 50 + 1 VP Kamala Harris out of 100… But with the filibuster in place (requiring 60 votes to pass legislation) and with Senator Joe Manchin power-tripping, Biden faces many more roadblocks ahead. Speaking of Joe Manchin…

Joe Manchin makes $500K a year from coal company Enersystems, and recently raised $400,000 from corporate coal lobbyists this third quarter alone.

— unusual_whales (@unusual_whales) December 21, 2021

He stated opposition to a proposed Build Back Better deal, with its clean electricity program.

Link: https://t.co/lodTLftEbF

Infrastructure, infrastructure, infrastructure

Last year, I highlighted which elected officials had their hands (read: financial portfolios) positioned in infrastructure prior to Biden’s Big Infrastructure Bill getting passed. It was interesting to see who was buying what to potentially profit from the influx of $550B in new infrastructure funding. Why is this still allowed? Read my coverage here.

The Fed

Although not elected by the people, high ranking officials at the Federal Reserve were exposed for insider trading in the latter part of 2021. Who watches the Fed? No one, it seems. Read the post here.

Counter China by making chips

The pandemic has caused a lot of problems on supply chains. One of those resulting in a major shortage in semiconductor chips, which are used in literally everything. Currently, China houses most of the world’s chip manufacturing capacity and in the last 2 years, we saw them hoard that supply for themselves. Congress was aware of this dependence (read: national security issue) back in 2020 and legislation was drafted accordingly. Proposals included ramping up domestic chip manufacturing capacity and tax credits for manufacturers. Throughout 2021, we’ve continued to hear about the urgency required to address this problem. With the following events happening:

- February: Biden signed an executive order to review critical supply chains such as chips and drugs

- June: Senate passed the United States Innovation and Competition Act of 2021 (USICA) that proposed $52B for domestic chip manufacturing

- Now: The House never took up the USICA or made any progress with past proposals

As it stands, no funding has been provided to address the problem. But this hasn’t stopped Congress from dipping into the chips industry! I highlighted this fact here.

Investing in pharma while funding pharma

Isn’t it a bit odd to be an elected official, where your colleagues and agencies you oversee are negotiating the finer details of vaccine pricing with pharmaceutical companies and funding the deployment of those vaccines, and you still decide to invest in said companies? Well that’s been happening throughout 2020 and 2021. You can read about my recent coverage on this topic here.

Congress + crypto

2021 was a year of firsts. One of those being the first time Congress entered the world of cryptocurrencies. Not only in legislation to regulate the industry, but also adding crypto to their financial portfolios.

A total of 6 congressional members bought and sold cryptocurrencies last year. They included:

House Representatives:

- Felix Moore: Invested up to $45k in ADA, $15k in DOGE and $15k in ETH

- Marie Newman: Invested up to $50k in GBTC

- Mark Green: Bought and sold BAT, CELO, DOGE, EOS, ETC, LINK and XLM with disclosed amounts varying between $15k to $30k

- Michael Waltz: Invested up to $100k in BTC

Senators:

- Patrick Toomey: Invested up to $15k in ETHE and GBTC each

- Cynthia Lummis: Invested up to $100k in BTC

Gotta have options

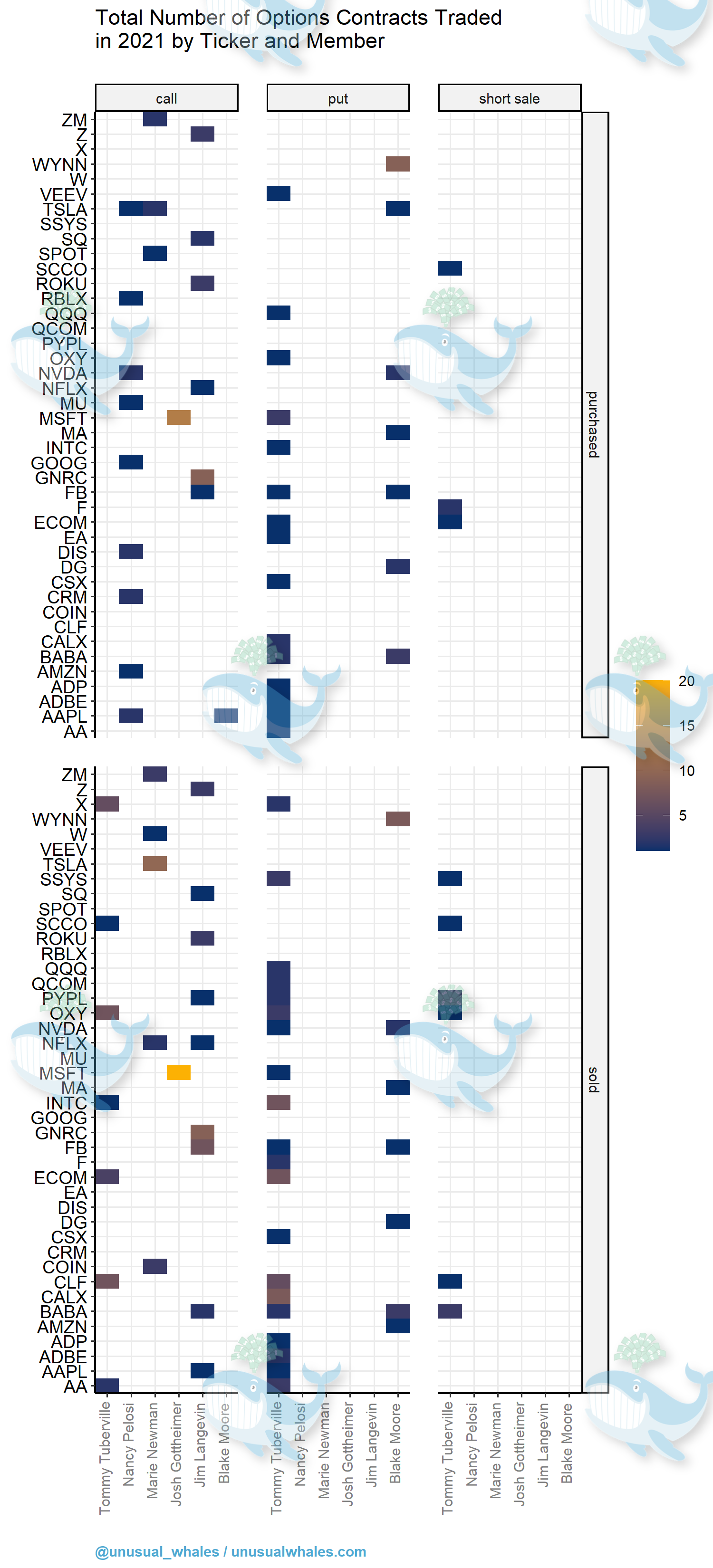

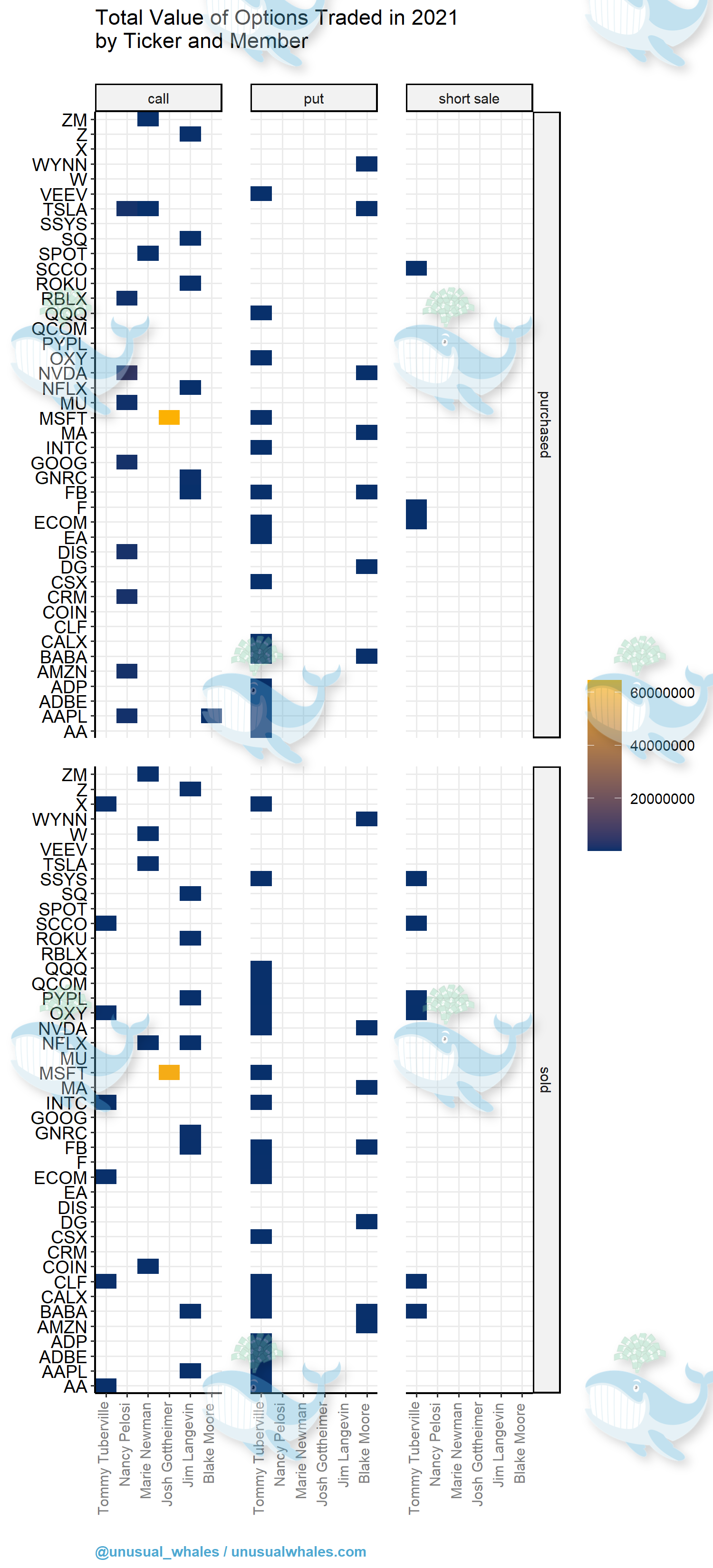

The general public has become aware of Speaker Nancy Pelosi’s proficient options trading. We have covered her trades and her portfolio elsewhere on this site. However, there are a couple other Congressional members who also traded options in 2021. Most notably is House Democrat Josh Gottheimer. We can see that he bought and sold over $60 million in calls alone. These disclosed values are so big that they skew other amounts disclosed by his colleagues. So I removed him in the following chart so we could better see other trades.

Speaker Pelosi comes in second with her calls totalling over $10 million, followed by Senator Tommy Tuberville and selling puts, calls and shorts.

Options were bought and sold for a diverse range of companies. The first set of heat maps show the number of times each member bought or sold options for specific companies. We see that all of Rep. Gottheimer’s calls were exclusively for Microsoft. Clearly, not an Apple fanboy. Meanwhile, Senator Tuberville’s puts were for his infrastructure and tech stocks.

The second set of heat maps show the total value spent per company options. As expected Rep. Gottheimer’s $MSFT calls outshone everyone else’s total traded amounts. If you’re wondering why Speaker Pelosi’s family trades options the way they do, we've got a post on that coming out later this week! Stay tuned.

In 2021 and 2020, we witnessed several elected officials trade options. I've written about Pelosi's options strategies here. It appears most of these politicians like to wheel certain trades, and seem to also be doing covered calls on larger share positions. Some even seem to be selling cash secured puts.

Because we cannot verify aspects of these individual trades (as details on options trades vary in detail per disclosure), we have to make a few assumptions about the options trading. For the sake of argument, we looked at around 100 option trades by members in 2021, and assumed these trades were buying/holding. Very simple long or short positions, nothing complicated. Although not fully accurate, let's determine the approximate returns overall:

It looks like the House Representatives are quite good at options trading (with an overall average returns of 35.7%). The best options trader in the House, from this limited analysis, is Rep. Blake Moore with an average return of 62.5%, followed by Speaker Pelosi with an average return of 36.6% at the time of this analysis. You can track her returns in real time at our i_am_the_senate page.

When we exclude puts, their returns are even better at an overall average of 47.1%. Here’s a chart of their returns on call contracts in 2021.

It should be stated that elected officials making leveraged options trades off privileged information should probably not be allowed. Here are some unusual option trades and the context around them:

- Pelosi’s DITM call leaps filed in December 2020, right before Biden’s Presidency started (ie. Her legislative influence in Congress increased exponentially)

- $BABA puts from Senator Tuberville and Rep. Moore who both sit on the Senate and House Armed Services Committees privy to information on emerging threats such as China

- Rep. Blake Moore’s super profitable $WYNN puts prior to its September collapse

Late Disclosure Club

First introduced by the STOCK Act, Congress has at most 45 days to file their financial disclosures from the transaction date. If they require more time, they have at most 90 days from the transaction date, but must file an extension request. Late disclosures are subject to penalties in both the House and Senate. See screenshots below from Ethics Committee websites.

Here is a list of elected officials who filed late financial disclosures in 2021 (ie. more than 45 days late. I did not confirm if extensions were filed for these). It is interesting to note Senator Tommy Tuberville’s 132 trades that were disclosed late. Apparently, he didn’t know the procedure. Right… Furthermore, the only consequence for filing that many transactions late is the single $200 fine! Senator Tuberville did not comment on whether he paid the fine. I wish the IRS were that easy on us. However some elected officials took action this past year to act in more of an ethical manner. For example, Rep. Tom Malinowsku moved his entire financial portfolio into a blind trust… after he was found to be in violation of the STOCK Act in early 2021.

Concluding Remarks

Whether it’s questionable timing or something the individual may or may not know, our elected officials put themselves in tough situations when they are allowed to trade in specific equities and derivatives while actively legislating. They open themselves up to perceived conflicts of interest, which can make the public question their motivations.

This is why many have called for measures that go above and beyond the STOCK Act. These include moving financial portfolios into blind trusts, being restricted to broad sector index funds only (and not individual company stocks), or not being able to trade at all while in office.

Ultimately, without any support from the Old Guard, such as Speaker Nancy Pelosi, these measures will never be implemented. Pelosi has been very vocal about whether elected officials should be able to trade while in office.

This report shows that in 2021 Congress continued to trade in the very sectors they were tasked to create legislation for. Our politicians traded in huge volumes and amounts while being privy to closed door meetings and negotiations on committees in the House and Senate. I have previously highlighted how our elected officials have profited during the beginning of the pandemic (links to House and Senate reports). This report shows that some continue to make mad gains. We track these trades daily on our website. It’s free.

For me, this analysis was surprising, maddening and upsetting. Despite what Speaker Pelosi thinks, the general sentiment amongst regular folks is that our elected officials should not be trading in the stock market while they represent us in office. We should remember though that we, the people, wield the power to elect folks who also believe in the same. One encouraging stat is that for every one Congressional member that did disclose trades in 2021, there were around 3 that did not trade at all in 2021. Until Congress changes, we’ll continue to highlight their financial ties here at www.unusualwhales.com.