Congressional Trading in COVID-19 Vaccine Stocks

From 2021

In previous reports, Unusual Whales has shown that elected officials often trade in sectors that they legislate in. They are privy to non-public information through the committee positions they hold while in office. Even if not acted upon, there is a perceived advantage over regular folks like this.

This perceived conflict of interest has not stopped and continues throughout the pandemic. This short post will highlight congressional members buying and selling stocks in Pfizer ($PFE), Moderna ($MRNA) and Johnson & Johnson ($JNJ) -- the world’s leading COVID-19 vaccine manufacturers.

Pfizer

Pfizer and BioNTech first announced their COVID-19 vaccine partnership on March 17, 2020. This also happened to be around the time the stock market crashed as the reality of the pandemic and its global impact set in. Interestingly, two weeks prior to this announcement, Senator David Perdue (yes, that guy) bought $PFE while the market was on its way down on February 26, 27 and 28 for a maximum disclosed amount of $260,000! One has to wonder why, especially as he sold up to $825,000 in stocks during this same period. Senator Perdue later sold off his Pfizer stocks between April 4-14, 2020 as the market recovered.

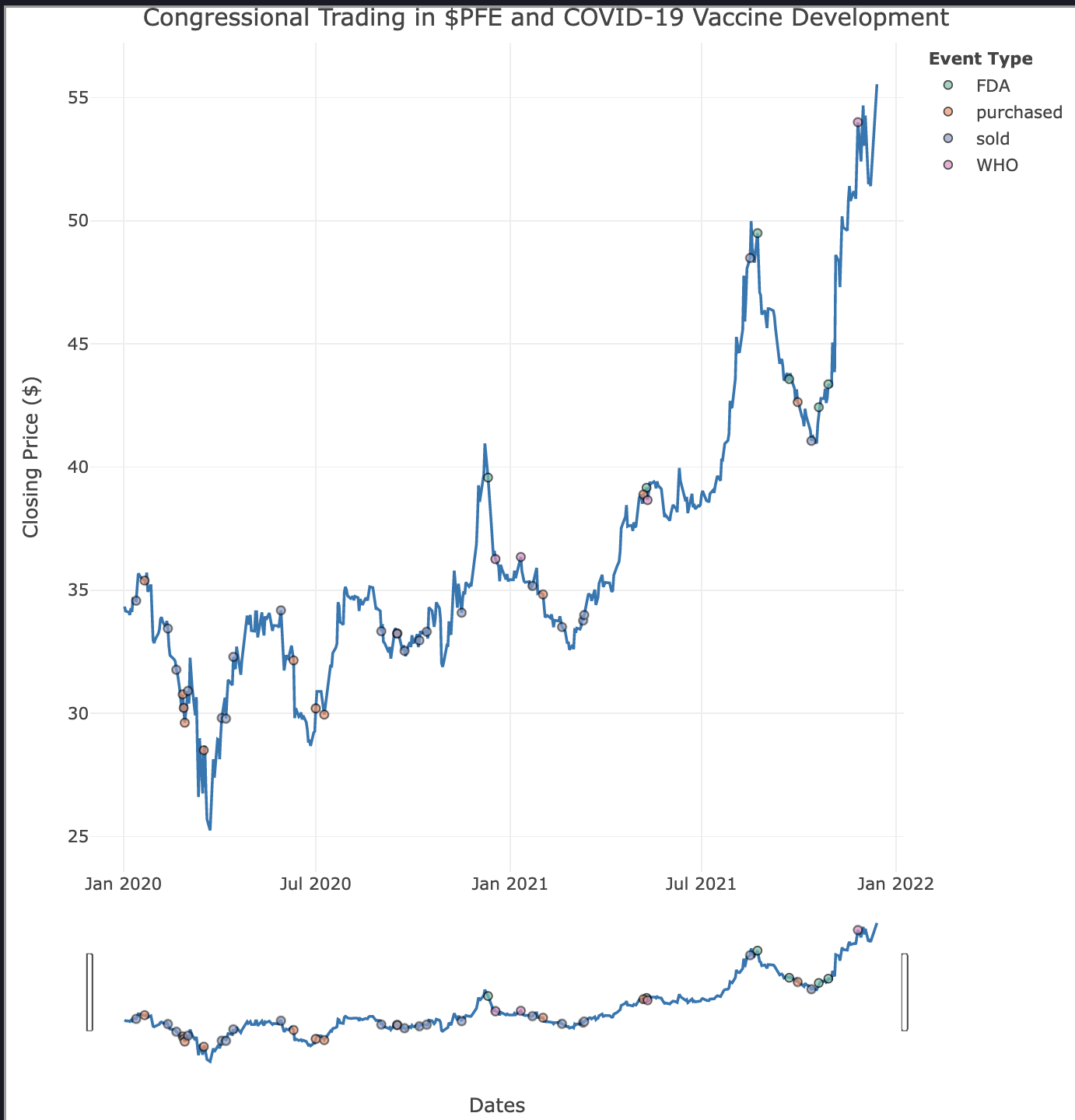

In the interactive chart below, we’ve mapped out all congressional trading in Pfizer and included key FDA and WHO announcements related to COVID-19 or vaccine development.

As Pfizer and BioNTech began clinical testing in summer 2020, congressional members continued to buy and sell Pfizer stock. These individuals included: House reps. John Yarmuth, Ed Perlmutter, Mo Brooks, Lois Frankel and Bob Gibbs, as well as Senator Thomas Carper. Pfizer’s stock hit an all time high at the end of 2020 when the FDA issued emergency use authorization to their COVID-19 vaccine.

This year, Pfizer hit a local high when its vaccine was officially granted FDA approval on August 23, 2021. Conveniently, House Rep. Mo Brooks sold up to $50,000 in $PFE stock one week before. This would mean he had up to +70% returns, if we take his earliest purchase date of March 17, 2020.

Other than House Rep. Zoe Lofgren buying and selling $PFE stock in October 2021, there haven’t been any other congressional trades reported yet. Pfizer’s stock is at all time highs as Omicron has officially been declared a Variant of Concern (VOC).

Moderna

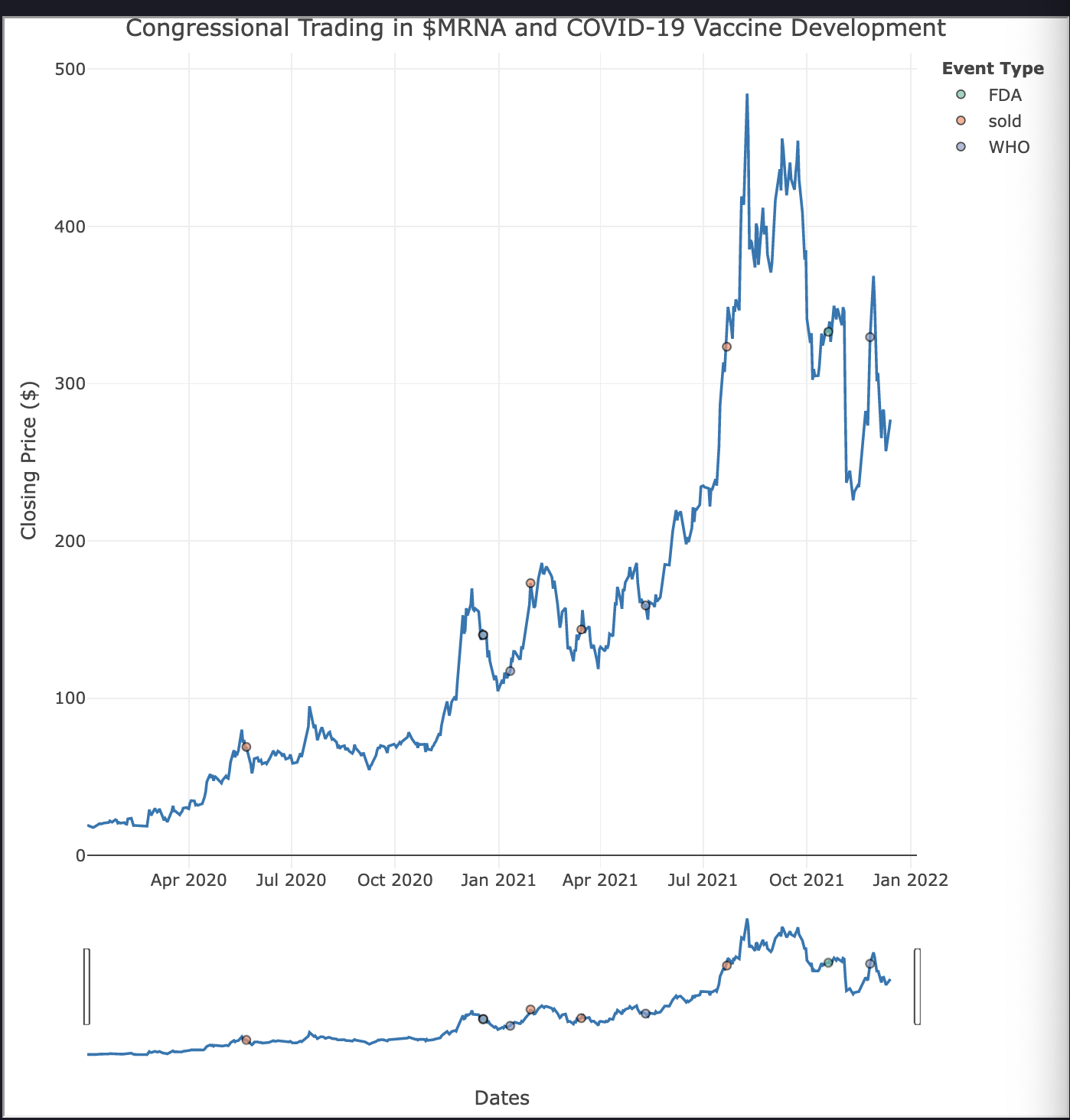

Moderna was a scrappy biotech developing cutting edge mRNA vaccines for rare diseases prior to the pandemic. They were able to quickly pivot and adapt their vaccine platform to target COVID-19 and the rest is history. Notably, news of Moderna’s vaccine development appeared as early as February 2020. Although we couldn’t find any stock purchase details by congressional members, the earliest reported $MRNA sale was by House Rep. Josh Gottheimer on May 22, 2020. He has been steadily selling off his shares, along with fellow colleague Marie Newman, throughout the pandemic.

Johnson and Johnson

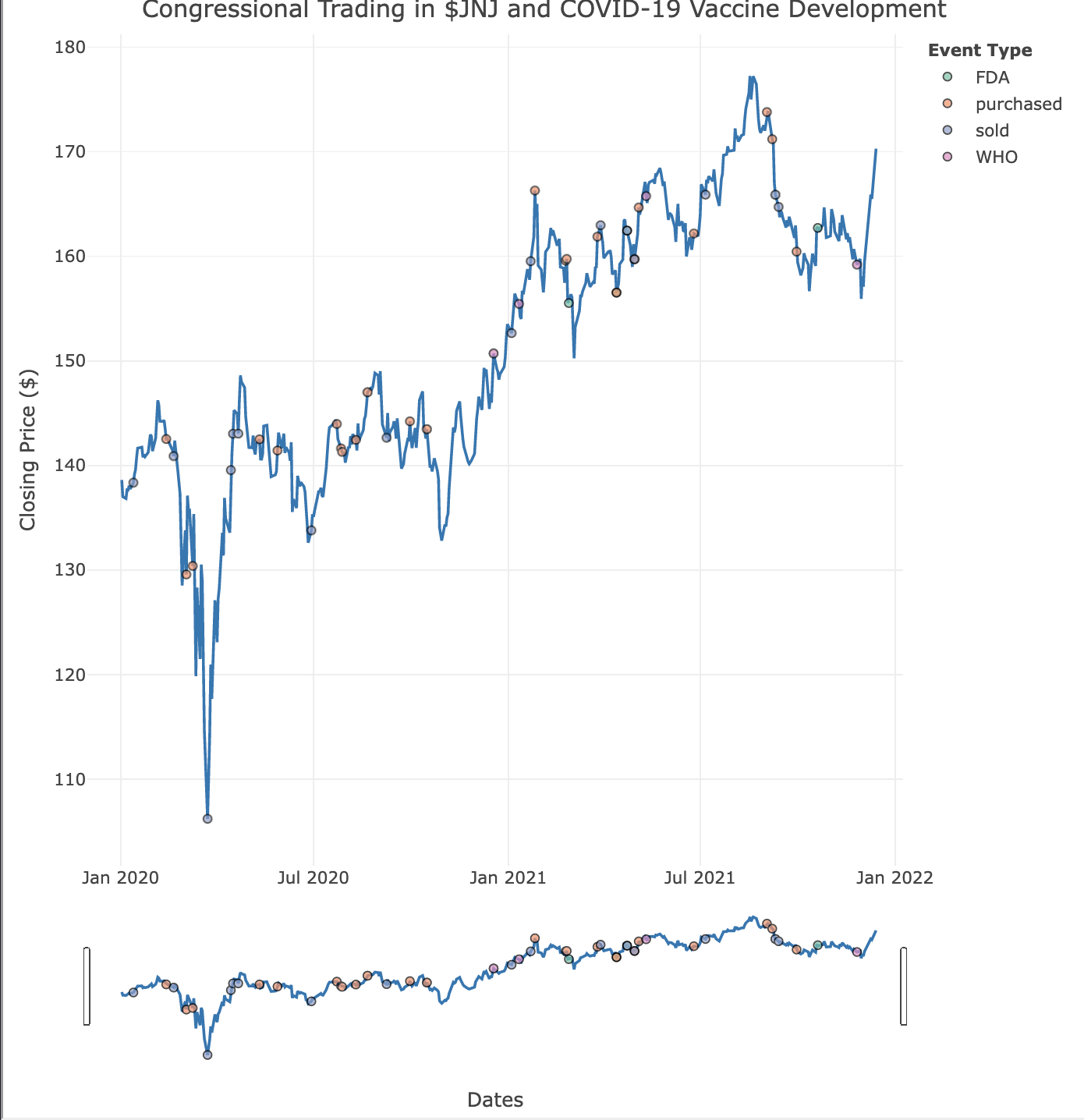

Johnson and Johnson first announced their lead vaccine candidate on March 30, 2020. As a legacy pharmaceutical company, we’d expect to see $JNJ to be a part of many congressional stock portfolios prior to the pandemic. However, even after announcing vaccine funding from the US Government, Congress continued to buy and sell $JNJ stock.

Interestingly timed trades include House Rep. Blake Moore began to buy $JNJ stock on February 24 and 25, 2021 just two days before the FDA issued emergency use authorization to the company’s vaccine. He’s continued to buy the stock and hold.

House Rep. Marie Newman purchased $JNJ on April 13, 2021 w

hich was the same day the FDA paused its vaccine rollout due to blood clot concerns. She then disclosed selling her $JNJ stock on April 23, 2021 which was also the same day the FDA lifted its restrictions on the vaccine and continued its rollout of the one-shot vaccine. She made a modest, but quick, 3.8% gain.

All three aforementioned vaccine manufacturers are reaching ATH as Omicron takes over. You’d think that our elected officials would steer clear of investing in companies that directly benefited from government funding based on their legislative decision making. But no. They continue to trade in these and others. As long as this continues, we’ll continue to report on their unusual trading. Follow along at @unusual_whales.