CoreWeave Stock Sinks – What’s Behind Today’s Dip?

What happened today

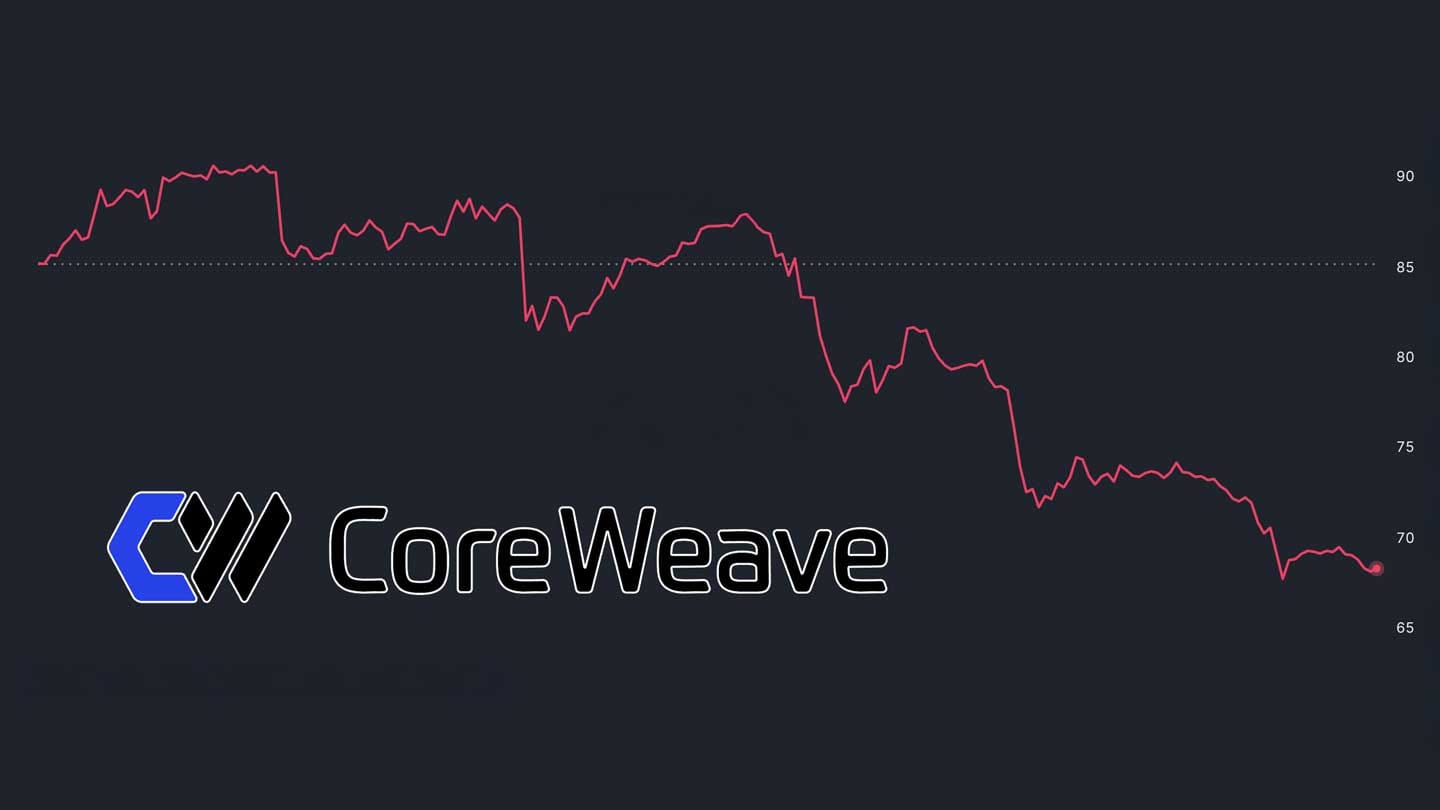

Shares of CoreWeave (Nasdaq: CRWV) continued their slide today (December 16, 2025). In mid‑day New York trading, the stock hovered around $69 per share, which was about 4% lower than its previous close.

The investor‑relations page reports heavy trading volume with more than 17 million shares changing hands and an intraday range between $67.88 and $71.50. These levels put the stock far below its 52‑week high of $187 (20 June 2025) but well above its 52‑week low of $33.52 (21 April 2025). Though the shares have fallen roughly 60% since their peak in June, the stock remains up about 81% year‑to‑date thanks to a surge after its March IPO.

Key trading metrics

The following bullet points summarise today’s trading metrics:

- Current price: approximately $69 per share, down around 4% from the previous close.

- Price reported by FinanceCharts: $68.80 per share, a 4.91% decline from yesterday.

- Intraday high and low: $71.50 / $67.88, showing considerable volatility.

- Volume: over 17 million shares traded by mid‑day.

- Year‑to‑date return: about +80.88%.

- Distance from 52‑week high: roughly –61%.

- Market capitalisation: about $33.8 billion.

Why the stock is down

Multiple factors contribute to CoreWeave’s decline. The following sections break down these drivers into digestible pieces.

Debt dilution – convertible notes offering

CoreWeave recently announced a convertible debt offering that shocked investors. On 8 December 2025, the company said it would sell $2 billion of convertible notes, allowing an additional $300 million if demand proved strong. Fast Company later reported that the deal was upsized to $2.25 billion. These notes pay about 1.75% interest and can be converted into equity, meaning existing shareholders risk dilution. Following the announcement, the stock fell around 8.5% and remains under pressure.

High borrowing costs and credit stress

Unlike the tech giants, CoreWeave must borrow at much higher rates. Reuters’ Breakingviews reports that data‑centre developers working with “neo‑cloud” providers borrow at roughly 7.5% interest—about 4.5 percentage points above SOFR—compared with 2%–2.5% spreads for large hyperscalers. Credit‑default‑swap spreads referencing CoreWeave’s debt spiked from 250–300 basis points to around 720 basis points after the company trimmed its 2025 revenue guidance due to capacity delays. Such stress signals that investors are concerned about CoreWeave’s ability to service debt.

Aggressive capital spending and thin margins

CoreWeave is racing to build GPU‑packed data centres to meet surging demand for generative‑AI computing. Fast Company reports that the company raised approximately $14 billion through debt and equity in 2025 and paid $311 million in interest during Q3 2025—triple the amount from a year earlier.

Management plans to spend $12–14 billion on infrastructure this year and expects that spending to double in 2026. While revenue surged 134% year‑over‑year to $1.36 billion in Q3, operating margins were just 4%, and the company reported an adjusted net loss of $41 million.

The Motley Fool notes that CoreWeave has burned more than $8 billion in free cash flow in the last 12 months and continues to spend twice as much on capital expenditures as it generates in revenue. GPUs have lifespans of three years or less, forcing constant reinvestment.

Operational delays and communication missteps

Bad weather in Texas delayed the completion of a 260‑megawatt data‑centre cluster that CoreWeave plans to lease to OpenAI. CEO Michael Intrator initially suggested only one facility was delayed, but later clarified that several were affected. This inconsistency, along with the guidance cut, has rattled investors.

Market rotation away from AI hype

The sell‑off is not unique to CoreWeave. Fortune reports that while CoreWeave fell about 8% and Oracle dropped 2.66% on 15 December, the S&P 500 slipped only 0.16%. Some investors appear to be rotating out of highly leveraged AI infrastructure plays toward sectors with steadier cash flows. Analysts quoted by Forbes warn that concerns about a “generative‑AI bubble,” rising capital‑expenditure needs, and heavy debt loads could continue to pressure CoreWeave.

Performance context

- March 2025 IPO and summer boom: CoreWeave went public in March around $40 per share and surged to about $187 by late June—a 360 % gain. Enthusiasm for AI infrastructure drove the rally.

- Autumn slump: In November, the company issued revenue guidance below analysts’ expectations, and shares plunged 45%. Short interest subsequently jumped 25.7%, now representing 10.5% of the float.

- Convertible‑note pullback: The December convertible‑debt offering triggered a fresh sell‑off, pulling the stock into the high‑$60s.

Bottom line

CoreWeave is building a business at the heart of the AI boom, leasing GPU‑rich data centres to clients such as OpenAI, Meta, and Microsoft. The firm boasts a revenue backlog of about $55.6 billion, including $14.2 billion from Meta, $22.4 billion from OpenAI, and $6.3 billion from Nvidia. However, delivering on that backlog requires massive capital outlays and heavy borrowing.

The recent $2.25 billion convertible note underscores those funding needs and raises the spectre of dilution for existing shareholders. With borrowing costs elevated, cash burn intensifying, and market sentiment shifting, the stock has slumped to around $69, about 61 % below its June high but still well above its IPO price. Investors should be prepared for continued volatility.

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through market tide, historical options flow, GEX, and much more.

Create a free Unusual Whales account to start conquering the market.