Bananas: Dole Plc (DOLE) Gets the Reddit Ape Treatment; but is it More than Just a Meme?

SEPT. 30, 2021

10:45ET: Over the last day and a half, Ireland-based fruit and produce company Dole Plc (DOLE) has gotten a lot of attention on Reddit. While it hasn’t been the most talked about, Dole Plc has found its way to the front page of Reddit’s most excitable trading subreddit, r/WallStreetBets.

Much like we saw in our article about SmileDirectClub (SDC), numerous people, traders, and apes have posited their respective YOLOs into the potential pop on Dole’s stock price. After taking a close look, though, it could be that the rationale behind the DOLE pop is more than just a meme.

Just months ago, Dole Food Company moved to combine with fellow produce company, Total Produce, to form Dole Plc. Shortly thereafter, the combined entity went public via IPO as a way to refinance and de-lever each company’s respective debts. By combining the two companies, Dole has effectively secured its place as the #1 fresh produce provider. You can see the details in this great write-up by Value Situations.

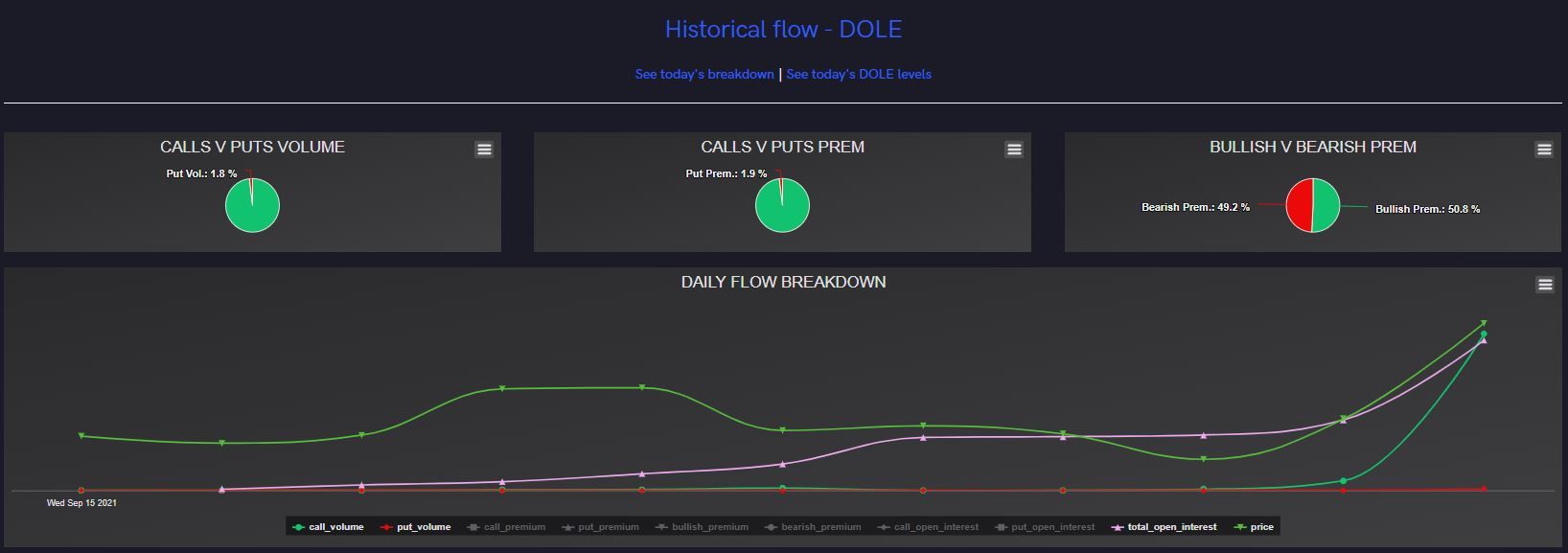

In the world of options trading, there is some evidence in the flow that seems to indicate that traders are eyeballing DOLE for more than just a short-term pop.

This image, taken the morning of September 30th flow, shows us a heavy focus on the October 15, 2021 striked. This is the sort of flow we have grown to expect from stocks with a heavy Reddit following or presence; short-dated expiries on orders, reflecting traders following the flow. However, we noticed a few long-dated orders, expiring in May of 2022. This led us to take a closer look.

We next filtered the tool to account for Ask-Side only orders with $5k or more in premium, and a minimum expiration date of 50+ days in the future. The resulting image above shows us a broader picture of how traders are preparing for a longer-term strategy.

Under these filters, the May 5, 2022, expiration date becomes the favored target, with the $17.5 call as the main target strike. Although the order sizing is smaller than those two-week-to-expiration in the previous image, this shows us that amid the frenzy to follow this short-term movement, some traders are planning for the future.

This doesn’t come as terribly surprising, however. According to Nasdaq, analyst price targets for the newly formed Dole Plc range from a low estimate of $15 to a high of $26, for an average price target of $19.60. Currently, DOLE is up 4% to $16.48, having reached a high of $17.39 this morning.