Earnings and Catalysts for 8 x 8 Inc. (EGHT) and NCR Corp. (NCR) Trigger Unusual Options Activity

Unusual Options Activity in NCR Corp. (NCR) and 8 x 8 Inc. (EGHT), captured by the Unusual Whales Flow tool yesterday (October 25, 2021), shows expectations of upward movement in the mid-to-long term. Although this was somewhat overshadowed by the frenzy of SPY hitting all-time-highs and the recent Tesla stock moon mission, it’s worth taking a closer look at how options traders seem to feel about these two stocks.

8 x 8 Inc. (EGHT), based out of Campbell, California, is a company engaged in voice over IP products, including cloud-based voice, contact center, mobile and video for businesses to utilize in their communications. Yesterday, the Unusual Whales flow tool captured a sizable order of 2,500 contracts for the $24 call strike expiring on November 19th, bought to open on the ask side. At the time, EGHT was trading at $22.72 per share. Opening these 2,500 call options, totalling $213k in premium, shows an expectation for the company to move 5%+ within the next few weeks.

If this large order isn’t indicative of bullish sentiment enough on its own, it’s also worth noting the massive gap between the last week’s call option volume and EGHT’s average daily volume. Historically, EGHT does not see large volume on call options.

On October 19th, 20th, and 25th, there were massive spikes in options volume. Sub 100 call volume is quite common for this stock; however, the last 7 days have seen call volume as high as 10,314, and put volume as high as 11,005. Don’t let the larger amount of puts on the 19th fool you, however; as flow marked “bullish” by the flow tool made up for over 98% of all premium paid. Granted, EGHT is expected to post earnings in the near future, so this sentiment could be related to an expectation that EGHT will beat earnings.

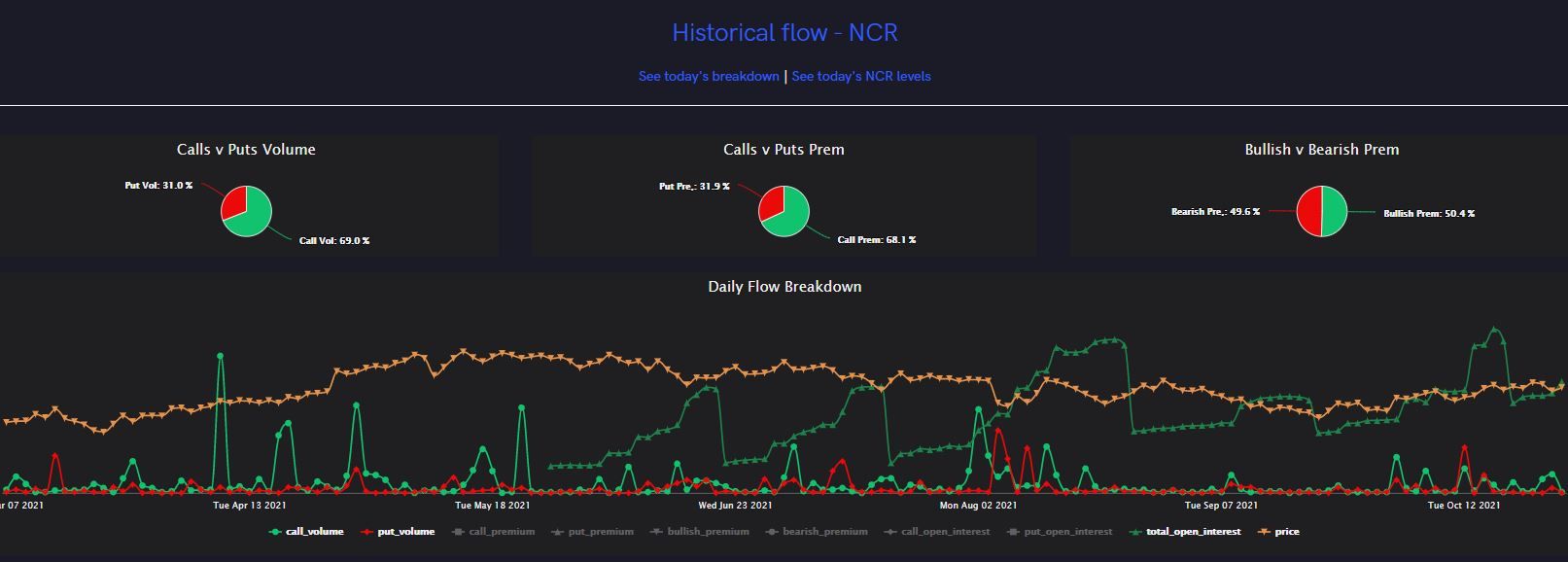

NCR Corporation (NCR) also demonstrated unusual options activity during market trading yesterday, with earnings reporting after market hours today, Tuesday October 26th. With 1,500 contracts opened on the $50 call strike expiring December 17th for a total premium of $107k, someone seems to believe the stock will continue its upward push.

NCR Corp. also had a promising catalyst. The company manufactures point of sale terminals, self-service kiosks, and ATMs. According to a Bloomberg article, convenience store chain Royal Farms out of Baltimore Maryland announced that it will be implementing NCR terminals and machines in all of its store locations. Royal Farms currently operates over 200 convenience stores, so this news is indeed noteworthy.

Currently, NCR is trading at a share price of $42.98, and showing signs of momentum.

EGHT is currently trading at $23.08.