How Elon Musk Influences Crypto: A Deep Dive Report

TL;DR

- Elon’s tweets have been found to move $TSLA

- Historically, his viral meme tweets yield higher short term returns than his tweets specifically mentioning the coins

- His tweets coincide with higher volume within the first 3 days of the tweet

- Building a crypto investment strategy around when Elon tweets is no better than randomly investing in the aforementioned cryptos

- Dogecoin is the anomaly, with consistently higher returns than randomly investing

The internet’s favorite, or least favorite, philanthropist Batman-esque billionaire Elon Musk is notorious for affecting prices within the stock and crypto markets, most notably with his tweets.

Over the past year or so, we have seen dramatic movements in crypto following his tweets, including with bitcoin, dogecoin, and recently, shiba inu. We have even seen the birth of shitcoins like floki, fuckelon, elonsperm, elongate, etc. because of his prolific tweeting on crypto (which we don’t look into in this report, unfortunately).

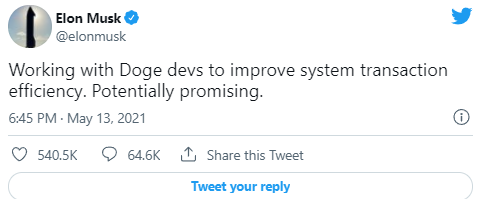

Here are some examples.

Following each of these tweets, we saw surges in dogecoin price, up to $0.8 at its peak.

Whenever Elon tweets crypto, crypto seems to move. Crypto traders are breaking their keyboards refreshing his feed, and high frequency crypto institutions catch these tweets within a second of them being sent. However, most people don’t have the time or bandwidth to catch these. We are preoccupied with daily life and most of us likely do not see these tweets the moment they happen, or even hours after they happen.

Is there still a chance for profit even after the fact?

Let’s find out.

First, a brief backstory on the pop-culture history of Elon, for those unfamiliar to the matter.

The Techno King of Tesla

What has propelled Elon Musk to be a massive market mover? How can one man have such an effect on the price of assets for his company with just his personality, or even assets entirely unaffiliated with his company? Well, nobody has a concrete answer, but here are some ideas:

His quick, witty responses to instigators; his outright detest towards the SEC; and his affinity to and fluency in meme culture, are a circular reasoning to what made him a meme in the first place.

There is a thread on Twitter that discusses more around what a “meme stock/leader” is, and what it reflects. Check it out below.

But on a deeper level, why else has his personality become a driving force behind different assets?

Looking at his business ventures, some would attribute it to his innovation of product which has allowed him to get to this level, others would say it is dumb luck this shtick stuck. But like him or not, here are some of his accomplishments.

- Elon has been the spearhead for the electric car market in the last 10 years with Tesla

- Made massive changes towards the future of space tech with the direction of Space X

- Launched affordable internet satellites into space with Starlink

- Used a mind reading chip on a pig with Neuralink

- Created flamethrowers and hyperloops with the Boring Company

So, there is no doubt that he has proven to be a successful entrepreneur.

But what about outside factors, such as his tweets? As mentioned, he has a history of moving markets. But why? Elon is a dominant force on Twitter, largely due to his thought leadership in innovation and more recently due to his ridiculousness. A point that was made in reference to the “what is a meme stock?” thread above. He has done many things deemed by the Internet to be eccentric, such as the name of his son, launching a sports car into space, or helping create a Black Mirror-esque mind reading chip. His following has continued to grow steadily, and with that, his online influence.

Is there a concrete answer to why he’s in this position? Most likely not, or other CEOs would have done the same thing to boost stock prices. At the end of the day Elon is just Elon, and he’s become the best example of a human meme lord we’ve found.

What’s really important to us is whether Elon has any effect on my portfolio and if we can find an alpha.

Now, let’s get into the nitty gritty.

The Effects of Elon’s Tweets on the Market

Disclaimer: The Twitter data was scraped from @elonmusk, and contains 10,000 tweets/replies from 2018-07-21 through 2021-11-24. We took into account all mentions of words concerning (bitcoin|btc / ethereum|eth / dogecoin|doge / shiba inu|shib), even replies, as to have a logical basis for the report and its objectives. Sentiment analysis of text or images was not done.

The Twitter data used in this analysis had the following:

Let’s start with understanding when Elon uses Twitter. Below is a heatmap showing when Elon tweets, by hours of the day, and days of the week. This is standardized in EST, as it coincides with market time, should that come into effect.

Elon is very active on Twitter from 12pm EST through 2am EST. He’s devoted to the craft of tweeting, and now we have data to back that up.

But, how much do his tweets affect the markets?

Let’s look at Tesla.

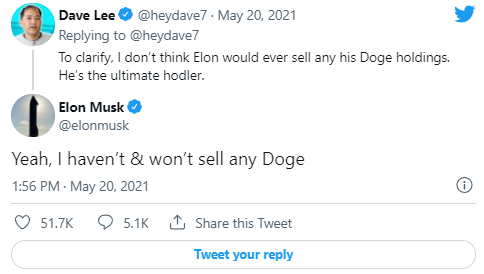

“too high imo”

The arguable birthplace of the questions surrounding Elon's market influence lies within the tweet below.

This tweet alone raised the attention of the SEC and caused them to take action. But after that, what effect has there been on his tweets mentioning Tesla? The tweet was in May 2020 when Tesla was around $200/share (pre-5:1 split). It caused quite a stir online, as CNBC wrote about Elon Musk’s tweets are moving markets some months later, more or less accrediting movement to his tweets and declaring manipulation. Is it intentional manipulation? More than likely not; he’s just a public figure with a lot of influence, so naturally investors would follow the CEO of one of the world’s largest companies rather closely and make decisions based off his tweets, whether intended to be good or bad, and end up reflecting movements in stock price.

The chart below shows all of Elon’s tweets about “TSLA” or “Tesla” as red dots on top of Tesla’s stock price.

We can see that Elon tweets often about Tesla, but displayed in this way it’s difficult to see whether his tweets have had an effect on the movement of Tesla’s stock price.

To understand how Tesla’s stock price changes around Elon’s Tesla tweets, let’s compare the days before and after these tweets. The following chart shows the percent changes in stock price relative to the tweet date. The main line shows the average, while the shaded area shows the standard deviation. The dashed white line indicates Day 0.

At first glance, you’d think “hey these guys did this wrong; it’s a straight line!”, but we need to realize that since January of 2020, Tesla is up 1100%. Does this chart tell us much about Tesla stock and Elon’s tweeting effects on it?

The question we begin to ask ourselves is “Are these events mutually exclusive?” Most likely, no, they’re not. We can’t entertain the thought that Elon is completely separate from Tesla’s 1100% rise, since it’s arguable that this would not have happened without his incessant tweeting.

On visual analysis alone (not reinforced by statistics), it seems like Elon’s tweets mentioning Tesla return higher than a random sample, but it’s hard to verify. The strategy seems to check out here -- at least at surface level -- and yields fairly consistent higher returns for each day following the tweets.

So, it’s clear Elon has an effect on his own company’s stock, but what does this say about crypto? After all, Elon has been a driving force into dogecoin’s adoption, and an advocate for crypto in general, considering Tesla’s massive purchase of Bitcoin in 2020.

Dogecoin

Elon has been very outspoken about crypto in the last year and a half, most notably with the original meme coin itself, dogecoin. His public support have help solidify dogecoin’s spot in the top 20 coins by market cap, at the time of writing it’s #11 with a market cap of $28 billion.

Let’s look at Elon’s tweets relative to dogecoin.

There are three periods that represent a clear, definitive move in dogecoin’s price.

- February of 2021’s tweet storm

- Final clustering of 3 tweets before April’s rise

- Tweet at the bottom of April’s rise

But how does doge, in general, perform after his tweets? Let’s look at the chart below for that.

Dogecoin has an average movement nearing 7% 2 days after a tweet, and seems to regress following, showing that price action could be attributed to sentiment. Again, are these events mutually exclusive? Most likely not.

In the above figure, we do the same analysis but filter on “viral tweets”, tweets with more than 50,000 likes, or more than 10,000 retweets. These tweets may not mention the asset in question, but are just considered viral tweets from Elon.

We can see that returns on viral tweets are very promising, returning fairly consistently in the 3 days following the tweets taking off. An imaginative stretch would be that the tweets are constituted as “viral” approximately 10 hours after the tweet is published, which reflects the vertical movement in doge from T=10h to T=25h.

Since a large portion of his influence in the crypto market is with dogecoin, let’s check and see the volume.

Based on his viral tweets alone, dogecoin sees a very large volume jump in the first hour compared to the time of the tweets. When we examine tweets specifically mentioning dogecoin, volume rises to ~100% within the first 2 days compared to the time of the tweets. It continues to rise to an average peak of 73% at 6 hours, peaking at 48 hours and then tapers.

How about with other cryptos?

Bitcoin

Musk is a prominent figure in the crypto world, so whatever he seems to talk about should have some effect, right? Let’s look at Bitcoin.

The chart reflects some decent sized movement within Bitcoin, specifically noting January 2021, and again seems like it gave another run around March, along with several pushes on the way to the local ATH in April.

One would look at this chart and think “Oh, there’s lots of upward movement from his tweets”, and they would not be wrong, if they were only accounting for the first 5 tweets about Bitcoin in 2021, but mean returns portray a different story.

From the chart, Elon’s tweets have a negative yield on average with Bitcoin within a 3 day period. Did his frequency of tweets throughout Bitcoin’s low period between May and July help push it up, or did it just bottom out and catch its legs? Since his direct influence to Bitcoin isn’t as attributable to movement as it is with dogecoin, it’s very hard to say.

When we check his viral tweets, the narrative flips slightly. Bitcoin has some moderate success after his viral tweets, but it’s extremely limited. A <2% move on average, especially considering the volatility of the crypto market, isn’t that large. However, it is a positive return, even after taking into account the chart of total Bitcoin tweets, and someone shows you can just buy whenever a tweet of his goes viral.

As we did with dogecoin, let’s check the volume change post-tweet.

When Elon references Bitcoin in his tweets, we see a spike near 22% in the immediate hour following, rising to 94% change in volume over the next 12 or so hours. Again, there seems to be a clear relationship between Elon’s Bitcoin tweets and volume changes.

When we apply it only to viral tweets, we don’t see as drastic of volume changes with average changes reaching up to 30% within 24 hours.

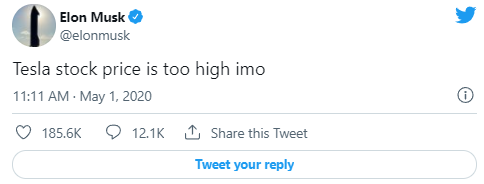

Further with Bitcoin, there are two explicit tweets which hold a lot of weight for the argument that Elon affects Bitcoin’s price.

The first being the tweet below.

Looking at the chart, there wasn’t much of an immediate response following the tweet itself. Bitcoin fell for several days, but found some legs and climbed above the time-of-tweet price at $54,585

However, the most interesting movement came from this tweet.

When including all tweets mentioning bitcoin or tesla, there isn’t much direct movement correlation. But, it’s clear that the above tweet was (at least partially) a catalyst for a massive selloff. May 12th itself was a $10,000 fall in bitcoin’s price (from high to low). Even without statistical significance, a mega viral tweet such as this (500k likes at 75k retweets), has a clear effect on Bitcoin’s price action.

Ethereum

Doesn’t seem to be much movement here due to a lack of tweets, but we can still check average movement after tweets about ETH. In fact, it’s seemed like he’s accidentally called local tops 3 times with Ethereum.

The above plot paints the rest of the story with ETH, in that the asset absolutely hates when Elon tweets about it. Not much to see here.

Inversely, the same story with Bitcoin and viral tweets is seen here, in that, on average his viral tweets yield a slight positive return with ETH.

The same volume trend in Bitcoin and dogecoin is also observable within Ethereum, though again, sample sizes make inference rather difficult.

Here, there is a definite volume spike in the 10 hours following his tweet’s mentioning ETH. This seems to be a general trend among cryptos he mentions, and has notable effects.

His viral tweets don’t appear to impact ETH volume, most likely because Bitcoin and Ethereum are so liquid already.

Shiba Inu

How about the doge derivative itself? The coin with a float of +$300 trillion, with each coin valued at a fraction of a penny, and a market cap somehow rivaling the other top 20 coins.

Note that Elon has far less SHIB tweets since he didn’t start talking about it until March 2021.

Backtesting with Elon

We’ve shown that Elon has some effect on the cryptos analyzed in this report. What if we were to develop a crypto investing strategy around when Elon tweets? Specifically, we run through the following strategies and backtest them to see how successful they would be compared to randomly investing in cryptos.

- Invest every time Elon tweets (since July 2018) mentioned crypto or went viral. Returns as of today?

- Invest every time Elon tweets (2021) mentioned crypto or went viral. Returns as of today?

- Invest every time Elon tweets (since July 2018) mentioned crypto or went viral. Returns within 24 hours?

- Invest every time Elon tweets (2021) mentioned crypto or went viral. Returns within 24 hours?

- Invest every time Elon tweets (since July 2018) mentioned crypto or went viral. Returns within 72 hours?

- Invest every time Elon tweets (2021) mentioned crypto or went viral. Returns within 72 hours?

Strat 1:

Strat 2:

Strat 3:

Strat 4:

Strat 5:

Strat 6:

Observing the returns of each of these strategies, there is no clear-cut winner, or blatant alpha. However, strategy 5 and strategy 6 with dogecoin seem to be the main anomalies, returning ~15% more than randomly investing in dogecoin. SHIB also has blatant bias and very few tweets to analyze, so it’s hard to constitute that as objective alpha.

Conclusion

The goal of this report was to analyze Elon Musk’s influence on the cryptocurrencies he’s mentioned in the past. We hope this report helps retail investors to better understand the historical impacts of his tweets on these digital assets and maybe anticipate future effects.

We show that:

- Elon’s tweets have been found to move $TSLA

- Historically, his viral tweets yield higher short term returns than his tweets specifically mentioning the coins

- His tweets coincide with higher volume within the first 3 days of the tweet

- Building a crypto investment strategy around when Elon tweets is no better than randomly investing in the aforementioned cryptos

- Dogecoin is the anomaly, with consistently higher returns than randomly investing

Whether he thinks this or not, Elon Musk is a prominent member of the crypto community. He is also a very influential figure on Twitter that has moved markets at the tap of a button. Love him or hate him, it’s clear that his digital persona has an influence on investment returns.

We hope you found this report interesting and/or helpful! If you’d like to share your thoughts with us, let us know @unusual_whales and @falcon_fintwit. Hit us up on Discord too!