JPMorgan Trading Desk Turns Cautious After Fed Probe Shock — Stocks & Options Impact

JPMorgan Trading Desk Flips to Caution Amid Fed Independence Risk

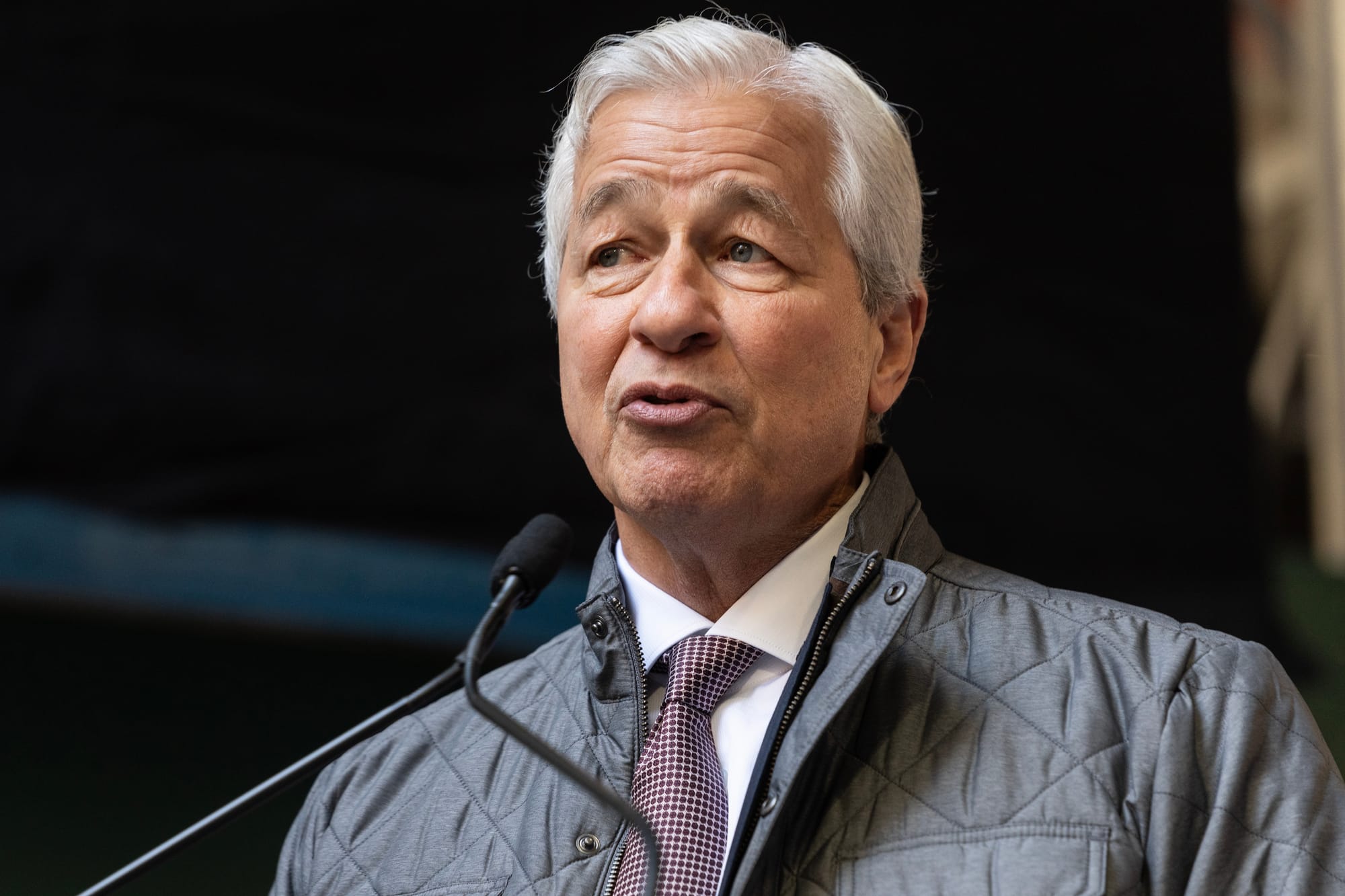

JPMorgan’s trading desk has shifted its stance to cautious on U.S. stocks after political pressure and a Justice Department investigation into the Federal Reserve rattled markets and threatened long-standing central bank independence.

The core concern? A criminal probe into Fed Chair Jerome Powell — officially tied to renovation testimony but widely seen by traders as politically charged — has sparked fresh skepticism about monetary policy autonomy and shaken confidence across asset classes.

This isn’t a normal market hiccup — it’s a structural debate showing up in risk pricing and trader positioning, and JPMorgan’s institutional desk is publicly flagging it as a near-term headwind for equities.

What’s Rattling Markets: Fed Independence Under Fire

Traditionally, the Federal Reserve’s independence has been a foundational support for U.S. financial markets: clear signals, predictable policy, confidence-anchored inflation expectations.

Now those assumptions are being reassessed.

JPMorgan’s team notes that:

- Political pressure on the Fed is intensifying.

- News of subpoenas and probe headlines hit futures and sentiment hard.

- Safe havens like gold and defensive bonds have seen flows amidst broader equity caution.

That combination is a risk-off tilt — not a full panic, but a caution flag that investors and traders cannot ignore.

Divider

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free account here to start conquering the market with Unusual Whales.

https://unusualwhales.com/login?ref=blubber

Short-Term Market Sentiment is Shifting

Since the probe and political headlines:

- Equity futures weakened.

- The U.S. dollar softened.

- Traders rotated into perceived safety plays.

This risk repricing shows up early in volatility expectations and options flow before it shows up in stock prices.

What used to be a macro narrative — rate expectations, inflation pivots — now has a political overlay.

When policy credibility is in question, markets often react first in implied volatility and skew, as traders hedge uncertainty around central bank actions. That’s where Unusual Whales data shines.

Stocks to Monitor on Unusual Whales

With caution rising in equities, certain key names and sectors are drawing heightened options flow and positioning shifts:

Mega-Cap Tech (Risk Market Barometers)

- Nvidia ($NVDA) — AI & compute king; big beta name

https://unusualwhales.com/stock/nvda/overview - Microsoft ($MSFT) — broad tech exposure

https://unusualwhales.com/stock/msft/overview - Amazon ($AMZN) — consumer + cloud bellwether

https://unusualwhales.com/stock/amzn/overview

These stocks often lead sentiment shifts — put flow and volatility expansion here can signal broader risk aversion.

Financials (Directly Tied to Fed & Rates)

- JPMorgan Chase ($JPM) — at the center of the narrative

https://unusualwhales.com/stock/jpm/overview - Bank of America ($BAC) — retail & credit monitor

https://unusualwhales.com/stock/bac/overview - Goldman Sachs ($GS) — trading & credit sensitivity

https://unusualwhales.com/stock/gs/overview

Financials tend to react sharply when rate policy uncertainty rises, especially at the front end of the yield curve.

Options Flow Themes to Watch

With rising caution, traders should keep an eye on:

1. Put Skew and Hedging Activity

When institutional desks turn cautious, we often see put buying and structured hedges in both indexes and single stocks — early signs of positioning for downside risk.

2. IV Expansion Ahead of Macro Anchors

If headline risk continues — like legal proceedings or policy clashes — implied volatility tends to widen before price breaks.

3. Spread Activity Around Data & Policy Events

Calendar and diagonal spreads can become attractive as traders bracket risk around key economic prints and court dates.

Broader Macro & Policy Impact

The implications of this shift extend beyond just stocks:

- Interest rate expectations — markets now price more uncertainty around future cuts or hawkish callbacks.

- Credit markets — credit spreads can widen when confidence in monetary decision-making falters.

- Safe haven flows — gold, Treasuries, and defensive options often benefit in heightened tension phases.

That’s why JPMorgan’s caution is not just a headline — it’s a positioning signal.

Final Thoughts

Wall Street hasn’t entered a full downturn — but JPMorgan’s shift toward caution reflects a growing risk premium in the system driven not by fundamental weakness, but by policy credibility concerns.

For traders, that means:

- Starting to watch volatility trends closely

- Monitoring put flow vs. call flow divergence

- Recognizing that political risk is priced differently than economic risk

And as always, the options market whispers before the equity market speaks — that’s where early edge lives.

Call to Action

Want to track the flows that lead markets, not follow them?

Unusual Whales gives you real-time and historical options flow, GEX analytics, market tide signals, and volatility insights.

Create your free Unusual Whales account and start uncovering opportunities before the crowd:

https://unusualwhales.com/login?ref=blubber