Larry Summers’ Epstein Email Fallout: What It Means for Markets & Trust

The Scandal In A Nutshell

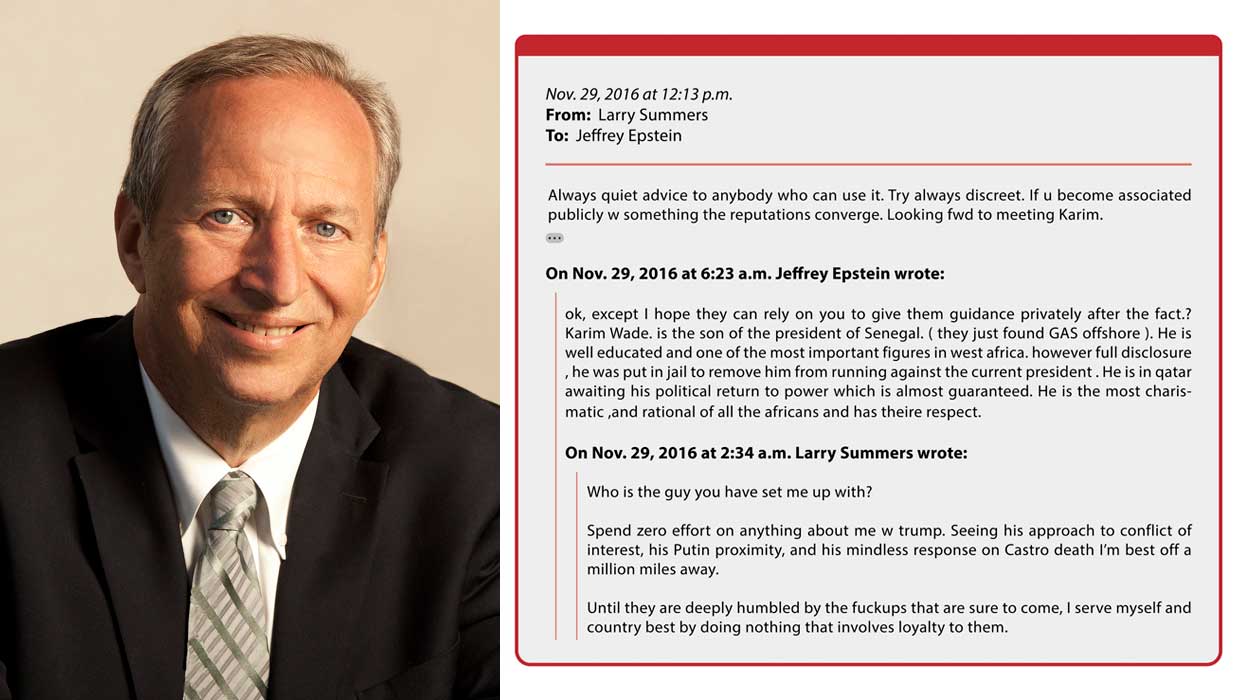

Larry Summers, once Treasury Secretary and President of Harvard University, has announced he will step back from public commitments after the release of hundreds of pages of email correspondence with convicted sex offender Jeffrey Epstein.

The communications spanned from 2013 through early 2019 and show Summers seeking personal and philanthropic advice from Epstein — even after Epstein’s 2008 conviction.

Summers described the relationship as “a major error of judgment” and expressed shame, but the damage is already cascading through institutional trust and governance arenas.

Why This Matters for Markets & Corporate Trust

Governance Risk Is Spotlighted

When a high-profile economist and institutional insider is embroiled in a reputational crisis — and major institutions (Harvard, OpenAI boards, etc.) are implicated — governance risk spikes. Investors hate uncertainty around board oversight, reputational damage, and regulatory or legal spill-overs.

Institutions on the Defensive

With the United States House Oversight Committee releasing the emails and public officials urging institutions to sever ties with Summers, the environment for corporate boards, university endowments, and non-profits just got more volatile. Politico

Market & Options Impacts

- Small-cap, governance-sensitive plays may trade at a premium risk. If investors see oversight gaps, expect increased implied volatility in such stocks.

- Institutions with heavy board/ex-official networks might face headline risk; protective puts could be attractive.

- Real-asset/alternative-investment firms tied to university or donor reputations may also feel the effect — think of names reliant on big gifts, donor relations or philanthropic-backed research.

If the reputation shock deepens, sentiment across “insider-dominated” institutions could ripple out.

Stocks & Themes to Monitor

- Educational/alternative-investment/board-heavy stocks: Firms like those in EdTech, university spin-outs, or firms deeply tied to legacy relationships may be impacted.

- Governance-affected financials: Companies with heavy board turnover or institutional affiliations might see options flows (puts) rise.

- Sentiment-driven ETFs: If institutional trust wanes, look for flows in ETFs tied to corporate governance or activist investing.

Options watchlist

- If you spot unusual activity: large open-interest increments in Puts for names with governance exposure.

- On the Call side: airlines, universities, or alternative-education firms may get bullish bets assuming rebound from bad PR.

The Macro Spill-Over

The Summers-Epstein affair isn’t just about one person — it touches on elite networks, institutional credibility, philanthropic funding and the governance paradigm. If multimillion-dollar donors and university boards are seen as compromised, the ripple could spread to endowments, research funding and capital flows into “trusted” institutions. That shift could impact sectors that rely on that ecosystem — from real estate to research-intensive biotech spin-outs.

Final Take

For traders and market watchers: the Summers saga is a governance risk alert more than an earnings trigger — but in an era of “tail risk via trust erosion,” that’s enough. Be alert for unusual options volatility in institutions and sectors tied to elite networks, board-structures and donor-driven funding.

Sign Up

Want to track institutional-governance risk, board-level surprises, and options flow around the world of elite networks and corporate oversight? Sign up for a free account at UnusualWhales for real-time options chain analytics, institutional ownership heat-maps, and live whale trade alerts.

➡️ Create your free account now