Levi Strauss (LEVI) Posts Stellar Earnings, Approves $200m Buyback, and Announces Dividend; Options Flow Shows Option Traders' Reaction

Captured and pinged by the Unusual Whales News Flow, Levi Strauss (LEVI), the American denim manufacturer based out of San Francisco, announced earnings on October 6, 2021. The earnings report revealed beats across the board, reporting an EPS of $0.48 (vs. an expected $0.37; a 28.04% surprise) and a revenue beat of 2.39%, with a reported $1.5B versus an expected $1.46B. For LEVI, this is demonstrative of their consistency as of late, as they have posted significant beats for the last several quarters.

In addition to their stellar earnings, the LEVI board of directors approved a $200 million share repurchase program and announced a dividend of $0.08 per share; totalling around $32 million, LEVI has raised guidance for the future, expecting full-year earnings per share to $1.43 to $1.45.

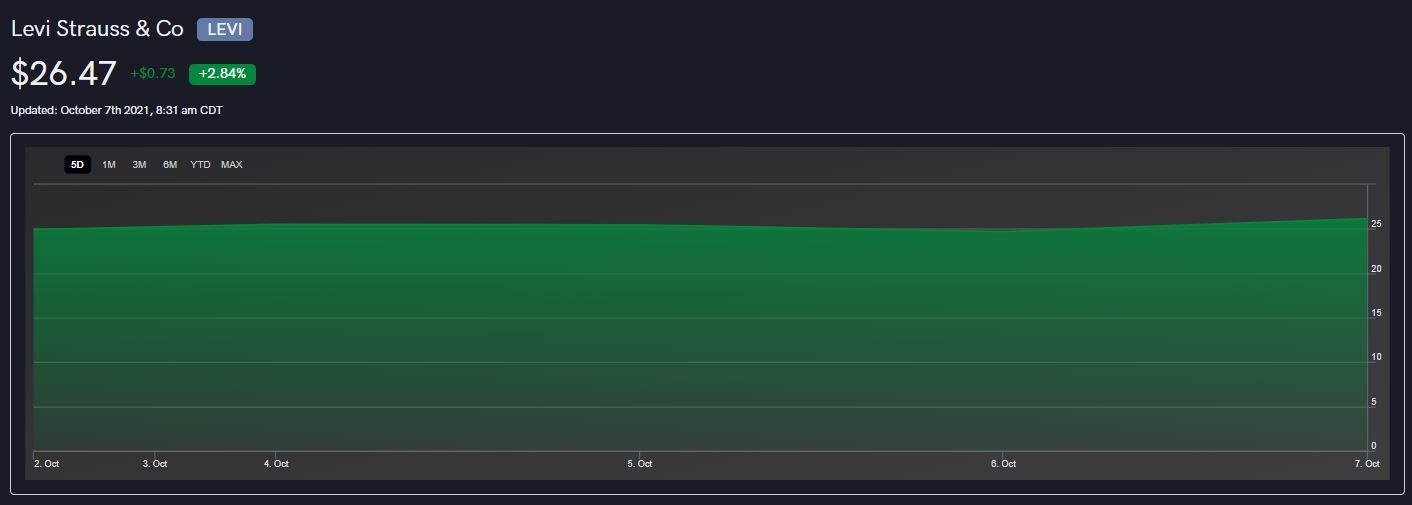

In response to the earnings and announcements, LEVI stock price has jumped significantly, and has been trading in a range of +6% and +9.45% (as high as $26.53) throughout the first hour of trading. The reaction we see in options trading is equally significant.

Ask-side flow for LEVI this morning following earnings shows us a positive reaction to the news. Of all options premiums spent, 63.38% reflects bullish sentiment. The main focus this morning lies with the $24, $25, and $26 call strikes expiring on October 15, 2021; reflective of those options traders wanting to capitalize on short-term movement regarding the stellar earnings report.

LEVI pre-earnings options flow also demonstrated bullish expectations for their earnings; which isn’t surprising when you consider the fact that LEVI has posted consistent earnings beats for at least the last four quarters. Yesterday’s flow bore more focus on the November 19, 2021 expiration date, with heavy focus given to the $22 call strike, especially.

So, where will LEVI stock go from here? According to the Analyst Research page at Nasdaq, LEVI has a low analyst price target of $31 per share, and a high estimate of $40, giving LEVI a $35.30 average price target, topped off with a Strong Buy rating. At the time of writing, LEVI is trading at $26.53 (+9.45%), and the options flow continues to reflect expectations for more upside, with some longer-dated call orders for 2022 and 2023 filtering in.