Looking Back on Unusual Options Activity in Tesla, Inc. (TSLA)

On November 2nd, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we reported on significantly sized options trading volume and activity in Tesla, Inc., which opened that day at $1,159.36.

- There were a total of 2,003 contracts traded on the $975 strike call option, at the ask, dated for September 16th, 2022.

- Additionally, there were another 1,675 contracts traded on the same strike and at the ask, but for June 17th, 2022.

- Altogether, these contracts represented approximately 3,678 shares and $125,200,000 in premium traded.

These orders had come in after Eva Mathews of Reuters reported that “Musk says Tesla has not signed a contract with Hertz yet, halts stock rally”.

Reported then, November 2nd, TSLA had 399,427 call contracts traded, down from yesterday’s 1,544,674, or October 25th’s 2,439,483 call contracts traded. TSLA’s average 30-day call and put volumes were 850,900 and 703,700 respectively.

As can be seen, there was increased volume as the day went on beyond the initial report, as call volume on November 2nd ended at 1,099,265 for the day; since then, it has continuously declined, reaching a new low of 855,193 on Friday, November 5th, and is now but 657,460 as of this writing (approximately 15:11 EST, November 8th, 2021).

Puts had a volume of 855,193 on the 5th, and are at 576,706 at this time. These 657,460 call contracts traded represent approximately 68.9% of Tesla, Inc’s average 30 day call volume.

“Zero Effect on Our Economics”

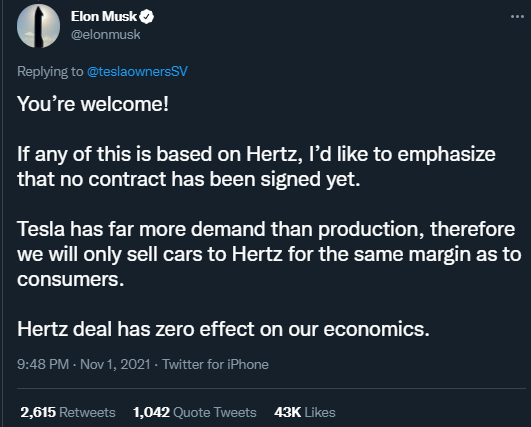

Concerns over Tesla, Inc.’s involvement with Hertz were assuaged by the time of these orders, gleaned from Musk’s tweet on November 1st, 2021, where he revealed that:

If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet.

Tesla has far more demand than production, therefore we will only sell cars to Hertz for the same margin as to consumers.

Hertz deal has zero effect on our economics.

Regardless of the aforementioned declines in options betting volumes, the open interest in Tesla, Inc. has steadily ascended. Open interest on November 2nd was 6,283,227 open contracts being traded, and yesterday, November 7th, had settled at 7,039,763, the highest open interest on Tesla, Inc. contracts in recent history (at least since May 27th, 2021). This implies that the high volumes of contracts betting in previous weeks are still being held open, despite a relative decrease in active trading day over day.

Furthermore, Tesla, Inc. continued to climb to new all-time highs, closing November 5th at $1,222.09, and closed November 8th at $1,162.94.

A Continuation of the Trend in by Floor Traders and Whales

Seen above, significant betting transpired on the $975 strike call option, which we reported on.

On November 6th, Musk asked his Twitter follows the question:

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

Do you support this?

And attached a poll with two options, “Yes” and “No”. At the time of this writing, November 8th, the poll had 57.9% for “Yes” and 42.1% for “No”.

In spite of the above poll, there was no significantly unusual options betting by the largest whales on the 6th--in fact, it was a decidedly uneventful day in the options market as this was a Saturday--and yet Monday did not tell a significantly different story:

Expounding the Unusual Whales options order flow from the 3rd to the 8th, it can be seen there was little to no noteworthy options betting until today, November 8th, in which 5,730 contracts were traded on the $1050 strike call option, sold to open at the bid, dated for September 16th, 2022. That order came together along with another:

If these orders were in fact together, it would be presumed that the $1025 strike call contract was being bought to close, with the $1050 strike calls being sold to open, the trader rolling their short position on Tesla, Inc. to later date and a higher strike.

Alongside the aforementioned rolled contracts, of options betting of premiums $30,000 or greater, currently 57.1% of bets taken are in bearish premiums, 57.7% being bid-side, and 74.8% in calls. Outside of contracts expiring this week, the most popular expiration being betted upon are those in the March 17th, 2023 chains. The most popular strikes of these levels are the $2025s, with $86,192,316 in bearish premium contrasted to the $57,803,158 in bullish premium. After those, the $1200 strikes are the next most popular, with $73,879,128 in bearish premium contrasted to $49,545,564 in bullish premium.

Contrarian Unusual Options Activity

However, in spite of all of the previously disclosed, bearish betting by whales at the largest premium sizes, there was an unusual option bet that came through the Unusual Whales Alert tool, viewable here.

The alert triggered at 14:44 on November 8th, 2021.

The ask of the contracts at the time was $1.92, and concluded at close at approximately $1.64. Unusual options activity often go without their own levels of intrigue and requisite need for analysis, as it cannot be clearly understood as to why a large whale order would come from on such an unusual contract such as this. After all, this was a .0479 delta bet, which only had 980 open interest upon it as of November 7th’s close, and as of this alert housing 6,285 in volume.

Priced In? What’s Next for Tesla?

The question must be asked: why would anyone take on this contrarian bet in spite of the options order flow and news that Musk was considering offloading some of his own shares?

Will Tesla, Inc. simply continue to defy all odds, and reach new heights?