Lululemon (LULU) Post-Earnings All Time Highs; Katapult Holdings Inc. (KPLT) Unusual Options Activity Katapulting in Volume

1:00pm ET: Lululemon (LULU) released their earnings yesterday (9/8/2021), beating estimates across the board. LULU reported an Earnings Per Share (EPS) of $1.65, shattering the expected $1.19 by 38.79%. They also beat revenue by 8.88%, reporting $1.45B versus the expected $1.33B. At the time of writing, LULU is up nearly 13% and holding strong, trading in-between $425 and $429 as the morning has progressed after touching an all-time-high of $433.88 this morning. The options flow for LULU has held fast to bullish sentiment following the earnings report.

Based on this image above, flow for LULU above $25k in premium has been bullish all morning, which is indicative of an expectation for the momentum to continue. Via the earnings report, LULU also indicated they expect to meet their 2023 revenue targets (which were put forth as part of a 5-year plan in 2019) by the end of this year.

Another ticker that caught our attention on the Live Flow Tool is KPLT. Katapult Holdings Inc. is a Lease-Purchase/Lease to Own company, and has been seeing some action after reports of Amazon (AMZN) integrating similar company Affirm’s (AFRM) consumer financing services, as reported by Nasdaq late last month.

This seems to have indicated to investors that KPLT could potentially receive the same treatment; that is, KPLT may be able to integrate into other e-commerce platforms. In the last 5 days, KPLT has risen over 28%, and the flow this week seems to indicate the bullish expectations will continue.

In a previous article, we outlined that not all flow has to come in a multi-million dollar package; and KPLT is a good example of this. Options Flow for KPLT both yesterday (9/8) and today (9/9) with a premium of greater than $2k have a heavy focus on the $6 and $7.5 strikes expiring in September and October.

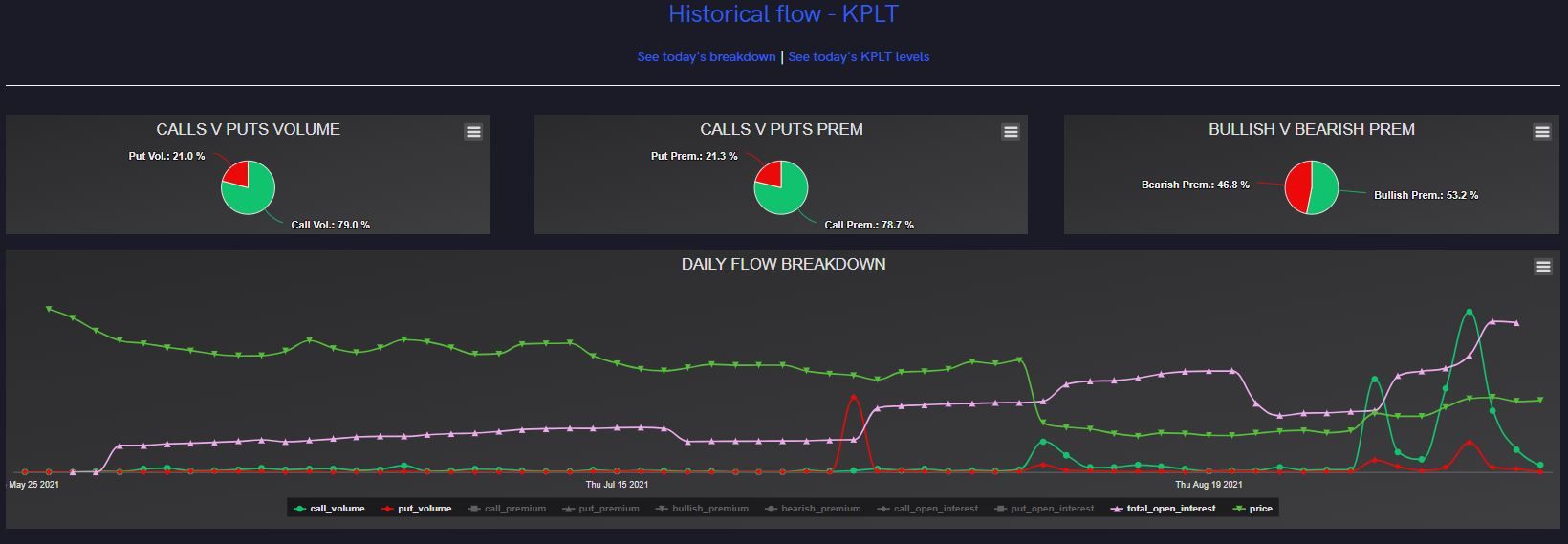

Historically, KPLT has maintained a bullish stance in its options flow; however, if we refer to the image below, we can see how immense the overall options volume is for KPLT in the last week.

From 2,400-and-some-change call volume on Thursday, August 26 to 174,082 volume a week later, it’s obvious that investors are leaning bullish. We won’t have a concrete answer of where KPLT will end up, but KPLT is currently trading 28% higher than it was before this flow started, and given the fact that the flow coming in today still holds that bullish sentiment, we wouldn’t be surprised to see KPLT holding onto these gains.