Man Poses as FBI Agent in Bizarre Attempt to Free High-Profile Inmate — Market & Risk Signals

Bizarre FBI Impersonation at Brooklyn Jail — Unusual Whales Take

A 36-year-old Minnesota man allegedly posed as an FBI agent and showed up at the Metropolitan Detention Center in Brooklyn trying to free an inmate, Luigi Mangione, by presenting fake paperwork claiming a court order for his release. Federal prosecutors charged him after authorities detained him on the spot; he now faces impersonation charges and was held without bail.

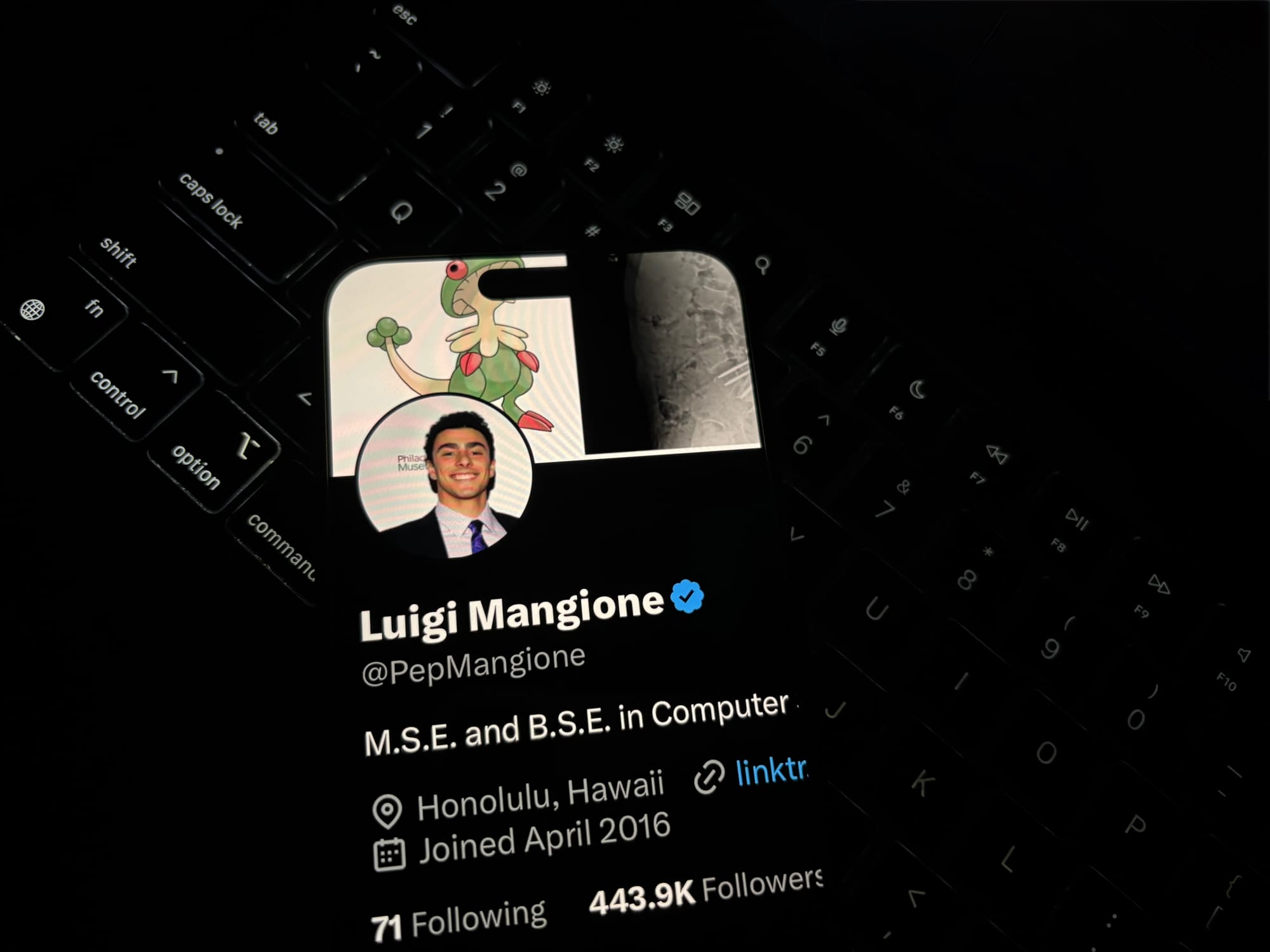

The inmate at the center of this strange event, Luigi Mangione, is in custody facing both state and federal charges related to the 2024 murder of UnitedHealthcare CEO Brian Thompson — a case that has drawn intense media coverage and legal scrutiny.

This odd attempt to break someone out of a federal jail — complete with fake credentials, barbecue fork and pizza cutter in a backpack — may seem like a crime-drama subplot, but events like this can influence risk perception and sentiment if linked to broader narratives about law, public trust, and institutional integrity. Here’s the Unusual Whales breakdown of potential market implications and signals to track in options flow.

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free account here to start conquering the market with Unusual Whales:

https://unusualwhales.com/login?ref=blubber

What Happened — The Bizarre Details

Here’s what law enforcement says unfolded:

- Mark Anderson, 36, traveled from Minnesota and entered the federal jail, claiming to be an FBI agent with paperwork “signed by a judge” authorizing the release of Luigi Mangione.

- Jail officers quickly challenged his credentials; Anderson presented a Minnesota driver’s licence, threw various documents at staff, and asserted he was armed.

- A search of his bag turned up a barbecue fork and a pizza-cutter blade — not standard FBI tools — and he was taken into custody and charged.

- He was ordered held without bail and is now in the same facility where Mangione is detained.

Mangione remains behind bars awaiting trial on murder charges related to the death of UnitedHealthcare CEO Brian Thompson, a high-profile case that has drawn public attention and controversy.

Why Markets Might Pay Attention

At first glance this reads like a headline-grabber, but here’s how traders and sentiment watchers might interpret this:

1. Risk & Institutional Confidence Metrics

Unusual incidents tied to law enforcement or corrections can subtly reverberate in risk sentiment, especially in credit, financial sector confidence, and volatility indicators. Sudden events that challenge perceived systemic stability — even outside macro economics — can feed short-term safe-haven positioning in markets.

2. Behavioral Signals Around Law & Order Narratives

High-profile crime stories can tide into broader policy sentiments — including debates over policing, criminal justice reform, and public trust in institutions. These narratives often find their way into consumer confidence surveys, bond market risk pricing, and Implied Volatility (IV) in certain assets.

FX and credit markets can be sensitive to unexpected social risk surprises, even if the direct ties are indirect; for example, a rise in perceived instability can boost volatility indices and safe-haven flows.

Hot Tickers & Proxies to Monitor via Unusual Whales

Here are some tickers where risk sentiment, volatility shifts, or institutional confidence moves might show activity in options flow following news like this:

Volatility & Risk Assets

- VIX (CBOE Volatility Index) — Broad market risk gauge

https://unusualwhales.com/stock/vix/overview - TLT (iShares 20+ Year Treasury ETF) — Flight-to-safety duration play

https://unusualwhales.com/stock/tlt/overview

Options angle:

- Call flow in VIX can signal rising fear/refuge positioning.

- Put accumulations in equities relative to Treasury calls may indicate risk aversion.

Financials & Institutional Proxies

- XLF (Financial Select Sector SPDR ETF) — Financial institutions exposure

https://unusualwhales.com/stock/xlf/overview - JPM (JPMorgan Chase) — Systemic financial barometer

https://unusualwhales.com/stock/jpm/overview

Options angle:

- Rising IV in financials during sentiment shifts can signal cautious capital rotation.

Consumer & Policy-Sensitive Names

- SPY (S&P 500 ETF) — Broad market sentiment proxy

https://unusualwhales.com/stock/spy/overview - QQQ (Nasdaq 100 ETF) — Tech/growth sentiment indicator

https://unusualwhales.com/stock/qqq/overview

Options angle:

- Divergences in IV and skew between SPY/QQQ and broader strips can highlight rotations around risk narratives.

Options Flow Signals to Track

When sentiment changes — even due to unexpected stories — unusual options activity often leads price action:

- Unusual call sweeps on VIX — traders positioning for broader caution.

- Increasing put volume in broad indices — early risk-off read.

- Shifts in skew between equities and Treasuries — signaling hedging behavior.

Unusual Whales’ historical flow and sweep trackers make identifying these shifts easier and actionable.

Behavioral & Narrative Summary

Here’s the concise perspective for traders:

- A Minnesota man was charged after impersonating an FBI agent during an attempt to free Luigi Mangione from federal custody — a strange and high-profile incident with wide media reach.

- Mangione’s case — tied to the **2024 murder of a major healthcare CEO — remains in court and has significant public attention.

- While not a traditional market driver, unexpected crime and institutional trust narratives can flick risk sentiment switches, influencing volatility and safe-haven flows in markets.

CTA: Get Tools the Pros Use

If you want to track unusual options flow, monitor volatility shifts, and build narrative-aware scans tied to risk sentiment and macro surprises, the Unusual Whales platform gives you the edge.

Sign up for a free account:

https://unusualwhales.com/login?ref=blubber