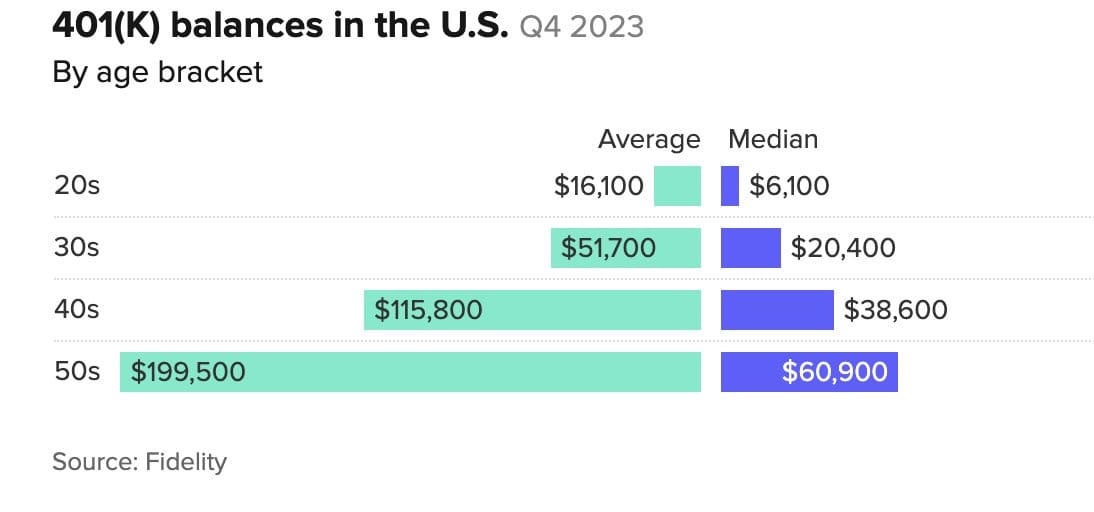

Median and average 401(k) balances in the US

Median and average 401(k) balances in the US, per CNBC:

Meanwhile, Americans need an average post-tax income of $68,499 to live comfortably in the U.S, per CNBC.

Recently it was found during tax season in the US, residents of three cities—New York, San Francisco, and Honolulu—face the reality that they need to earn over $300,000 to take home $100,000 after taxes and cost-of-living adjustments, according to an analysis by financial information provider SmartAsset. The analysis adjusted a $100,000 income for the local cost of living in 76 major US cities and accounted for federal, state, and local taxes for a single taxpayer with no additional withholdings.

In the most expensive cities, where housing costs and other expenses are high, residents need a net income of over $180,000 to achieve a purchasing power equivalent to $100,000. High earners in these cities are taxed at rates exceeding 40%, requiring substantial salaries to maintain six-figure purchasing power.

In contrast, cities like Houston, Texas, have lower costs of living and no state income tax, allowing residents to achieve the same purchasing power with a gross income of around $125,000. In other Texas cities, such as El Paso, Corpus Christi, and Lubbock, salaries as low as $122,000 can provide the equivalent of a $100,000 income.

The rise of remote work has prompted professionals to consider relocating to states like Florida and Texas, where the cost of living and taxes are lower. For example, while Miami has a higher cost of living than cities like Baltimore and Chicago, it is more affordable due to Florida's lack of income tax. New York State Comptroller Thomas DiNapoli has warned against tax increases that could drive wealthy residents away and reduce state revenue.

Read more: https://unusualwhales.com/news/you-need-a-300-000-salary-to-take-home-100-000-after-taxes-in-in-nyc-and-sf