Michael Burry Calls Out Fair-Value Risk at NVIDIA After $112.5 B Buyback Claim

What’s Going On: Burry Forces a Spotlight on NVIDIA’s Capital Allocation

Michael Burry, famed for his “Big Short” call, is now publicly challenging NVIDIA’s capital-allocation practices. He claims NVIDIA has spent approximately $112.5 billion on share buybacks — a figure he argues signals overvaluation and possible structural fragility.

Burry further compares the AI-investment frenzy to prior tech bubbles, and says that the company’s accounting and balance-sheet decisions warrant extra scrutiny.

This isn’t a passive critique — it’s a bold risk indicator for the AI trade.

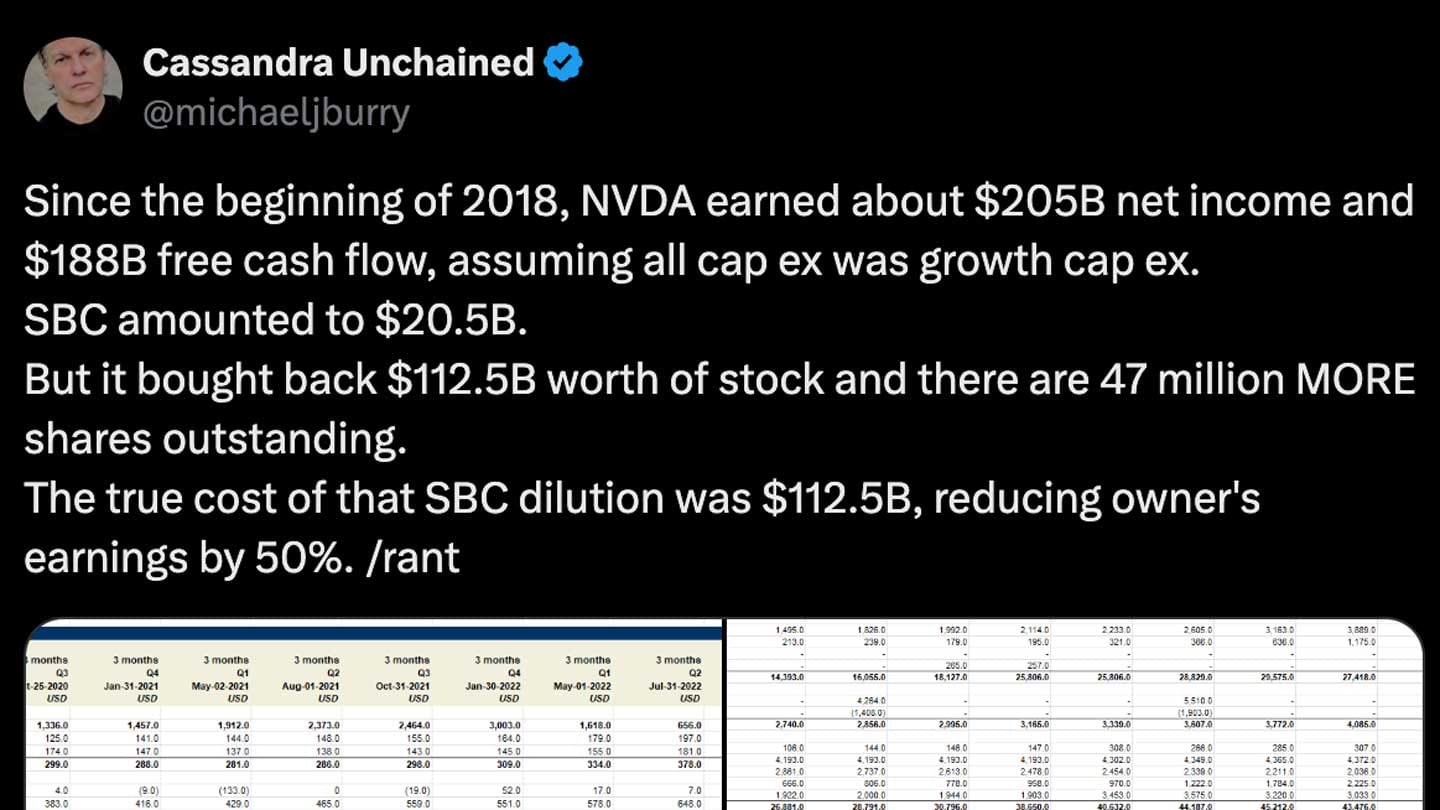

Since the beginning of 2018, NVDA earned about $205B net income and $188B free cash flow, assuming all cap ex was growth cap ex.

— Cassandra Unchained (@michaeljburry) November 20, 2025

SBC amounted to $20.5B.

But it bought back $112.5B worth of stock and there are 47 million MORE shares outstanding.

The true cost of that SBC dilution… pic.twitter.com/u8VhZyokrB

Why It Matters for Markets

- NVIDIA is the poster child for the AI boom: when its fundamentals or cash usage get questioned, the whole AI infrastructure complex feels it.

- A large buyback figure raises questions about future growth: Are earnings and reinvestment being sacrificed for stock price metrics?

- Options markets often act before text: if hedge funds smell risk, they begin positioning ahead of a broader rotation or de-rating.

Options-Market Signals: What Flow Traders Should Watch

Primary Ticker

Flow Indicators

- Put sweeps on NVDA: Look for large blocks if hedge funds are betting on a downside surprise or de-rating.

- Call spreads on AI infrastructure peers: If money is moving away from NVIDIA, it may shift toward less crowded names.

- IV (Implied Volatility) spikes in NVDA: Sudden jumps often reveal elevated concern about event risk or narrative risk.

- Dark-pool prints: Large, discreet trades in NVDA suggest institutional repositioning ahead of public shift.

Related Tickers to Monitor via Unusual Whales

- AMD

Why: Chief competitor in AI chips; a beneficiary if risk rotates away from NVIDIA. - ASML

Why: Supplier to the semiconductor ecosystem; flow may precede shifts in capital-spend narratives. - QQQ

Why: Broad tech-exposure ETF; often reflects rotation out of high-expectation names like NVIDIA.

The Bottom Line

Michael Burry’s accusations against NVIDIA are more than controversy — they’re a signal.

When the sharpest hedge-fund minds raise red flags about fundamentals in the fastest-growing sector, options traders pay attention.

If you’re tracking flow: watch NVDA closely. The smart money might already be positioning — either hedging downside or rotating into adjacent names.

Sign up for a free Unusual Whales account to track real-time options flow, dark-pool prints, sector heat-maps, and narrative oscillations.