Money market funds are the "next bubble," per Bank of America, $BAC

Money market funds are the "next bubble," per Bank of America, $BAC:

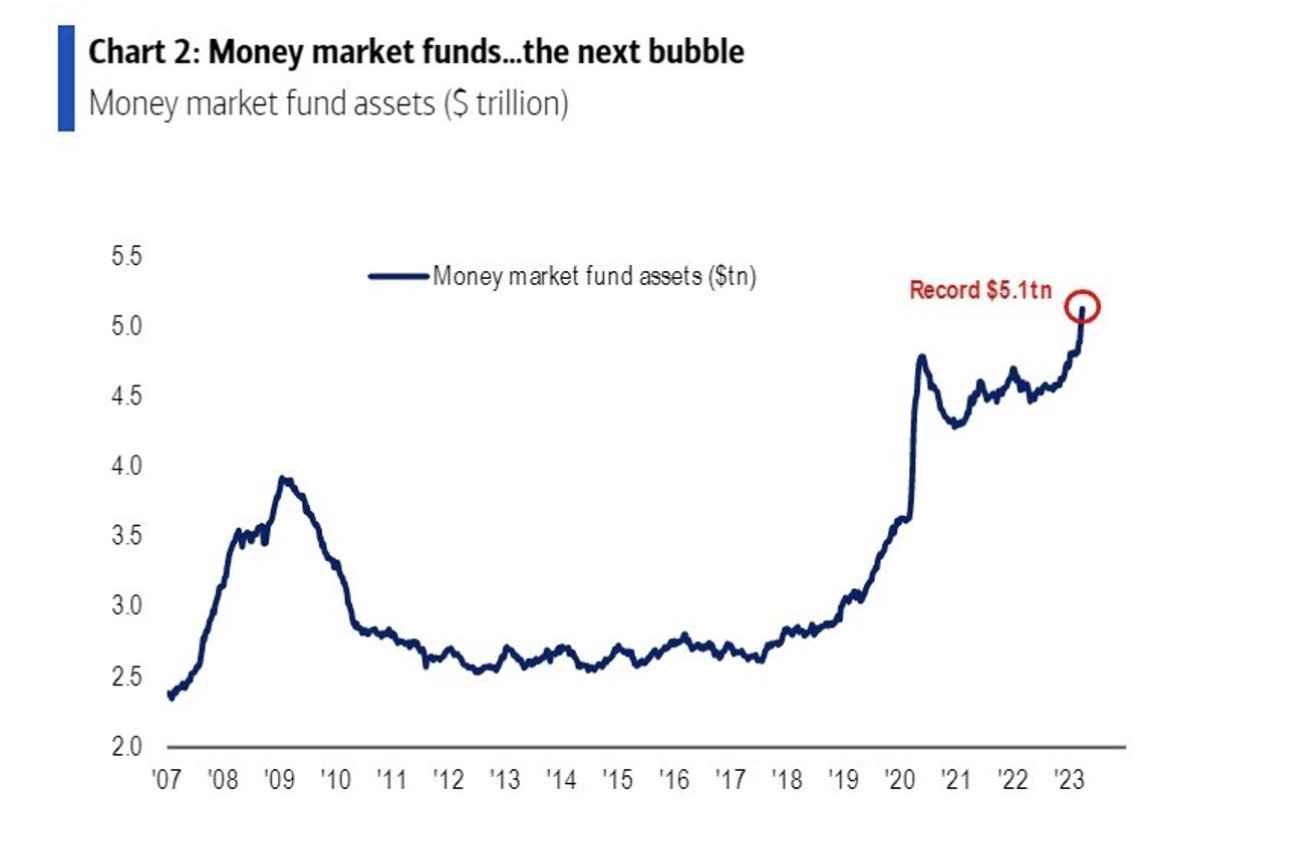

Total assets held in money-market funds, which are investment vehicles that buy cash-like securities such as short-term Treasury bills, recently reached close to $5.5 trillion, according to RBC. That is the highest on record.

The yield on the 1-month Treasury bill has slipped to about 4.5%, which is consistent with the idea that the Federal Reserve may cut rates or pause in increasing them.

This decrease is “suggesting a potential moderation in bank deposit outflows,” wrote Yuri Seliger, credit strategist at BofA.

“The next bubble…money market fund AUM,” a separate team of BofA strategists wrote, referring to assets under management. Deflating it could help some struggling lenders.