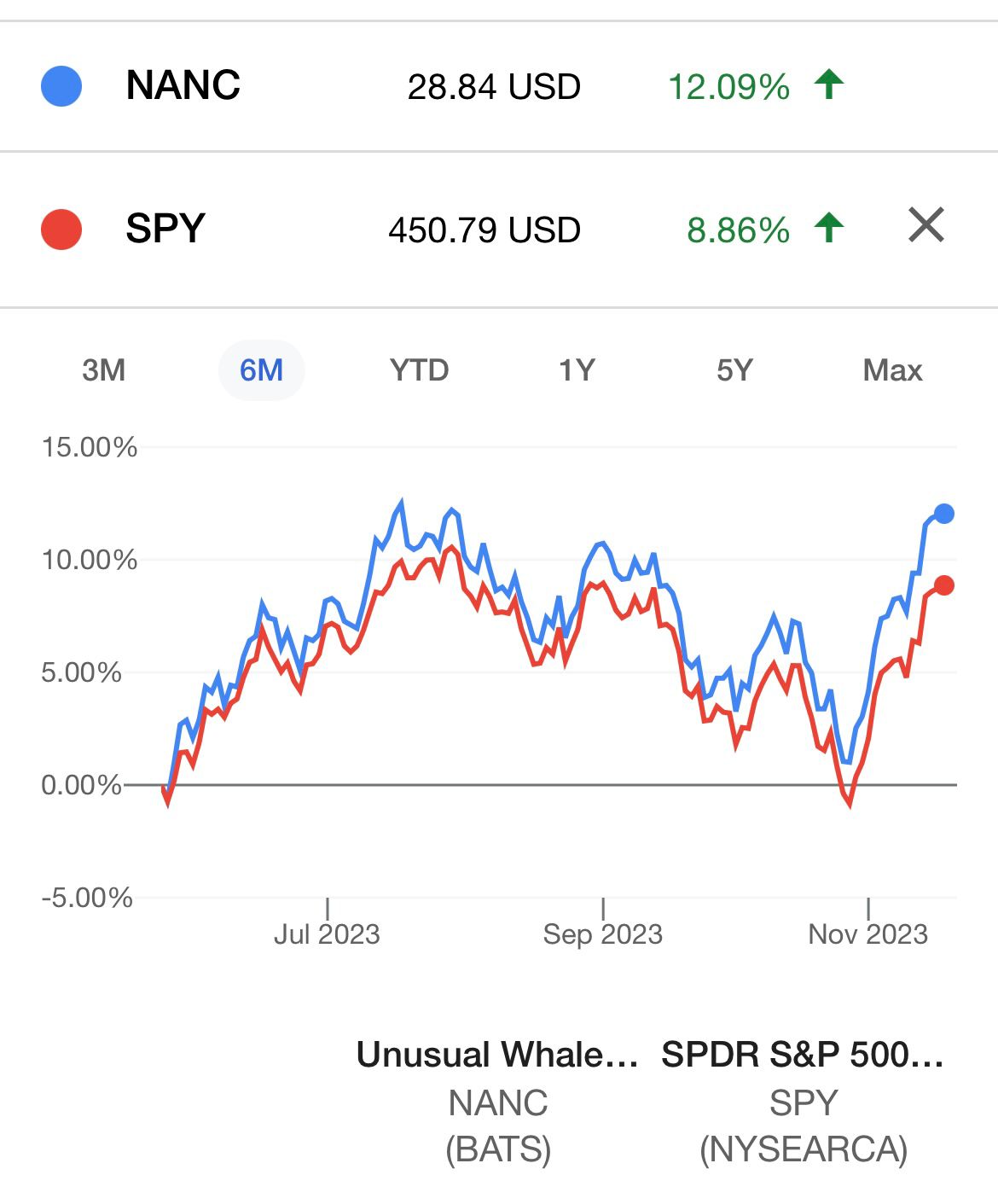

NANC is beating the S&P500, per Subversive ETFs

Congressional ETF is beating the S&P 500

Image description: (the hand-drawn distribution of the observations from the day of the 1906 exhibition. The dotted line is the superior prediction when compared to expectations from a normal distribution. It is also how the allocations in $NANC & $KRUZ are determined)

During the cool Fall days of 1906, just west of Plymouth, England, farmers and butchers meandered around a county fair where they found a lone Ox with an unfortunate, but quite certain, future.

For the price of a half shilling, they could guess the dressed weight, after slaughter, with the closest guess taking home pieces of our lonesome Ox. When examining these statistical results, it was noticed that the distribution of the correct choice of weight was not random, and the variance was smaller.

Turns out, this works for both Oxen and Congressional stock portfolios because a “smaller variance” in an ox judging contest is mathematically identical to “less risk” in portfolio management. So far this year, NANC is beating the market on both an absolute return basis and risk adjusted basis.One of the more common questions we get about the congressional ETFs is “Why are there so many holdings?” NANC (Pronounced “Nancy”) has around 750 and KRUZ has around 500, many of them held at a fraction of a percent.

What I feel people really want to ask is why don’t we simply hold the “best” traders in Congress or try to pick off member’s options trades? First and foremost, we launched these ETFs to highlight what members of Congress are trading and we fully support banning members of Congress from active trading, as does Unusual Whales, our data provider.The key choice made in the portfolio design of the Congressional ETFs was to build the holdings around the relative dollars disclosed by each member and their families.

In other words, more dollars equals more “votes”. When a member discloses a trade, we explicitly choose the midpoint of that disclosure range, ala County Butcher style, no matter what the member actually bought or sold. This choice is what drives all the relative allocations in both $NANC and $KRUZ. Not only were the farmers of Devon County more accurate than random chance would suggest in 1906, but in 2023, when constructing a congressional trading portfolio in almost exactly the same way, NANC is beating the market on both an absolute basis and a risk-adjusted (Sharpe ratio) basis.

The wisdom of the crowd is once again delivering superior returns with less risk, and when you divide the pocketbooks of Congress by party, a definite look starts to emerge. NANC has a bubbly, cloud-ish, tech-focus but also-owns-Shell-just-for-the-dividends kind of vibe. KRUZ is a bit darker. KRUZ has seen some things. KRUZ is not here for your A.I. mumbo jumbo. It is energy, healthcare, and core American value investing. KRUZ is “print free cash flow to equity” time, dirty jobs, with a focus on making things.

These are all expertly managed, fantastic businesses, and generating enormous cash flows but it is telling that the divisions we see in politics are also present in the portfolio holdings between the Left and the Right.

Pick the coastal liberal from the midwest conservative by portfolio alone; I’ll bet you won’t be wrong:

As of 08/31/2023. Fund holdings and sector allocations are subject to change.

KRUZ was tracking with the S&P 500 until the Ides of March stormed through during the Silicon Valley Bank mini-panic and KRUZ has underperformed the market on both a risk basis and a return basis since then.

Let's deal with the obvious question first: “Are Democrats just better traders?” No, I don't think that is the case but I do have a theory about what is going on. We are living through the early stages of what it is going to take to rebuild the world in NATO and Non-NATO aligned customers, supply chains, and vendors. The U.S. restrictions on chips were really the early tremors of a decade-long decoupling. That takes time to evolve and is net inflationary.

This instability is going to create cycles when a hopeful, optimistic outlook might outperform, and there are times when a value-based, everything-is-going-to-hell focus might outperform.

There is a live natural experiment underway, where you can own the macro focus of your choice plus the qualitative information advantage of congress. The congressional ETFs are not about politics but rather the magic of relative holdings, and the tapestry of correlation that comes with them, that combine in a macro view, all powered by the crowd.

The new fundamental asset management question isn't “Which index should you own?” but “What state of the world are we in?” Are we in a $NANC state of the world or a $KRUZ state of the world? The Vox Populi price of either is live every day on your favorite trading app.

At the end of the day, it is not the lone trader, dipping out of congressional committee meetings to place trades, that create value but rather the collective intelligence of the best-informed and most sought-after crowd on the planet; holding the right names in the right ratios during the right part of the right cycle.

NANC has performed as designed, but if this world is changing the way I think it might, we could be in a KRUZ state of the world for a while.

P.S. I’m happy to report that no Oxen were harmed during the construction of these portfolios. I would also like to thank the seven hundred and eighty-seven butchers and farmers of the 1906 “West of England Fat Stock and Poultry Exhibition” for their contribution to financial engineering.

~~~Fin

Definitions:

- Sharpe Ratio: measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns.

- Free Cash Flow: represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets.

- S&P 500: a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus and summary prospectus available on this website. Please read the prospectus and summary prospectus carefully before you invest.

Distributor: Quasar Distributors, LLC.

There is no guarantee that the Adviser’s use of investment techniques and risk analyses to make investment decisions will perform as expected.

Investing involves risk including possible loss of principal. It is possible that legislation or regulation could be enacted that limits, restricts or prevents United States Congresspeople and/or their spouses from personal securities trading. Legal, tax and regulatory changes could occur that may adversely affect the Fund and its ability to pursue its investment strategies and/or increase the costs of implementing such strategies. Government regulation may change the manner in which the Fund is able to implement its principal investment strategy. Government regulation may change frequently and may have significant adverse consequences for the Fund or its investments. It is not possible to predict fully the effects of current or future regulation.

A high portfolio turnover rate has the potential to result in the realization and distribution to shareholders of higher capital gains, which may subject you to a higher tax liability. High portfolio turnover also necessarily results in greater transaction costs which may reduce Fund performance.