Nobody Knows - Looking Back on Unusual Options in Bakkt Holdings, Inc. (BKKT) and Arqit Quantum Inc. (ARQQ)

This is an op-ed. These views do not necessarily reflect the opinions of Unusual Whales, Inc.

Sometimes, there are trades taken that are quite unusual, without a clear explanation until some revealed catalyst.

And we report on those. So, so many of those.

Our job in this report is not to report on nefariousness, necessarily, but instead to ask questions.

And as you read this report, if you think you might have answers, do reach out to us, perhaps on our Discord.

A Review of Bakkt Holdings, Inc. (BKKT)

We previously reported on Bakkt Holdings and its unusual deep in the money call positions that were being taken by floor traders repeatedly in the past couple of months. If you have read our previous report, you may scroll down to read about our novel findings in Arqit Quantum, Inc.

Intercontinental Exchange Holdings, Inc. (ICE) first announced their own digital asset custodian service, Bakkt, in 2018.

In early 2021, Bakkt announced its intention to go public through the SPAC VPC Impact Acquisition Holdings (VIH).

Today, Bakkt Holdings, Inc. trades among the underlying components of the NYSE, and began trading at $9.41 on October 18th, 2021.

It traded around that price until October 25th, 2021, when it climbed to $13.86. On November 1st it saw a high of $50.80, and today, December 8th, 2021, Bakkt closed at $17.14, after having experienced a low of $13.05 and a high of $18.32 on the day.

Looking Back on Noteworthy Options Activity in Bakkt Holdings

The first noteworthy options activity that set off our investigation was on October 26th, 2021, reported by this Twitter user. They were specifically captivated by the $15,800,000 in premium sold on the $4 strike call option dated for December 17th, 2021:

The $4 strike call option was not the only unusual activity in the $BKKT chains, as $7,100,000 in premium was traded on the $9 strike call option, traded close to the ask, dated for November 19th, 2021, the closest expiration at the time of entry. Furthermore, the $9 strike call option was significantly in the money, as $BKKT was trading at approximately $23.17 at the time.

That day, visualized above, 65.1% of betting was in bearish premiums, with 66.5% bid-side, and 96.2% in call premium. The most popular chains were shorter-dated, including the November 19th, 2021 chain, and of deeper in the money strikes, such as the $11 strike, with significant bearish betting across all strikes and expirations.

On October 27th, 2021, Bakkt opened at $21.17.

As compared to the October 26th options order flow reviewed above, the flow had switched to bullish, and significantly so. 77.7% of premiums at these levels were bullish, 73.3% in ask-side orders, 86.5% in calls. The most popular chains were now composed of the December 17th, 2021 dates, with the most popular strikes at $22, with nearly $500,000,000 in premiums traded.

Deep In the Money Call Purchases

There are a wide variety of reasons as to why deep in the money calls would be purchased:

- “Contracts are bought, executed, and then bought again at the same quantity and strikes and executed again – thereby keeping OI unchanged but with two sets of orders for the same strike and quantity appearing on the order book.”

- Upcoming dividend dates in which market makers are looking “to capture as much of the dividend as possible. Two market makers enter into an agreement to trade deep-in-the-money call options back and forth with each other on the day prior to the ex-dividend date.”

- An entity (singular or otherwise) looking to buy leveraged exposure to the company; however, these types of orders are rarely bought to open at the ask--especially in a liquid ticker where there is a relevant bid-ask spread. (Thanks to the SqueezeMetric team for the idea!)

It cannot be clarified within the current set of data as to why these deep in the money purchases are being made.

In the Money Floor Trades on Bakkt Holdings

As can be seen, the percent of trades that were marked as from the floor of an exchange were the majority of all trades until November 18th, when they subsequently fell off, and on November 22nd, 2021, as did open interest.

The volumes were sometimes above even the open interest and the open interest did move down to the 100,000 contracts range during November, yet the volumes remained high, such as on November 3rd wherein nearly 90% of all contracts traded were marked as floor and in the money.

On October 31st and November 1st, there were notable increases on options volumes overall. As noted in the previous chart, nearly 75% of these trades were marked as in the money floor trades. Thereafter, the total options volume traded on Bakkt has steadily declined overall, before reaching a new low on November 10th. Of note, on November 11th, Bakkt reached nearly a new high of open interest on all its contracts in circulation.

Furthermore, Bakkt’s price since October 30th had steadily declined: on November 1st, 2021, Bakkt closed at $36.23 after having reached a high of $50.80.

Then, on November 2nd, 2021, Bakkt opened at $36.80.

A Review of Arqit Quantum, Inc. (ARQQ)

Arqit Quantum was incorporated in 2017 and is based in London, the United Kingdom; it is currently traded on the Nasdaq Capital Market (NasdaqCM) by way of the acquisition by US SPAC Centricus Acquisition Corp.

It began trading on April 1st, 2020 at $9.60. It remained around that price until September 7th, 2021, in which it hit a new high of $26, but closed at $11.30. It would repeat this pattern of reaching an exorbitant high in the day and then closing much lower, such as on September 23rd, 2021, when it reached a high of $41.52 and closed at $28.

Looking Back on Noteworthy Options Activity in Arqit Quantum

As with Bakkt, Arqit has also had deep in the money floor trades, consistently, for some time over the past couple of months. Of note, the trades represented here are the largest orders (based on size of the order) in Arqit, without any sort of filtering.

The topmost orders were only 1,000 contracts, which is an expected amount from floor traders, representing 100,000 shares. The premiums of these trades were approximately $1.6 to $1.7 million, which, again, would be considered an expected amount from the floor.

However, take a look at the strikes of these call options--again, these are the largest trades to have transpired on Arqit. All of them were traded deeply in the money, sometimes by an order of magnitude. The topmost trade was the $20 strike call option dated for January 21st, 2022, while Arqit was trading at $36.39.

Another example would be the $2.5 strike call options dated for December 17th, 2021, while Arqit was trading at $24.75 and $13.95.

Why is this noteworthy or significantly unusual? Let us compare that to another, randomly chosen company’s flow with the same sort of filters and sorting:

Turtle Beach’s top five orders, as seen, are all in out of the money contracts, such as its topmost order of $42 strike call options, dated for January 21st, 2022, while HEAR was trading at $29.40. As seen, all of its top trades were all slightly or significantly out of the money, and furthermore, its fifth most largest trade was not even tagged as a floor trade, but was a cross trade, in which a broker executed the buys and sells for this chain across several other client accounts to achieve the best possible pricing before having reported it on a single exchange.

Of the top 250 trades in Arqit, sorted by the size of the position taken, only 23 were not floor trades. 92% of these largest trades in Arqit were from the floor.

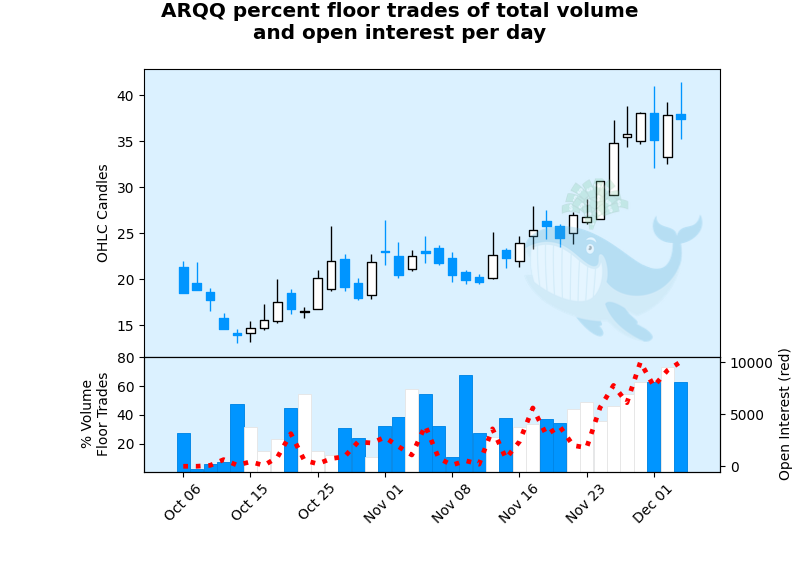

In the Money Floor Trades on Arqit Quantum

Notably, not until November 30th did this phenomenon truly begin with Arqit, as noted by the percentages of floor trade volumes in the chart above. While there were significant bets being made prior, they were not consistent as they have been in the recent days. A hypothesis would be that, if this is indeed the same phenomenon as witnessed in Bakkt, that there will be a continuation of this trend, with large-sized, deep in the money floor trades coming through during the day and potentially exercised during the day, as well, resulting in an inconsequential change in the open interest for sometime.

Thereafter, again, if the hypothesis is correct, there will be an expectation that Arqit’s underlying value will begin to test new highs until the retail market also begins to purchase call option contracts.

As previously mentioned, in regards to retail, there has now been a significant increase in their holdings beginning on December 1st, 2021, a day after the floor trader percentage-wise holdings increased. This was the same occurrence that transpired in Bakkt. It would be anticipated then, as previously mentioned, that after Arqit tests its new highs, that its underlying price shall begin to crawl back down to its mean. Obviously, this is purely speculation, and that is the purpose of this report, to inquire how to best investigate and anticipate these occurrences ahead of time.

Luckily, we have the Unusual Whales flow, which has enabled this investigation fully and completely, and even if there are not clear conclusions to be made as of know--even if nobody knows--we shall continue to do our due diligence into figuring out what strategy or strategies are being explored to see if they can be of a benefit to retail traders everywhere.

Stay tuned as we continue to update on the unusual options activities transpiring in not only Bakkt Holdings and Arqit Quantum, but all other companies, too.

Addendum: Breakdowns of Options Activity on Bakkt Holdings from October 4th to November 4th, 2021

If you are interested in our full data set analysis on Bakkt’s unusual activity, please visit our site and view the requisite charts. Their significance, as stated repeatedly throughout this report, is not yet ascertained, and feedback is welcomed.

Additional Resources

- https://alpineglobal.com/guiding-principles/

- https://www.linkedin.com/company/alpine-partners/

- https://www.glassdoor.com/Overview/Working-at-Alpine-Global-Management-EI_IE1284665.11,35.htm

- https://www.bloomberg.com/profile/company/1183031D:US

- https://www.salon.com/2020/12/17/this-hedge-fund-billionaire-is-a-huge-fan-of-sen-kelly-loeffler--but-why/

- https://www.sec.gov/Archives/edgar/data/1423053/000110465921093452/tm2122532d3_sc13g.htm

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Unusual Whales, Inc.

You may also read this article at Nasdaq.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.