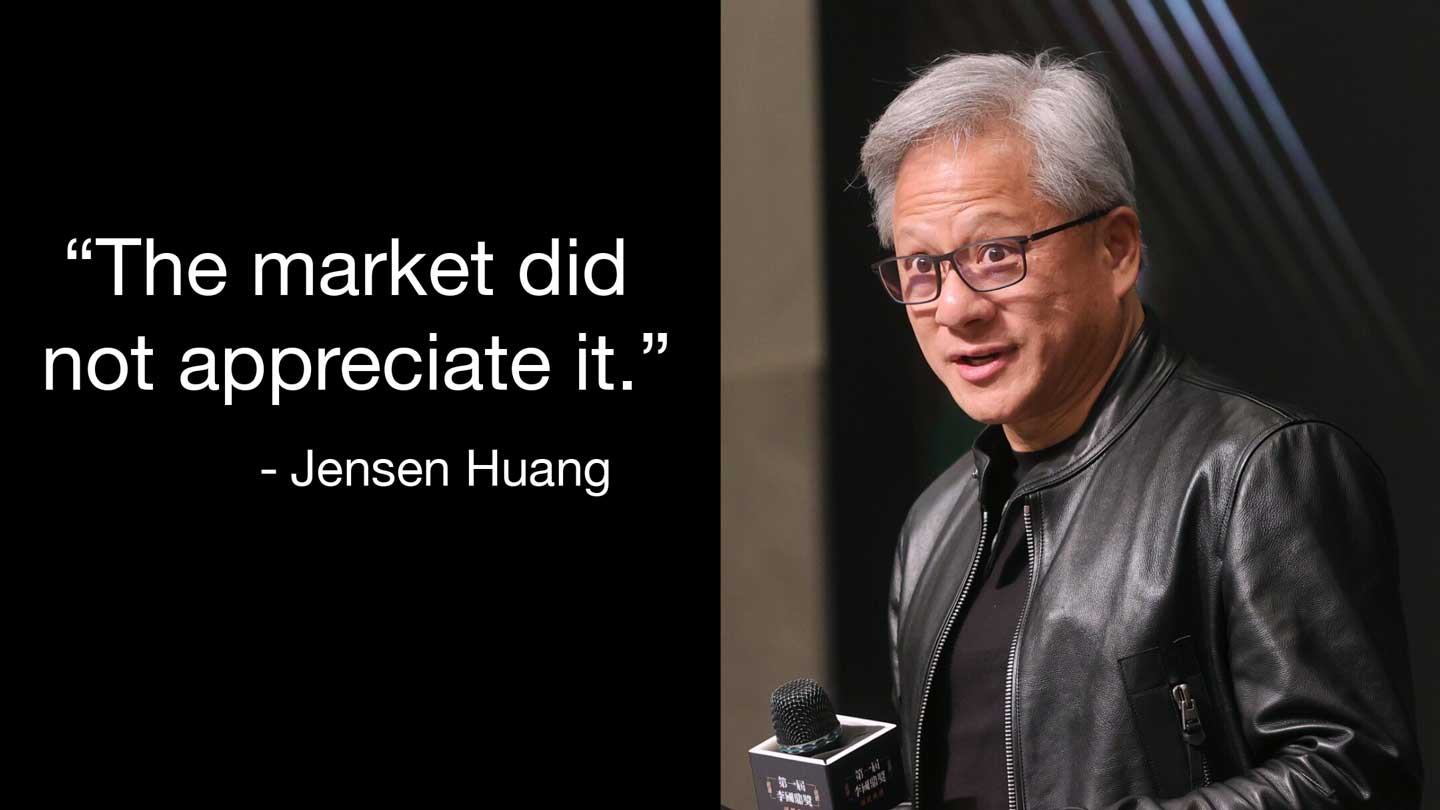

NVIDIA Delivers Record Quarter — Yet CEO Says “Market Did Not Appreciate It”

NVIDIA’s Blowout Quarter — Then the Market Yawn

NVIDIA delivered a powerhouse quarter, posting record revenue and raising guidance — but in a leaked all-hands meeting, CEO Jensen Huang admitted something shocking: “the market did not appreciate it.”

Huang laid it out straight: deliver a bad quarter → you’re fueling fears of an AI bubble. Deliver a great one → you still get pegged as bubble-fuel. The company faces a no-win game in market perception.

He also underscored the scale of the business: a market-cap slide of ~$500 billion in just a few weeks. At that level, every quarter carries planet-scale expectations.

Why This Matters

This isn’t just another beat-and-raise: it’s a marker for the AI trade’s durability and how the market is digesting that thesis.

- The AI infrastructure cycle is already priced in. NVIDIA’s outperformance challenges whether there’s much upside left if the market doesn’t reward the beat.

- When leading names like NVIDIA don’t get credit for monster results, it raises the question: Is it the company? Or is it investor fatigue?

- Option-flow and dark-pool signals often precede broader market moves — and this kind of “beat but no credit” scenario can spark big redistribution of risk.

Options-Market Flow: Signals You Should Be Watching

For traders on Unusual Whales, this is how you set up your radar:

Primary Ticker

- NVDA (NVIDIA)

What to Watch

- Unusual put activity in NVDA: Smart-money hedging if the beat wasn’t enough to lift expectations further.

- Call buy sweeps in names adjacent to NVIDIA (GPU suppliers, AI infrastructure) if market flow rotates out of NVIDIA and into lesser-recognized players.

- IV (implied volatility) spikes around earnings/guidance events in NVIDIA and peer space — suggesting hedges are being placed for downward surprises or disappointment risk.

- Dark-pool prints showing accumulation/distribution in NVIDIA ahead of follow-up earnings — could signal institutional repositioning.

Related Tickers to Monitor

- AMD (Advanced Micro Devices)

Why: Major competitor in the GPU/AI space — if NVDA gets muted reaction, AMD might catch flow. - ASML (ASML Holding)

Why: Key lithography supplier for the AI-chip ecosystem; sensitive to infrastructure spend. - QQQ (Invesco QXD – Nasdaq-100 ETF)

Why: Broad tech exposure; if macro sentiment shifts from “AI never dies” to “AI is priced in,” tech heavyweights like QQQ will move.

The Bottom Line

NVIDIA didn’t just beat — it blew out expectations. But investor reaction? Flat.

When the poster‐child for the AI trade doesn’t get a “thank you”, it hints that maybe the story is fully baked or that the bar has moved even higher.

For flow traders: this is your cue. Monitor NVDA, watch adjacent names, and follow where the smart money is hedging. Because when the leader stagnates in appreciation, the juniors often light up next.

Want to track this kind of flow live?

Sign up for a free Unusual Whales account to follow real-time options flow, dark-pool prints, sector-rotation alerts, and more.