Congress personally invested in semiconductors

Congress has passed the CHIPS Plus or Chips and Science Act. Which elected official could be benefiting personally from this? Let's find out!

Global supply chains are a mess. Semiconductors, which are in all facets of our modern technological lives, have been severely affected. This shortage has exposed America’s overreliance on China’s chip manufacturing industry.

After numerous iterations and lengthy debates, the Senate passed the Chips and Science Act (aka CHIPS Plus) on July 27, 2022. The House quickly followed by passing the bill on July 28. The CHIPS Plus Act provides up to $280 billion in subsidies and funding to the semiconductor industry. The hope is to bolster domestic manufacturing, offer incentives, and increase innovation and R&D in order to compete with global powerhouses like China.

We covered congressional trading in semiconductor stocks last year. Now that Congress has cast their votes, let's do a follow-up to see who might benefit personally from passing the “CHIPS Plus” Act.

Who’s Currently Invested?

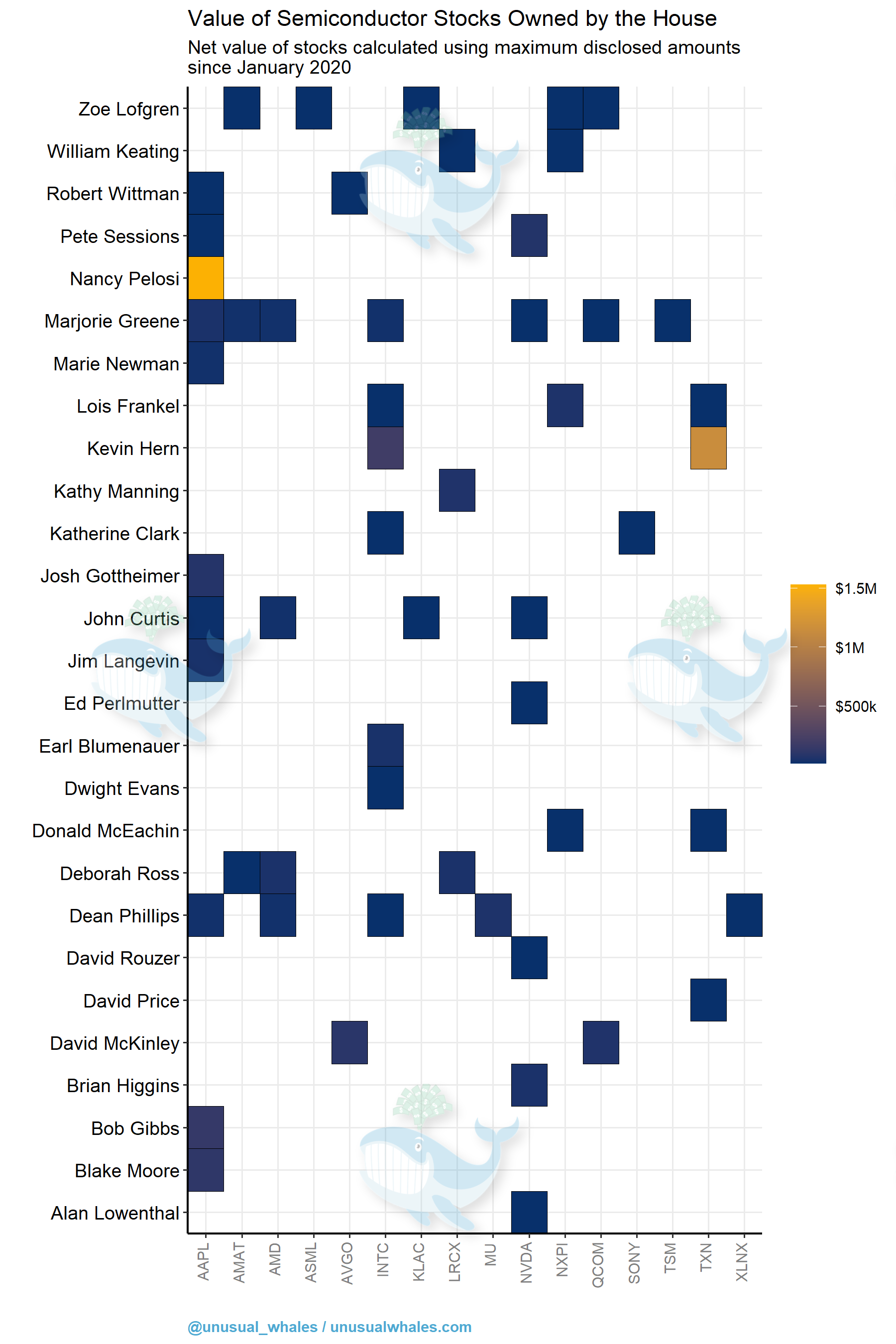

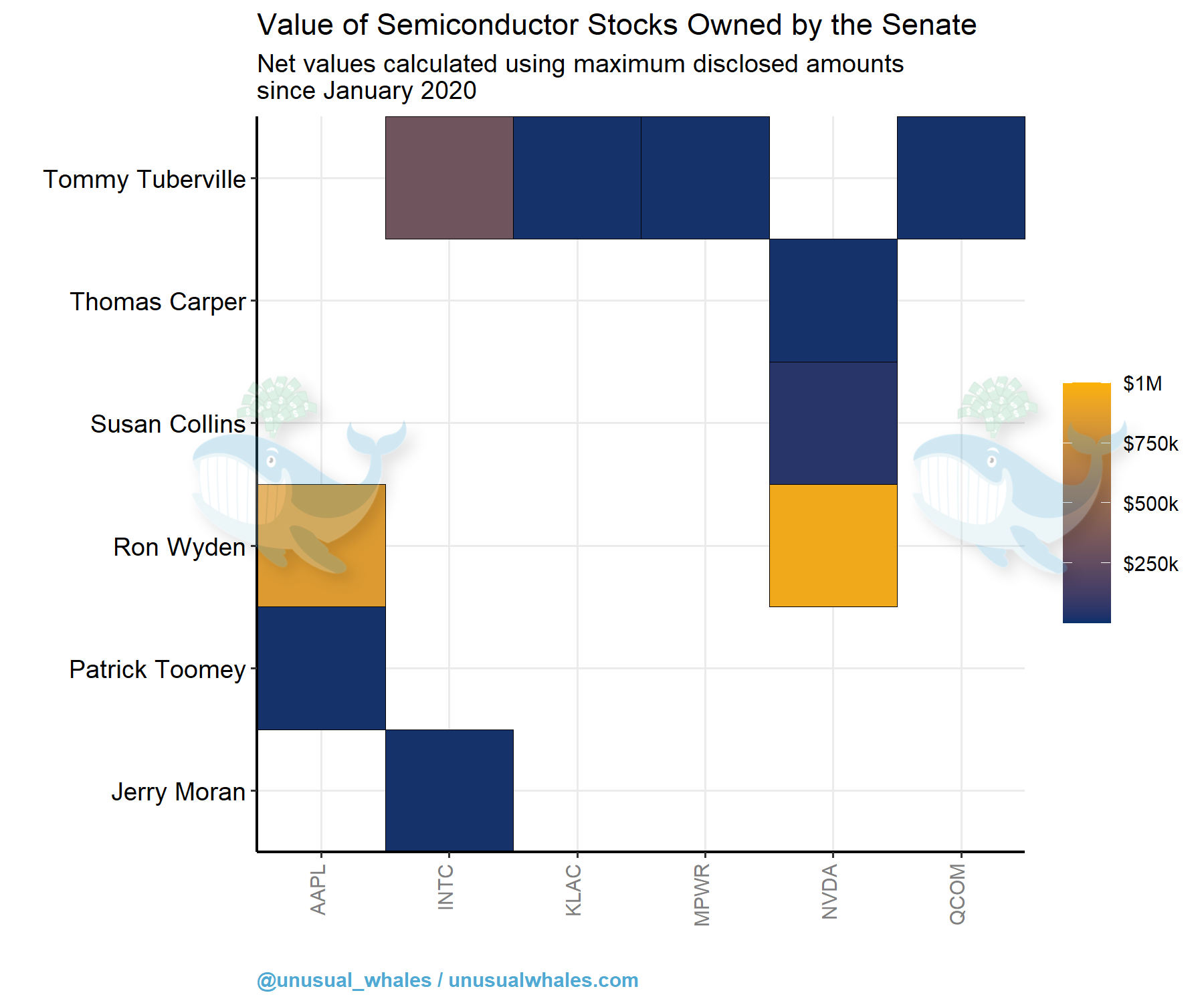

Using data from 2020 onward, we found that a number of current House Representatives and Senators own semiconductor stocks.

We estimated the value of each Member of Congress’s stocks using the earliest known buy trades since 2020, and accounted for subsequent sales. We used the maximum disclosed amounts for our estimates. Any sales prior to the earliest buy trades were removed. We found that some members had divested out of semiconductors during this time period so they won't show up in the following charts; however, their returns are noted in the following section.

By far, Speaker Nancy Pelosi (via her husband) disclosed picking up the most semiconductor stocks since 2020 with approximately $1.5M in Apple (AAPL) and at one point owning about $4.5M in NVidia stocks (NVDA).

On July 26, Speaker Pelosi disclosed selling all her NVDA shares (25,000 shares) at an average share price of $165.05 and for a disclosed loss of $341,365. This was one day before the Senate voted to pass the CHIP Plus Act. One would assume this move was to avoid criticism and perceived conflicts of interest as the House Speaker.

Unfortunately, we cannot confirm whether any other members sold off their semiconductor holdings prior to voting...

The following heatmap shows the net value each Member owns in different chip stocks.

Following Pelosi, Senator Ron Wyden (AAPL and NVDA) and Rep. Kevin Hern (INTC and TXN) own the largest holdings.

House

Senate

Not shown here as he only disclosed selling semiconductor stocks since 2020, but Rep. Chris Jacobs sold AAPL stock in 2020 and early 2021 while being a co-sponsor for the CHIPS for America Act.

Former Members of Congress were removed from this updated analysis. But we noticed that Reps. Susan Brooks, Greg Gianforte and Joseph Morelle all traded semiconductor stocks in 2020 while signing on to co-sponsor the original CHIPS for America Act. Conflicts much?

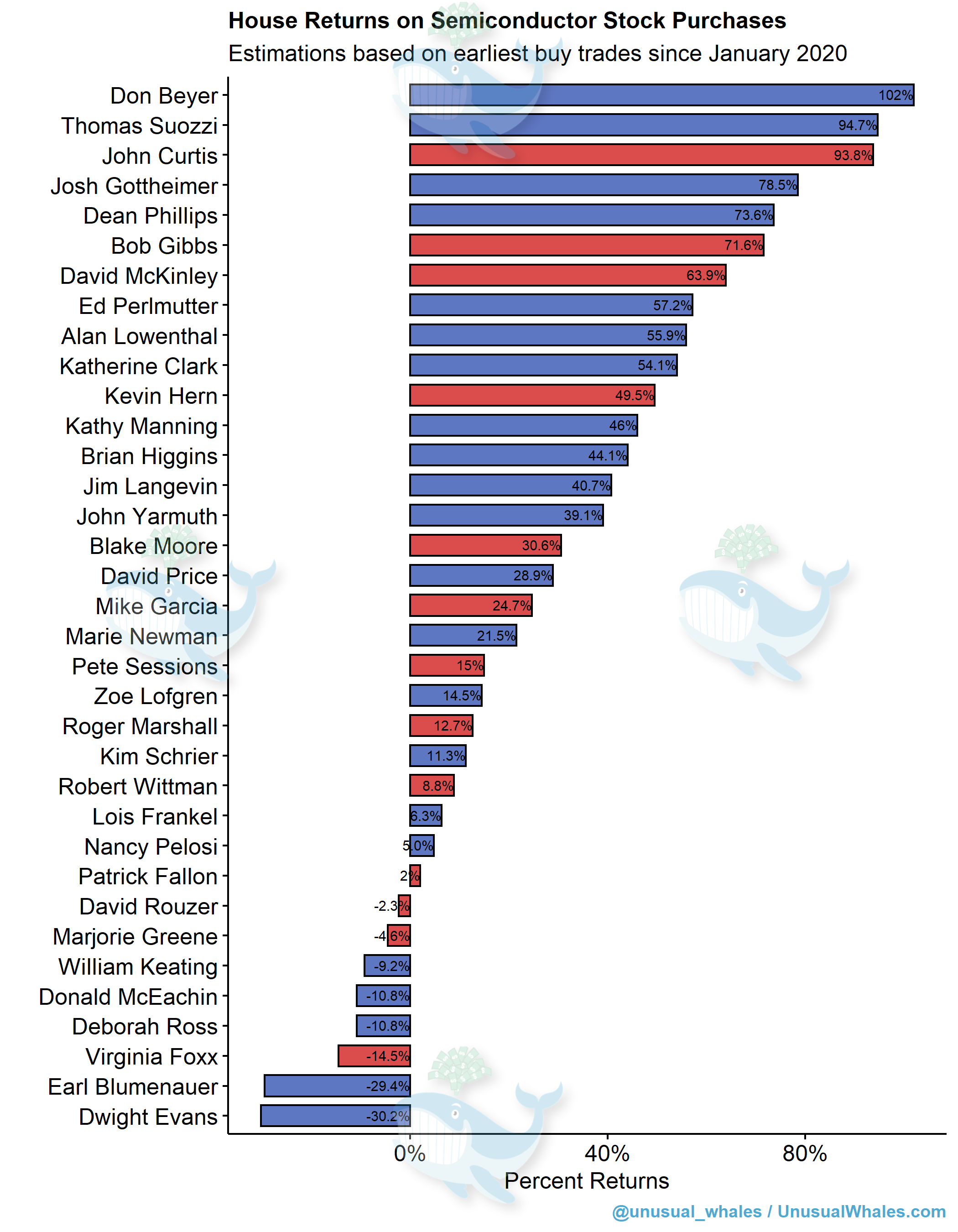

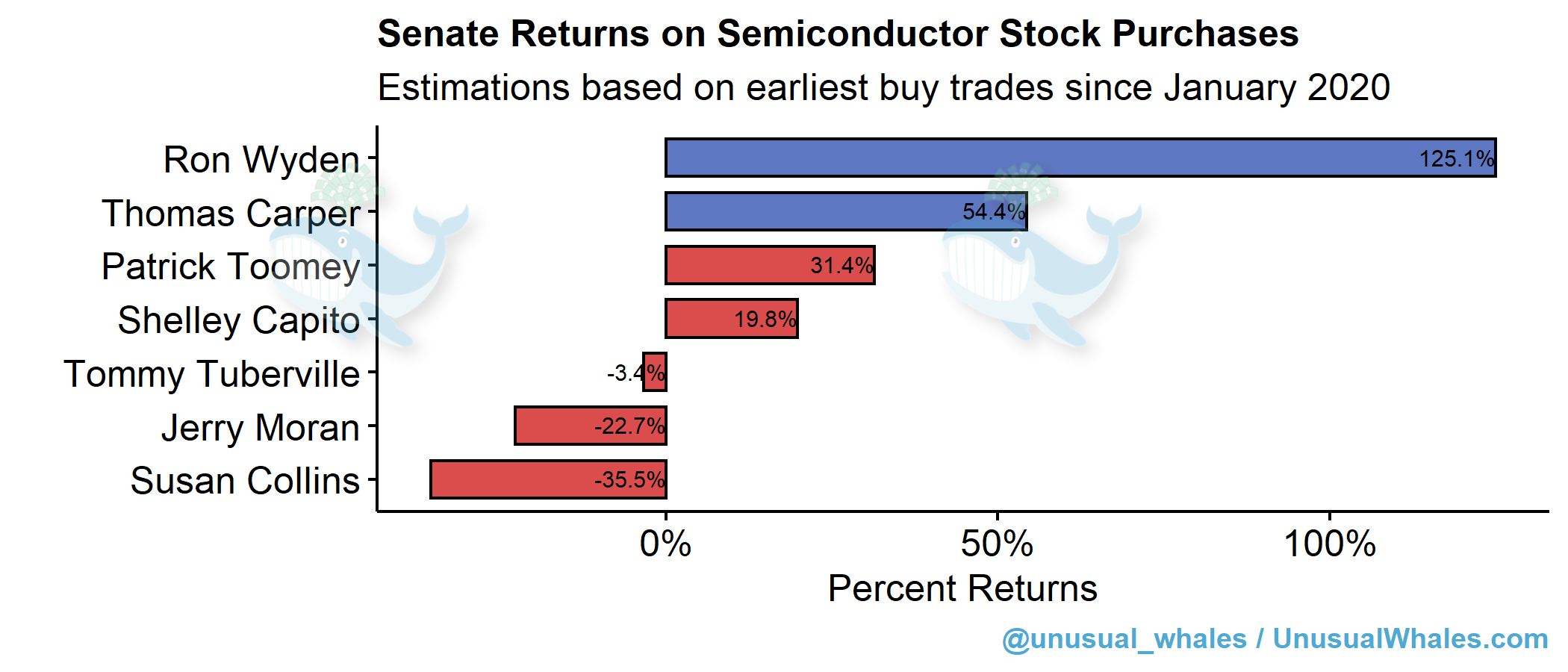

Estimating Chip Gains

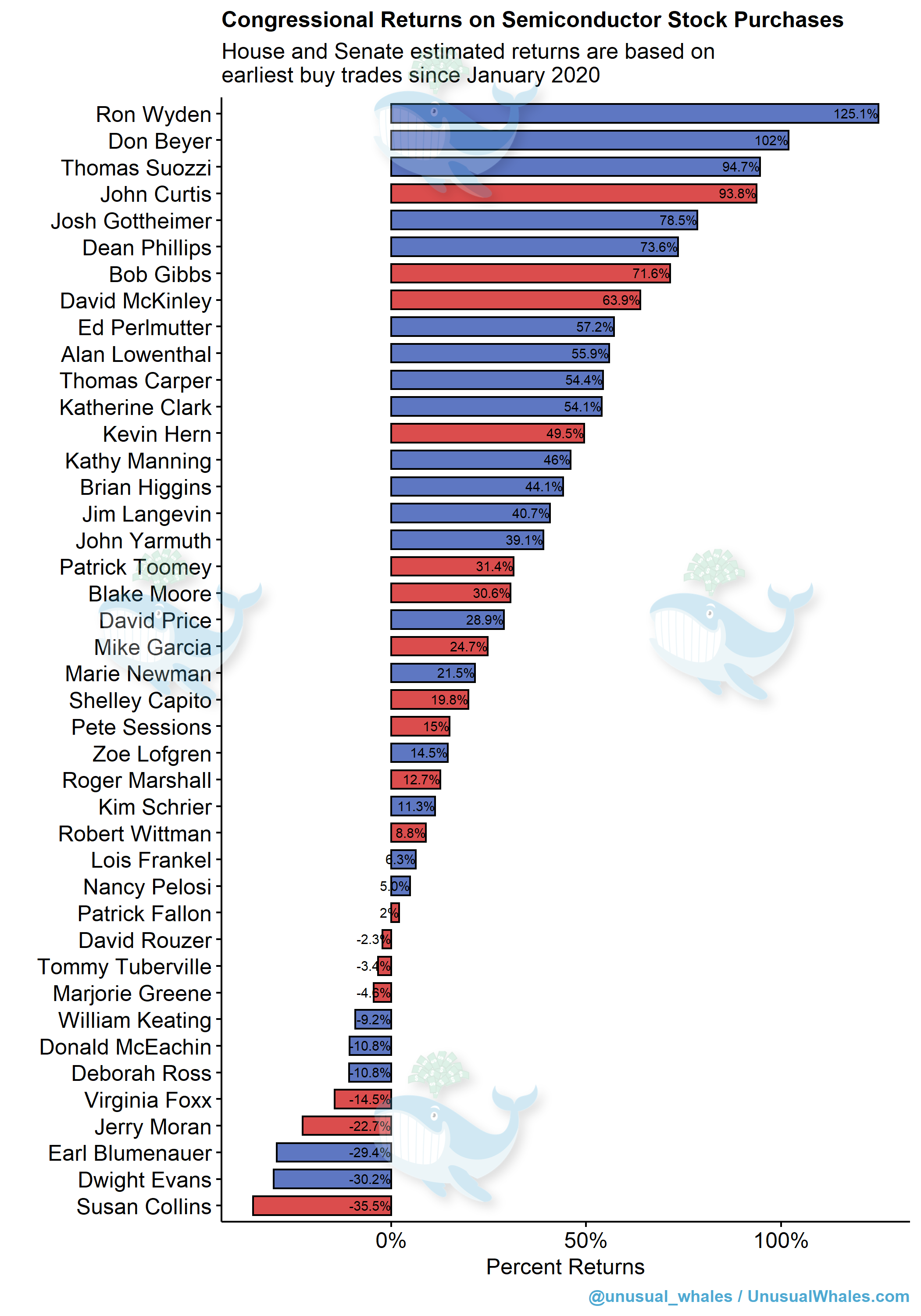

Next we estimated the percent returns for each Member who bought/sold or held semiconductor stocks. To do this, we calculated the percent returns for sales transactions using the earliest known buy trades since 2020. If no stock sales were disclosed, then the most recent date was used to calculate current returns. Note that this estimation method may conflate returns by assuming longer periods between buy and sell trades. However, financial disclosures don’t offer enough granular detail to pinpoint exact returns.

The following tables show estimated returns for Members of Congress that have invested in semiconductor stocks. In the House, Reps. Don Beyer, Thomas Suozzi and John Curtis had the highest estimated returns on their stock trades. Both Beyer and Suozzi voted to pass the CHIPS Plus Act.

Interestingly, the top 5 House Representatives sat on Congressional committees that were tasked with reviewing the CHIPS for America Act in 2020. 4 out of 5 of them voted to pass the bill.

House

Senate

Senate Democrats Ron Wyden and Tom Carper had the highest returns in the Senate. Notably, both Senators sit on the Senate Committee on Finance which was tasked with reviewing the Senate-equivalent of the CHIPS for America Act in 2020. Both voted to pass the funding last week.

Here's a summary chart showing both House and Senate estimated returns:

As Congress voted to increase American competitiveness in semiconductors, let’s remember that some of them have added personal incentives to pass this funding. This serves as yet another example of why our elected officials should be banned from trading stocks. Unfortunately, there’s been little to no movement on that initiative.

Join the discussion on our Discord or on Twitter @unusual_whales or read more of our congressional stock trading coverage at /i_am_the_senate. And as always, follow the flow!