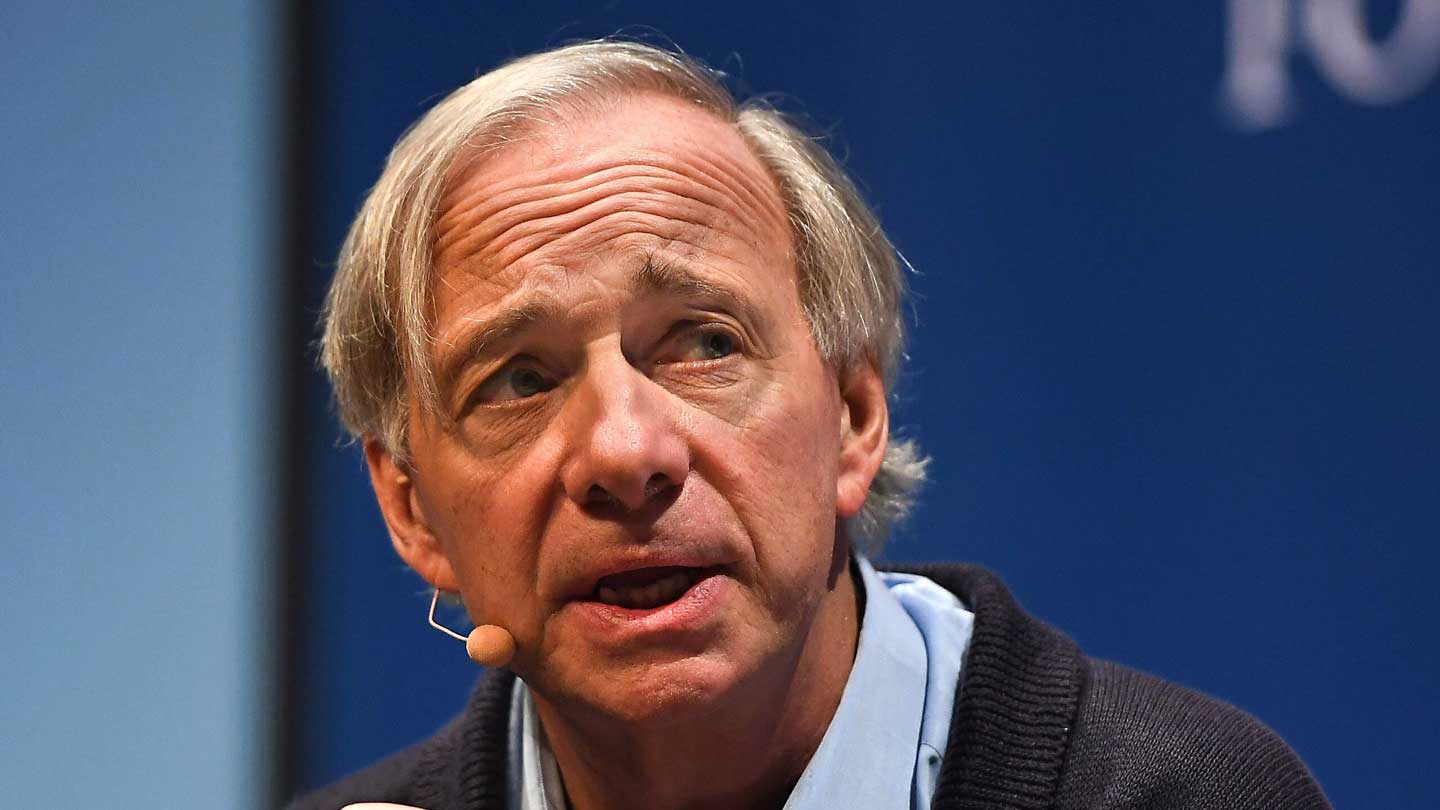

Ray Dalio: Middle East Becoming New AI Hub Amid Economic Risks

Ray Dalio Says Middle East May Become a New AI Powerhouse

Legendary investor Ray Dalio has said that the Middle East is emerging as a new focal point for artificial intelligence and technology development, comparing its potential to historic innovation centers. Dalio also warned that global economic risks, including debt cycles and political instability, could challenge markets in the next one to two years.

This view shifts focus from traditional tech hubs to regions investing heavily in compute infrastructure, data centers, and AI-related economic development — a change that markets are watching closely.

Why This View Matters for Markets

A New Geographic Axis for Tech Growth

Dalio’s comments suggest that investors should consider the geographic diversification of AI development, not just well-known centers like the U.S. and parts of Asia. If capital flows toward emerging tech hubs in the Middle East, it could influence valuations and competitive positioning in global tech.

Macro Risks and Debt Cycles

Dalio also highlighted global debt dynamics and political uncertainty as material risks for the broader economy. These concerns can shape macro expectations and asset price behavior, affecting equities, credit markets, and risk sentiment.

Political Instability and Market Volatility

Political volatility — especially in regions undergoing rapid transformation — can increase risk premiums for certain sectors. Traders may adjust hedges and volatility exposure as narratives around emerging hubs evolve.

Market and Sector Implications

Technology and Infrastructure

If the Middle East accelerates AI investment, firms tied to cloud infrastructure, hardware, and high-performance computing may see shifts in derivative positioning as traders price in new demand centers.

Commodities and Capital Flows

Many Middle Eastern economies are heavily tied to commodities. A tech pivot in the region could influence capital allocation patterns, commodity demand, and currency flows.

Defensive and Macro-Sensitive Assets

Dalio’s warnings on debt cycles could push market participants toward safe havens or defensive sectors. This shift often shows up first in volatility surfaces and hedging flows.

What Options Traders Should Watch

- Volatility regime changes in tech and infrastructure equities

- Unusual options flow tied to emerging market exposure

- Skew adjustments as macro risk narratives shift

- Protection demand in rate-sensitive and capital goods sectors

Macro narratives and regional tech shifts often precede spot moves, showing up early in derivatives markets.

What to Monitor on Unusual Whales

- Unusual options flow in cloud, semiconductors, and macro-sensitive names

- Volatility spikes tied to geopolitical and debt-cycle headlines

- Market-tide indicators showing rotations between growth and defensive positioning

- Positioning changes as traders price long-term AI demand expansion and macro risk

Unusual Whales’ tools — options flow tracking, volatility analytics, and market-tide metrics — help detect early positioning shifts as broad economic narratives evolve.

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through market tide, historical options flow, GEX, and much more.

Create a free Unusual Whales account to start conquering the market.

Ray Dalio’s view that the Middle East could rise as an AI hub — combined with caution over global debt and political risk — underscores how macro and structural trends can reframe where growth and risk are priced in global markets. For traders, watching derivative flows and volatility responses to these themes can reveal early positioning shifts.