A Review of Unusual Options Activity in Taiwan Semiconductor Manufacturing Company Limited (TSM) and Unusual Options Activity in The Kroger Co. (KR)

A Review of Unusual Options Activity in Taiwan Semiconductor Manufacturing Company Limited (TSM)

Reported yesterday, and again in the NYSE, we saw unusual activity in Taiwan Semiconductor Manufacturing Company Limited (TSM), which opened then at $140.75 and today at $$136.09.

- The trades have been tracked via reports from a user on Twitter. Yesterday, reports revealed the $140 strike calls dated for the 21st were closed, and were rolled to higher strikes and further out dates.

- You may want to watch this video to see how to track these kinds of opportunities in the Unusual Whales flow.

Seen today, utilizing the historical flow page on the Unusual Whales site, it is evident that this trader did, in fact, close their positions on the 21st as the open interest decreased approximately in the amount of the size(s) of the order(s).

The open interest of 28,993 decreased to 17,522 as of this morning’s open, meaning more traders left this chain than had entered into it yesterday, in spite of the volume.

Furthermore, the volume reported yesterday was, as reported, opened, as we can see that the open interest today has increased by the approximate requisite amount.

Be mindful! Just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open; however, they were traded at and in some cases above the ask, so assuming long, bought-to-open positions is often what intuition tells us.

Furthermore, the bullish sentiment on Taiwan Semiconductor is propagated by positive earnings, which Kwhen Finance Editors elaborated upon, revealing:

“shares closed [on the 10th] 13.4% lower than it did at the end of [the 9th].”

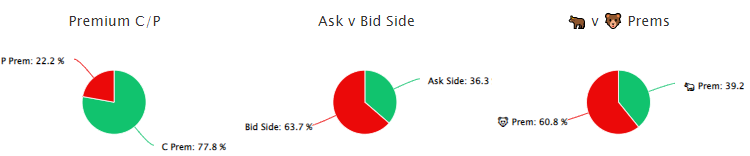

In spite of this trader and their bullish positions taken, 60.8% of the premium traded at these premium levels are in bearish bets, with 63.7% as bid-side orders, and 77.8% are in put premiums.

To view more information about TSM's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in The Kroger Co. (KR)

Today, January 14, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Kroger, which opened at $49.39.

- There were multiple sets of the $49 strike put options dated for March 18th, 2022, bought to open at the ask, amounting to over $1M in premium.

This is not the first time we have reported on unusual options activity in Kroger.

On November 2nd, 2022, there were insider trades that transpired just before market close, just ahead of news that Kroger would sell Bed Bath & Beyond products on Kroger’s website and in a “small-scale physical store pilot” in 2022.

These orders come after Zacks Equity Research reported that Kroger “extended its partnership with Nuro, an autonomous vehicle company, to offer fresh groceries via all-electric, autonomous vehicles”.

As can be seen, the volume on this chain overshadows the open interest (which is hardly viewable given the scale of these orders), so we know these contracts were, indeed, bought or sold to open, not closed.

To view more information about KR's daily flow breakdown, click here to visit unusualwhales.com.

Still haven't read the Unusual Whales Congressional Trading in 2021 Report?

Here is the TL;DR:

- Hundreds of millions of dollars have been exchanged on the stock market by our elected officials in 2021 alone

- In just equities, Congress bought and sold nearly $290 million throughout the year.

- In 2021, Congress beat the market!

- This report shows which sectors were preferred by each party and branch, oftentimes huge trade amounts could be attributed to one or two members.

- Big legislative events (such as the Infrastructure Bill getting passed by the Senate) were often preceded by politicians trading in the sectors affected. There were tons of unusual trades where politicians made millions of dollars.

- Congress has 45 days to disclose trades to the public, sometimes they are late and you can see a list of late disclosures here!

- Some politicians held securities in the sectors they vocally expressed support for (such as Senators holding cryptocurrencies while drafting crypto regulations).

- The report highlights many of these and other unusual instances!

Go check out the full report here, and you are encouraged to read through and share your thoughts on Twitter and the Discord community.

And for more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.