Revisiting Unusual Options Activity for Coty Inc. (COTY) and Cameco Corp. (CCJ)

October 1, 2021

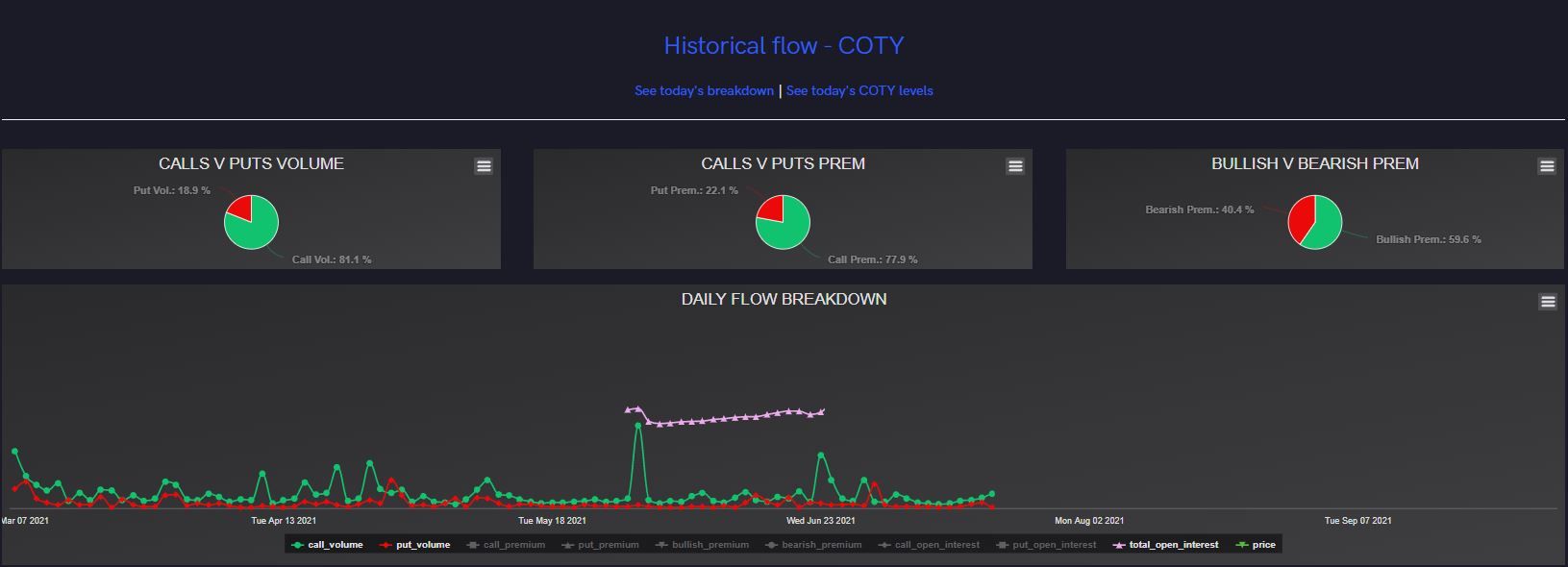

10:55ET: In early September, we released a short Nasdaq article outlining unusual options activity on Coty Inc. (COTY). In that article, we viewed a total of 9,765 contracts traded on the $9 call for November 19th, 2021. At the time of the publication (which was on September 8th, 2021), the COTY stock was trading at $8.36 per share.

Since then, COTY has traded in a range from $7.86 to $8.30. Over the last week or so, we’ve once again been able to observe substantial options trading; only this time, traders have their eyes set further in the future.

In the Unusual Whales flow image above, dated from the morning of September 30th to the morning of October 1st, we see a significant amount of attention on call contracts expiring in January and February of 2022. Most notably, the $9 strike for both January 21st and February 18th of 2022 garnered a massive amount of attention; one order alone consisted of 25,575 contracts for a total of $1.9M in premium.

Another popular subject of September was uranium. We discussed in a Nasdaq article and Unusual Blog post the unusual options activity for Cameco Corp. (CCJ) a prolific uranium mining company that had experienced consistent gains as the price of uranium rose. At the time of the first article (September 2nd), CCJ stock was trading at $19.49. By the time the second article released (September 8th), CCJ had already risen to over $22 per share. Since then, CCJ has traded as low as $20.07 during large market pullbacks, and as high as $24.73 in mid-September. The bullish sentiment of options traders appears to have maintained, however.

In the flow, there doesn’t appear to be a clearly targeted strike that traders are gravitating to. However, the December 17th, 2021 expiration date appears most frequently. The largest order between the mornings of September 30th and October 1st was 1,624 contracts on the $25 strike expiring November 19th, 2021, for a total of $180k in premium.