SEPT. 3, 2021 Metro Mile (MILE) Options Flow Shows Us Not ALL Unusual Options Activity Involve Multi-Million Premiums

11:49AM ET

Over the last several days, Metro Mile Inc. (MILE), a San Francisco-based car insurance company, has seen a significant hike in options activity.

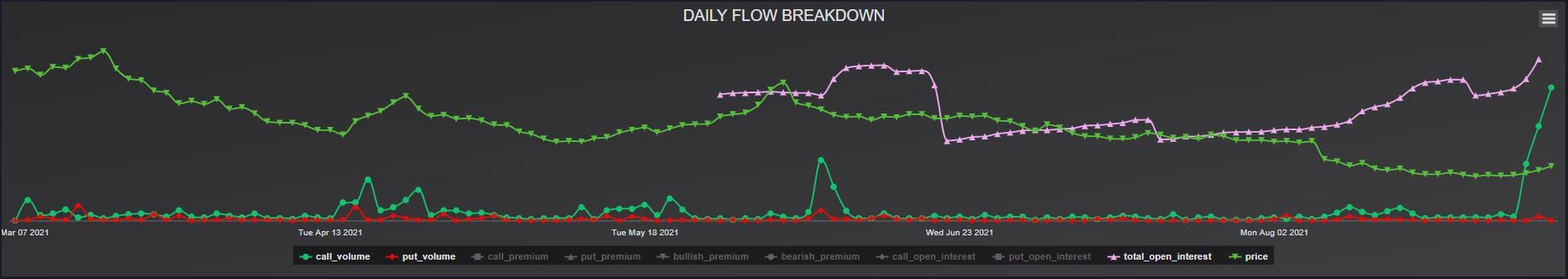

Compared to the last week, for example, call volume has rocketed from an average range of 1,300 to 1,500 call volume all the way up to 60,000 call volume today (and we haven’t even finished the morning trading session, yet). The focus is on call volume, as we can see in the chart below.

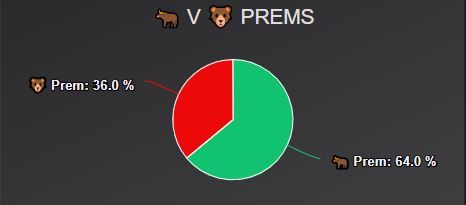

Today, there is only 366 put volume vs the nearly 60,000 call volume, a P/C ratio of essentially zero. In addition to this, that call volume is overwhelmingly bullish, demonstrated by the Bullish-to-Bearish premium ratio pie charts below.

At the time of writing, MILE is up 8.6% to $4.82, on seemingly no news. Keeping an eye on flow, we can see that the morning session continues to show consistent ask-side call purchases across all premium levels, mostly on OTM calls.

In the image above, Unusual Whales Flow filters are set to Ask-Side only, with a minimum of $10k in premium for MILE. The buyers have a heavy favoritism for the $5 and $7.5 strikes expiring on October 15, 2021. This shows expectations that MILE will push higher in the short term.

When compared to the historical flow for MILE (pictured in the header of this article), these levels of option volume are extremely out of the ordinary.

As the flow continues to sweep through, and MILE stock price works closer toward that $5 mark, we’re reminded that not all Unusual Options Activity wears the supermassive, multi-million dollar premiums; and that there are plays to be made on even the smaller, less-known names.