The Pelosi Portfolio

From 2021

There’s been intense interest in Nancy Pelosi’s financial disclosures for a long time. Whether it’s her family’s wealth, her district’s proximity to Silicon Valley, her partner Paul’s business dealings, or her long tenure in Congress, the general consensus is that her family may be privy to non-public information. In the last two years, retail investors have started to pay closer attention to Pelosi Plays with some even looking to mimic them.

In this report, we’ll look at her financial assets, stock portfolio, options strategies and see what retail investors can learn from the Pelosi Portfolio. Should retail investors even pay attention to Pelosi’s trades? Let’s find out.

TLDR

- The Pelosi family is RICH, RICH: Earning millions in annual income through assets such as capital gains, dividends, rent and grapes

- The Pelosi Stock Portfolio is filled with big tech picks. Pelosi’s simple stock trading principles include: buy big tech, HODL, profit!

- The Pelosi Options Portfolio consists of big tech calls that are consistently deep ITM LEAPS with expiration dates over a year. Typically, exercised one day before expiration date.

- Pelosi plays beat SPY more often than not.

- Be the first to know about Pelosi plays by following Unusual Whales.

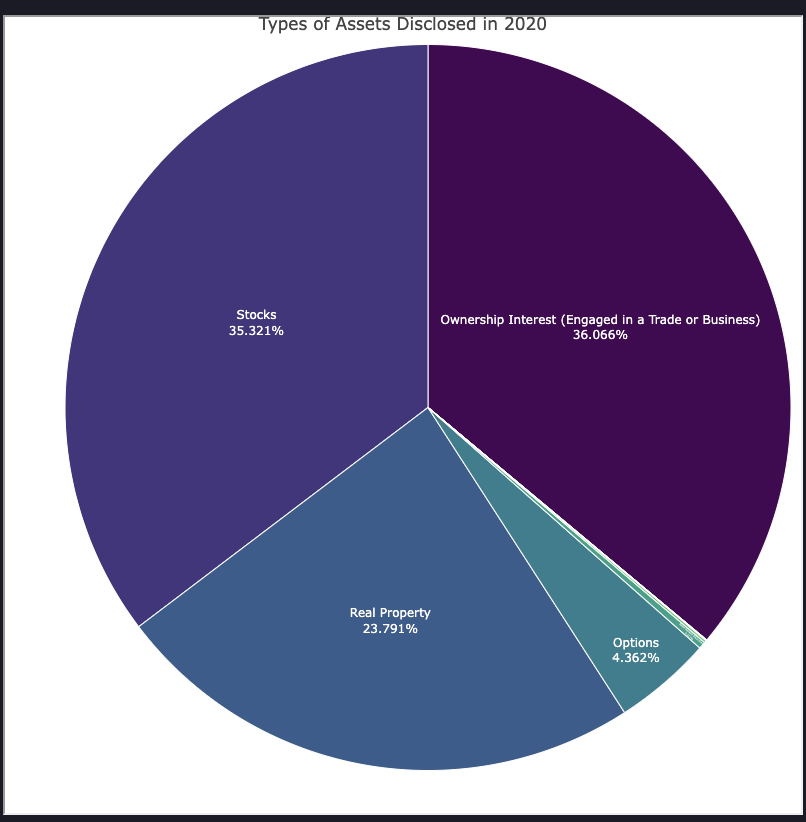

Wealth Portfolio

What makes up Pelosi’s wealth? According to her 2020 annual disclosure, stocks and ownership interest in companies make up the majority of their wealth portfolio (>70%). This is followed by real estate and then options positions. You can hover over the pie chart to see the maximum disclosed amounts that make up these assets.

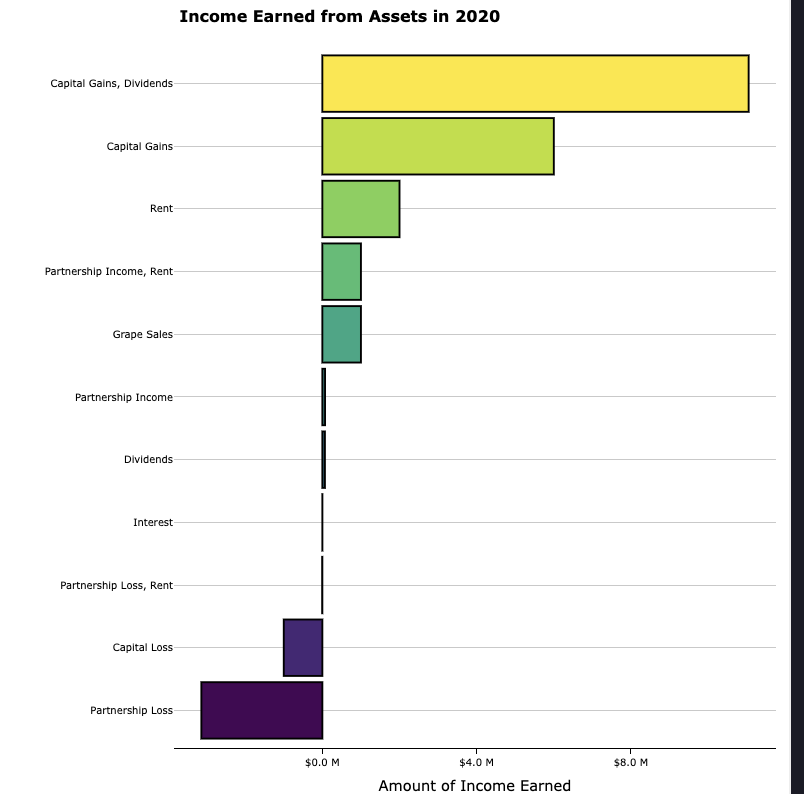

Some of these assets generate income for the family. Below is a chart illustrating the income earned from assets in 2020. We see that capital gains and dividends generated the most income for Pelosi with maximum disclosed amounts totalling over $17M. We also see capital losses and partnership losses used to balance out the spreadsheet. I wish I could sell grapes for $1M too…

It’s interesting to note that Pelosi has been in office since 1987. As House Speaker, Pelosi’s income from her congressional position was only around $223,500.

Stock Portfolio

What can we learn about Pelosi’s trading? Using her disclosures going back to late 2015, we can get a close estimation of Pelosi’s current stock portfolio. By grouping stocks into their respective sectors, we see that the current portfolio consists of mostly tech stocks (60%), followed by retail trade (22%), consumer services (10%), finance (7%), and lastly communications (1%).

We can also plot her family’s trades in each stock over the years. You can check out each ticker’s price chart with Pelosi stock and options trades overlaid. Apple has been a family favourite for a long time and you can view all the trades made since 2016 below. Note that in 2021, Pelosi disclosed that her husband had bought shares in AllianceBernstein Holding (AB), a global investment firm. A later disclosure classified these transactions as ownership interest in AB, hence the double labelling of those transactions.

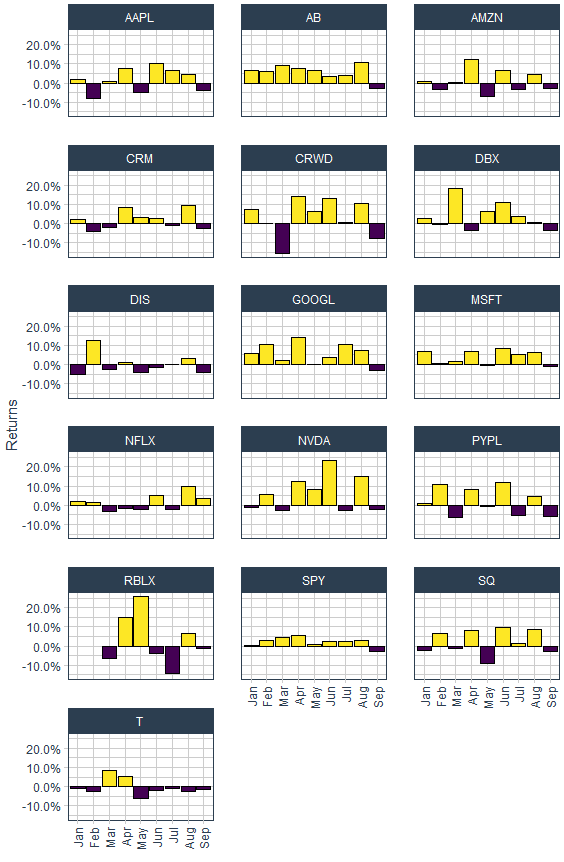

Using this data, we can extrapolate a best guess at Pelosi’s current stock portfolio. Notably missing is the number of current Visa (V) shares since Pelosi has disclosed only selling Visa shares since 2016. Here’s how these tickers have been performing with monthly returns in 2021. SPY included as a benchmark.

It’s interesting to note that although we see swings in monthly returns for some tickers like CRWD or RBLX, Pelosi doesn’t sell.

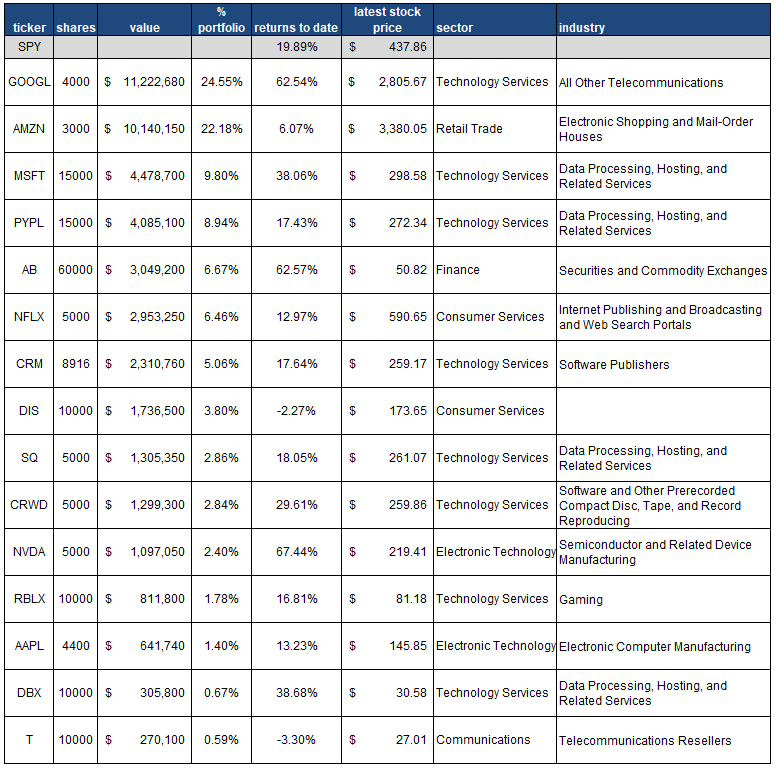

Below is the Pelosi Stock Portfolio organized into a table showing:

- The total number of shares Pelosi currently owns

- The estimated total value of each stock in her portfolio (as of late September 2021)

- The percentage make-up of the total portfolio based on its value

- The estimated annual returns to date calculated from January 1, 2021 to late September (note this isn’t Pelosi’s returns for each stock). This can be used to see that if your portfolio was made up of these stocks at the beginning of the year, how it would be performing by September 2021.

- The stock’s latest adjusted closing price

- The stock’s sector and industry

At the time of this analysis, a portfolio filled with Pelosi picks in 2021 would have returns of 26%, beating SPY at just under 20%.

When does Pelosi sell?

Interestingly, the only two stocks consistently sold by Pelosi were Apple and Visa. Since we have the original strike prices for AAPL calls that were eventually exercised, we can calculate the approximate gains from sold Apple stocks. When Pelosi disclosed selling AAPL in December 2017, the approximate gains ranged from +83% to +106%. When Pelosi disclosed selling AAPL in May 2020, the approximate gains ranged from +119% to +137%. Impressive! It’s challenging to estimate Visa gains as we don’t know when and how many shares Pelosi bought pre-2016 (it’s greater than 23,000 shares though).

Let’s summarize the Pelosi Principles on Stock Trading:

- Buy big tech stocks

- HODL no matter what

- (Make sure economy runs smooth-ishly)

- Profit!

The Pelosi Options Strategy

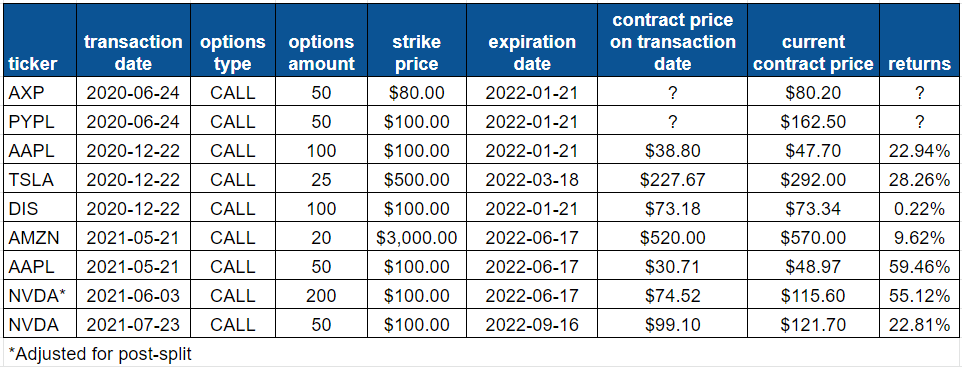

Paul Pelosi also makes several options trades per year. Here’s a list of his active option contracts, and their current returns (as of late September, where info is available to calculate). Again, mostly big tech! The typical scenario appears to be exercising the contracts on the expiration date or a couple days before (usually one). We can look forward to January 20-21, 2022 for Pelosi exercising AXP, PYPL and AAPL calls...

So far Pelosi’s options portfolio is up 28%, again beating current SPY returns in 2021.

You can actually find Pelosi calls from 2021 using the Flow tool at www.unusualwhales.com/flow. Thoughts on adding a Pelosi emoji tag in the future? 👸?

Let’s summarize the Pelosi Principles on Options Trading:

- Buying calls? Buy deep ITM LEAPS with expiration dates over a year from now.

- HODL no matter what

- (Make sure economy runs smooth-ishly)

- Exercise or sell one day before expiration date.

- Profit!

Following Pelosi

I guess we come to the most important question:. If TikTokers already follow Pelosi’s trades, should you follow Pelosi trades?

To answer this, let’s first understand the House’s financial disclosure process. Congress has a 45-day policy to file/notify the Clerk’s Office of a trade. This date is known as the notification date. From the notification date, it can take some time until financial disclosures are published online. Unusual Whales reports on all Congressional disclosures when they are published here.

Interestingly, Pelosi is always prompt with filing her disclosures. She files them on the same day as the transaction date. That means the only lag time is between the transaction/notification date and the publication date by the Clerk’s Office. The media pounces on Pelosi disclosures roughly on the day they’ve been published. Using these article dates, we can readily associate publication dates for most disclosures since 2020. The average amount of time between these two dates for Pelosi disclosures was ~35 days or ~25 business days.

Do Pelosi disclosures influence stocks?

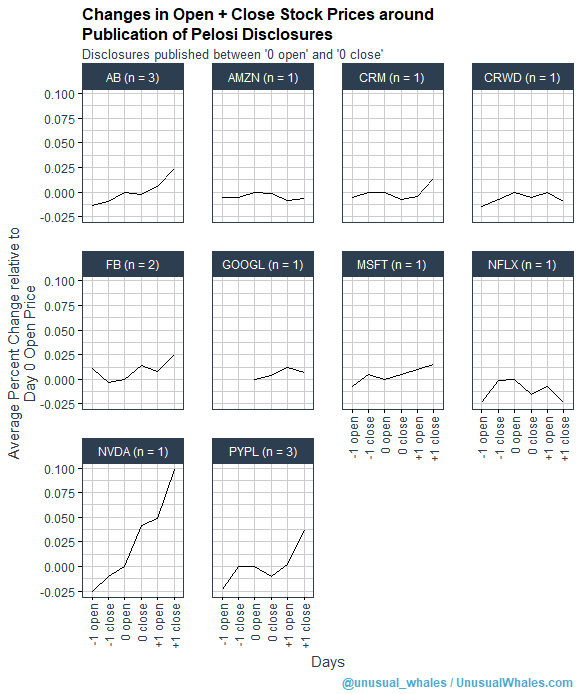

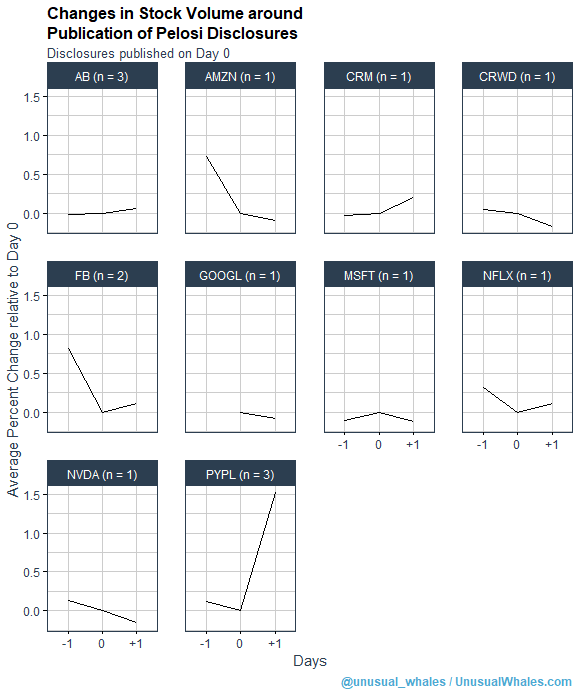

When the media reports on Pelosi’s trades, do we see any significant changes to the stocks? It’s difficult to answer this question definitively due to the small number of trades per ticker, but here’s what we can observe with stock price and volume.

The following chart shows the changes in stock price prior to and following the day Pelosi’s disclosures are publicized. Open and close prices are compared for each day. We can observe that big tech stocks (ie. AAPL, FB, MSFT, PYPL, NVDA) increase marginally the following day after Pelosi trades are publicized, but note the small sample sizes. As for stock volume, we see small volume increases in CRM, FB and NFLX. With a large one following Pelosi’s 3 big PYPL stock purchases last summer. Again, with so little data it’s hard to definitively say Pelosi influences these stocks.

Retail + Pelosi Plays + Returns

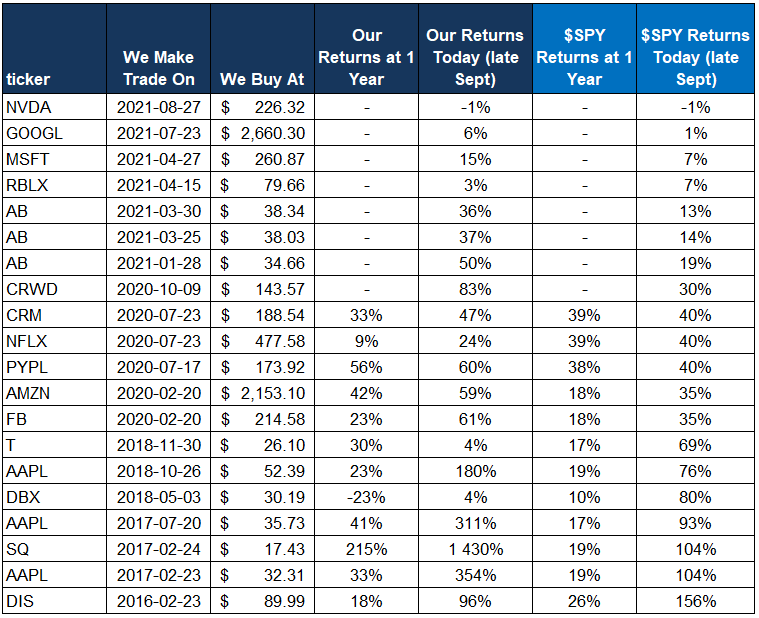

So, no immediate influence of Pelosi disclosures on the stocks. That’s ok. What would our returns be if we, as retail investors, applied the Pelosi principles on Pelosi Plays? Let’s do a thought experiment on her disclosed stock purchases in the last 5 years.

Experiment: Buy every stock Pelosi buys on the date the disclosure is published (25 business days after her initial transaction/notification date), what would our returns be?

The below table shows the estimated returns at one year out and as of late September 2021 for each disclosed stock purchase. If we apply the Pelosi Principles of buy, HODL and profit, we see that most of our picks would be in the green in all cases except her recent Nvidia buy! Furthermore, in 67% (8 out of 12) Pelosi trades beat SPY at 1 year returns. As of late September 2021, 70% (14 out of 20) Pelosi trades have beaten SPY.

Conclusion

Nancy Pelosi has been a politician for over three decades. She is currently the Speaker of the House, the highest-ranking legislative official in America. In this role she wields great power: she ensures Democratic-supported legislation passes and determines which bills reach the floor for debate and voting. She has disclosed that her family generates income totaling millions off of assets like stocks and ownership interest in companies. Her husband actively trades millions in stocks and options. This report summarized those trades in a way for retail investors to learn from and apply Pelosi’s successful trading principles. Her family makes consistent gains over the long term. I hope this helps you too.