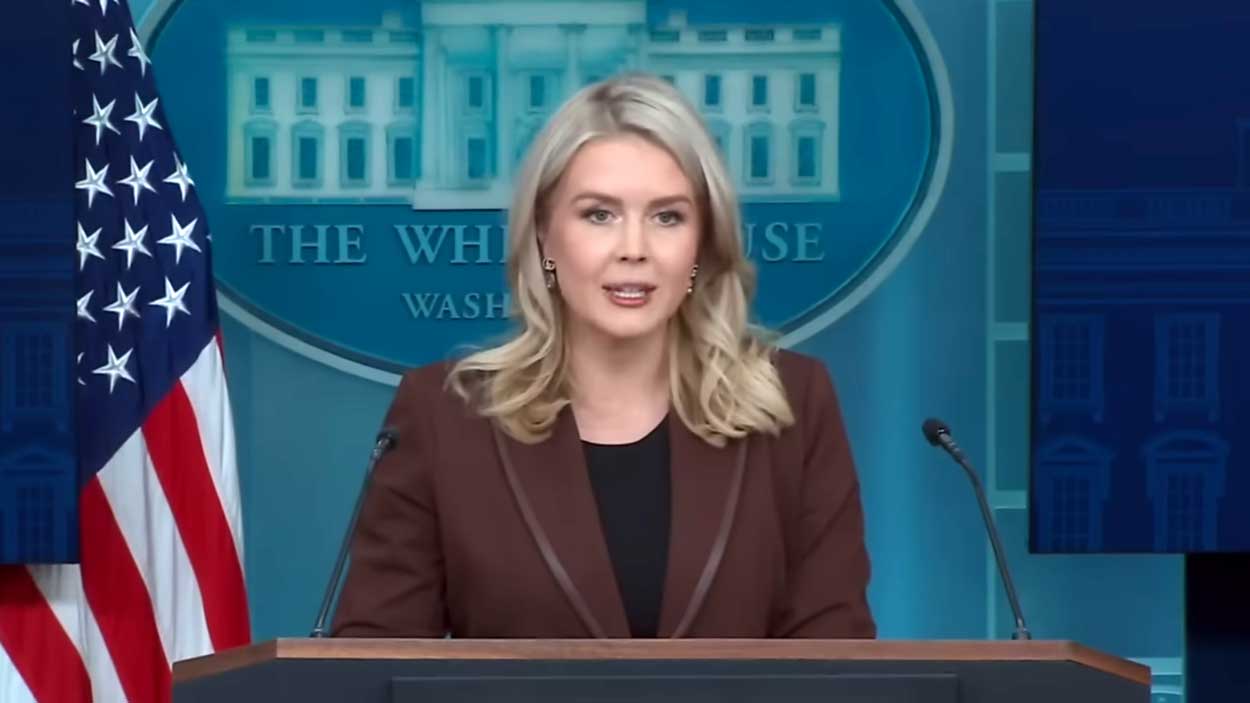

The White House Press Secretary Leavitt just said: The October CPI and jobs data will likely never be released

Data Gaps After Shutdown

The White House acknowledged that the October employment report and October CPI may never be published because the government shutdown hit during a critical data-collection window.

Press Secretary Karoline Leavitt said the shutdown “may have permanently damaged the federal statistical system,” adding that any reconstructed data would be “permanently impaired.”

The Bureau of Labor Statistics was unable to survey households, employers, or price indexes during the shutdown period, leaving statisticians with an incomplete and potentially unrecoverable dataset.

Private-sector labor trackers have already pointed toward cooling conditions, including rising layoffs and a potential unemployment uptick, but without federal confirmation, the official macro picture remains incomplete.

Why It Matters

The Fed Is Flying Blind

The Federal Reserve has not faced a data blackout of this scale in decades. With no official jobs or CPI data for the month, policymakers lose two of their most important gauges just ahead of critical rate-setting meetings.

The absence of these figures limits the Fed’s ability to justify tightening, easing or maintaining policy, and increases the likelihood of misalignment between market expectations and monetary decisions.

Markets Lose Their Anchor

Equities, bonds, and options pricing all depend on consensus macro data. Missing a full month’s report creates a hole in trend analysis at a moment when recession odds, inflation stickiness, and labor-market cooling are all contested.

Investors will lean more heavily on private payroll trackers, credit-card spending data, corporate earnings commentary, and high-frequency indicators — all of which vary in reliability and methodology.

Options Market Impact

The lack of official data increases uncertainty, which typically raises implied volatility across major indices.

Expect traders to:

- Price in wider volatility bands for SPY and QQQ

- React more aggressively to private data drops

- Hedge more frequently against sudden downside surprises

- Push options flow into macro-sensitive sectors

This creates opportunities for both directional plays and volatility strategies as the market interprets fragmented economic signals.

Stocks to Monitor (Linked to Unusual Whales)

- GS — Highly sensitive to rate expectations and macro volatility.

- JPM — A financial bellwether; options flow often spikes during data uncertainty.

- XLY — Consumer Discretionary ETF; spending patterns hinge on labor-market health.

- SPY — Market-wide exposure; traders may hedge aggressively given missing economic data.

These names typically show early signals in unusual options activity when macro conditions shift. Monitoring their IV rank, flow spikes, and whale trades can help traders anticipate broader market moves.

What Could Go Wrong

A few risks could amplify volatility:

- If eventual reconstructed data sharply contradicts private indicators, markets may whipsaw.

- Investors may overreact to estimates that aren’t statistically representative.

- If November data is also disrupted, the market loses sequential comparisons — a major analytical problem.

- Economic narratives could diverge wildly without official benchmarking.

Bottom Line

A missing month of jobs and inflation data is more than an administrative issue — it’s a potential market catalyst. With the Fed operating in a fog and investors substituting private signals for federal statistics, options markets may see sustained elevated volatility and more aggressive positioning.

This is a period where watching institutional flow becomes even more important.

Call to Action

For real-time options flow, IV scans, and sector-specific alerts on the tickers above, create a free account at Unusual Whales.