Trump Blasts Fed Over High Rates and Takes Aim at JPMorgan’s Jamie Dimon

President Donald Trump has sharply renewed his critique of the Federal Reserve’s interest rate policy, calling for lower rates after recent inflation data showed headline inflation still above the Fed’s long-run target. In speeches, Trump labeled Fed Chair Jerome Powell a “real stiff” on monetary policy, advocating a return to what he described as older economic decision-making.

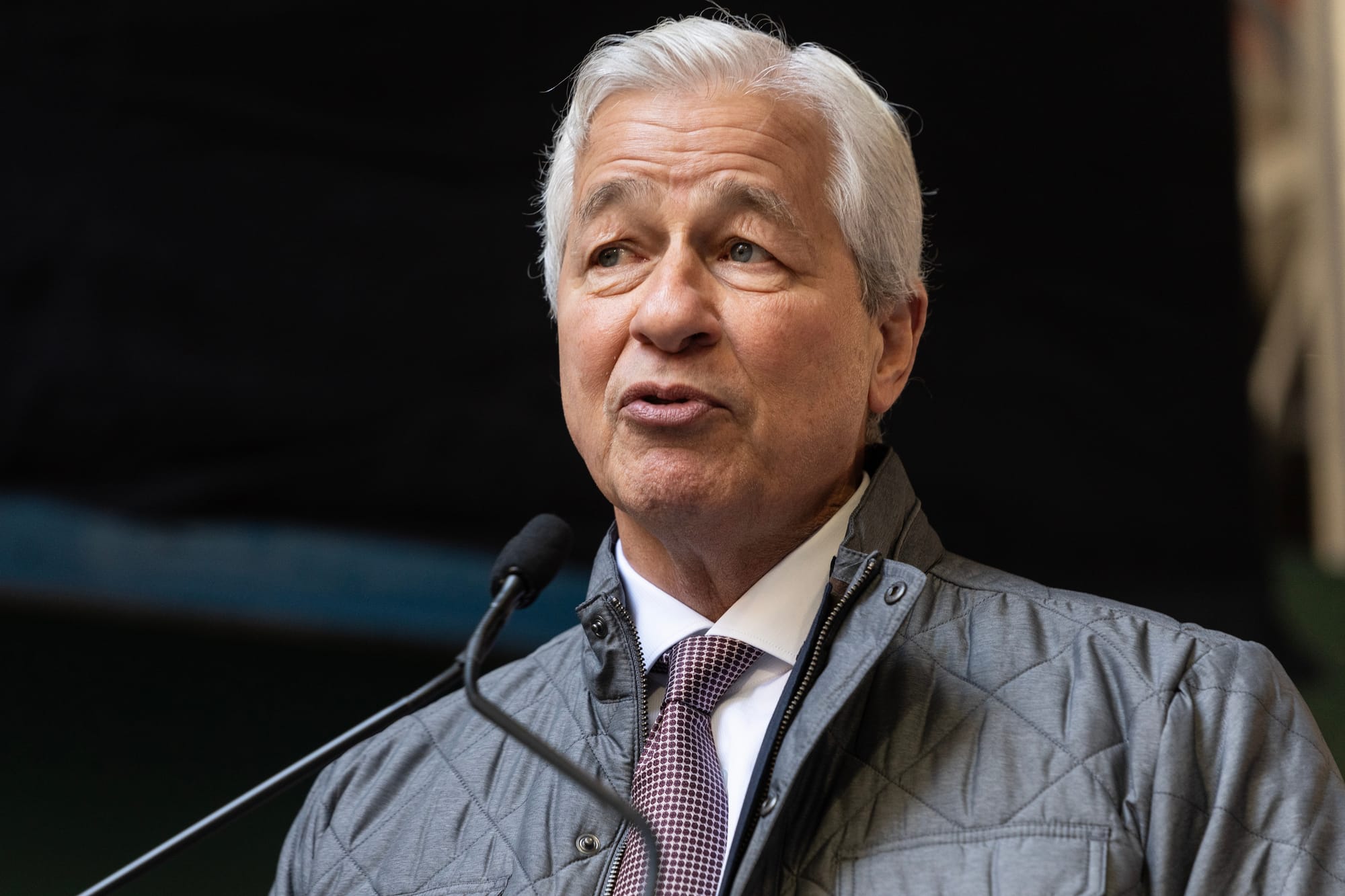

In that same string of remarks, Trump publicly rebuked JPMorgan Chase CEO Jamie Dimon, dismissing Dimon’s criticism of the administration’s actions regarding the Fed. Trump said Dimon was “wrong” to argue that political attacks on the Fed’s independence could harm economic stability, and suggested Dimon favored higher rates because it could benefit the bank financially — a claim that sparked backlash among Wall Street leaders.

This clash comes amid broader political tensions around the Federal Reserve’s independence and a Department of Justice investigation into Fed Chair Powell’s actions, which critics (including Dimon) say threaten the credibility of the central bank.

Divider

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free Unusual Whales account to start conquering the market.

Why This Political Clash Matters to Markets

Trump’s renewed attack on the Fed and public spat with one of Wall Street’s most influential CEOs isn’t just political theatre — it’s a signal of rising policy and institutional risk that traders watch closely.

Here’s why traders care:

1. Monetary Policy Uncertainty

Trump’s pressure on the Fed to cut rates against a backdrop of inflation above target introduces uncertainty around future rate paths, which feeds directly into fixed-income pricing and equity risk premiums.

2. Central Bank Independence Debate

Dimon and other financial leaders (including global central bankers) have emphasized the importance of an independent central bank and warned that undermining it could boost inflation expectations and weaken economic stability. When political pressure enters the monetary policy conversation, markets often price increased risk ahead of fundamentals.

3. Risk Sentiment & Volatility

Public confrontations between political leaders and financial executives — especially around the Fed — can push perceived risk premiums higher, often reflected first in implied volatility and options skew before equity indices move.

Macro & Financial Leader Positions

Jamie Dimon has been vocal in defending Federal Reserve independence and cautioning against political interference in monetary policy, warning that undermining this independence could fuel inflation and higher interest rates long-term.

Earlier reporting shows that global central bankers have also come out in support of Fed autonomy, underscoring how significant this debate is for economic stability.

Trump also pushed back on media reports about whether he ever offered Dimon the Fed chair role — a matter Dimon never confirmed and which Trump later denied, even announcing plans to sue over related claims.

Stocks & Sectors to Watch on Unusual Whales

When markets digest monetary policy uncertainty and institutional risk narratives, certain stocks and sectors often reflect those shifts early in options flow and implied volatility.

Banking & Financials

- JPMorgan Chase ($JPM) — direct focus of Trump-Dimon clash

- Bank of America ($BAC) — banking sector risk barometer

- Goldman Sachs ($GS) — trading and macro sensitivity

Financial names react quickly when interest rate path uncertainty rises, often through skew and volatility adjustments.

Macro & Growth Indicators

- Nvidia ($NVDA) — broad market beta leader

- Microsoft ($MSFT) — defensive tech exposure

- SPY (S&P 500 ETF) — broad market sentiment barometer

Macro leaders and broad indexes often reflect risk appetite changes when monetary policy narratives shift.

Options Flow Themes to Monitor

Political attacks on monetary institutions and executive pressure on policy often manifest first in derivatives markets:

1. Volatility Expansion

Implied volatility in financials and broad indexes can rise as uncertainty around rates and policy independence grows.

2. Skew Adjustments

Put/call skew may increase in financial and macro beta names as traders hedge against downside risk.

3. Hedged Spread Activity

Calendar and diagonal spread activity often accelerates ahead of key macro data (e.g., CPI, Fed meeting statements) as traders price in uncertainty.

Unusual Whales historical flow tools help spot these shifts before price action fully reflects them.

Broader Market & Economic Implications

This political battle feeds into broader themes that markets price continuously:

- Inflation expectations: If political pressure pushes the Fed toward premature rate cuts, inflation expectations may rise, affecting yield curves and credit spreads.

- Currency markets: Uncertainty in rate policy can influence the U.S. dollar and emerging market flows.

- Safe-Haven Demand: Escalating institutional risk often boosts demand for safe havens (Treasuries, gold), visible in derivatives and cross-asset correlations.

These multi-vector dynamics influence volatility and risk premiums across sectors.

Final Thoughts

When a sitting president criticizes the central bank and publicly challenges one of Wall Street’s most influential CEOs, markets take notice — not because of personality, but because such events can signal heightened policy uncertainty and shifting risk appetites.

Options markets often price these narratives before equity prices do, making flow, skew, and volatility valuable early indicators.

Sign Up

Want to track political risk and positioning before price reacts?

Unusual Whales gives you real-time and historical options flow, implied volatility analytics, GEX indicators, and market tide signals — the tools traders use to anticipate where markets go next.

Create a free Unusual Whales account to start conquering the market.