Trump predicts $20 trillion could be injected into the U.S. economy by the end of this year

Key takeaways

- Trump claims as much as $20 trillion could enter the U.S. economy through reshoring, tariffs, and domestic investment.

- Economists say the number is not supported by measurable commitments and would rival the size of the entire U.S. GDP.

- Inflation and job growth remain weak, creating tension with the White House’s optimistic messaging.

- Stock market reaction has been mixed, with investors unsure how realistic the figure is.

- The messaging shift is strategic, aimed at voters frustrated by high living costs.

Trump projects a historic investment wave

President Donald Trump said this week that up to $20 trillion could be injected into the U.S. economy by the end of 2025. He framed the projection as the result of aggressive reshoring, new tariffs, and corporate investment agreements that he argues will restore American manufacturing at a historic scale.

Watch President Trump make the claim on Fox Business:

Economists say the figure would be unprecedented. For context, U.S. gross domestic product in the second quarter of 2025 was about $30.5 trillion. A $20 trillion injection would amount to roughly two‑thirds of the entire economy.

Analysts also note that Trump’s team previously boasted of securing $17 trillion in new investments, but an Associated Press fact‑check found that the sum included projects announced under President Biden and that the actual confirmed commitments were in the hundreds of billions.

A pivot toward affordability

The Trump administration has been recalibrating its economic message to focus on affordability, one of the top concerns among voters. Officials point to:

- Lower advertised drug prices from pharmaceutical makers. In March 2023, Eli Lilly announced it would cut the list price of its most commonly used insulins by 70%, and Novo Nordisk said it would reduce U.S. list prices on several insulin products by up to 75%. The administration has cited these cuts as evidence that policies are reducing costs.

- Retailer price reductions posted on social media.

- Foreign investment announcements and stock‑market gains as signs that economic growth is accelerating.

Trump contends that Republicans are doing more to lower costs than Democrats and has labeled Democratic criticism a “con job.” This message has been amplified by White House posts highlighting price drops at major retailers and by officials who tout targeted progress.

Economic conditions paint a more complicated picture

Despite isolated price cuts, broader economic data show a persistent strain:

Inflation remains elevated

The Consumer Price Index (CPI) for September 2025 showed that the food index rose 0.2% in a month, with food at home up 0.3%. Over the prior 12 months, food‑at‑home prices increased 2.7%, and the electricity index rose 5.1%, while natural‑gas prices jumped 11.7%. These figures underscore how grocery staples and utility bills remain high despite selective price cuts.

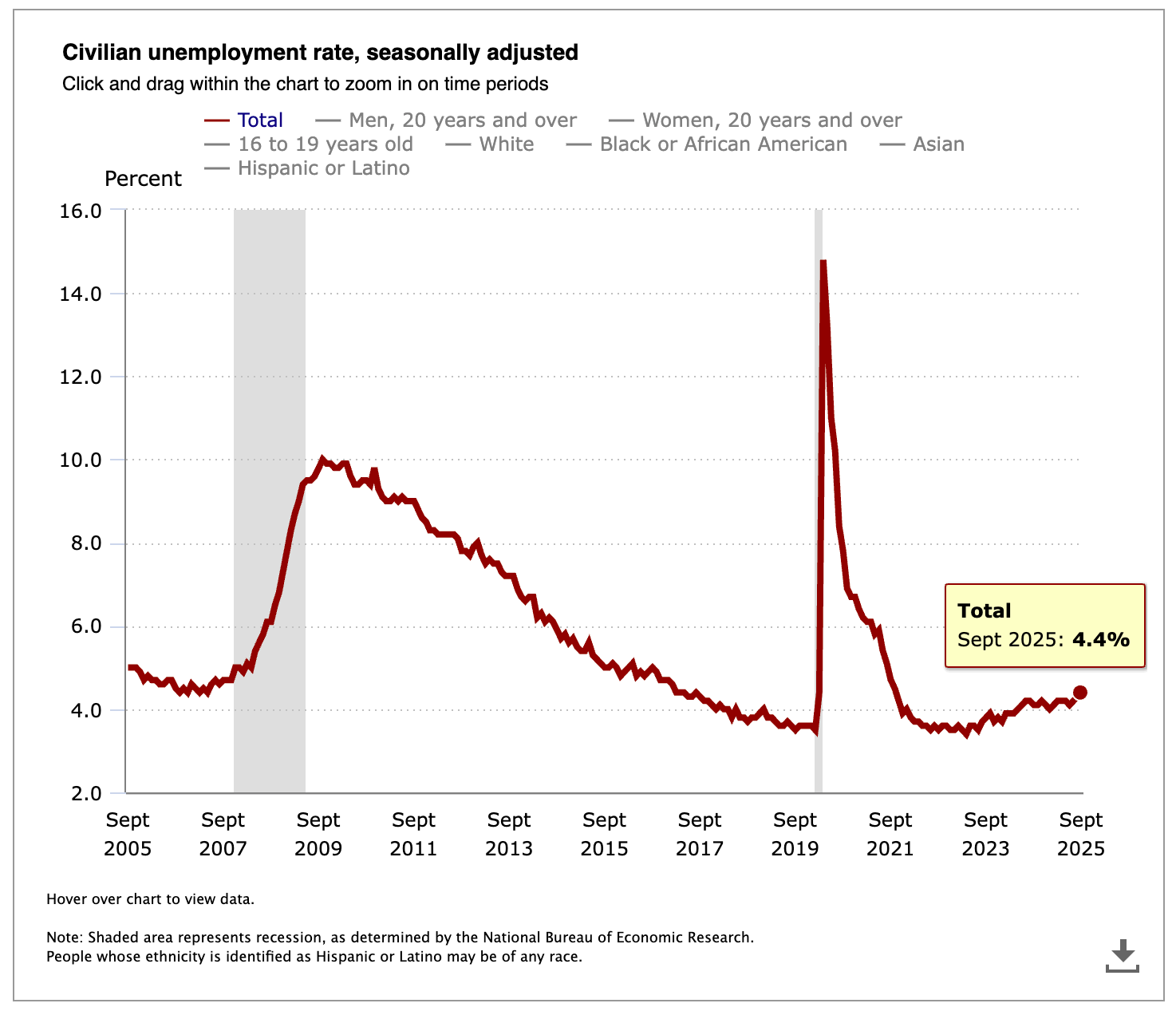

Job growth has slowed sharply

Job creation has cooled. Non‑farm payrolls increased by just 22,000 jobs in August, the smallest gain since April, and the unemployment rate ticked up to 4.4%. Economists say that tariffs, immigration crackdowns, and public‑sector firings were weighing on hiring. The slowdown contrasts with the White House’s upbeat tone about growth and employment.

Voters are feeling the squeeze

A Washington Post–ABC News–Ipsos poll reported by Axios found that 59% of U.S. adults blame Trump for rising prices. Majorities also said they were spending more on groceries and utilities than a year earlier. This sentiment explains why the administration is leaning heavily on affordability messaging.

Analysts question the $20 trillion figure

Economists caution that Trump’s projection is not substantiated by available data. A $20 trillion injection by year-end would require:

- Capital flows are nearly equal to the total annual U.S. GDP

- Rapid operationalization of projects that are still years away

- A historically unprecedented pace of foreign and domestic investment

Several reviews have found that many of the projects the White House highlights predate the Trump administration, reflect long-term commitments, or involve smaller spending than advertised.

Analysts describe the number as “aspirational” rather than evidence-based.

What this means for markets

Market reaction to Trump’s projection has been muted and mixed. While some industrial and reshoring‑linked stocks have seen speculative gains, broad indices have not rallied. Multiple forces are at play:

Equity markets

Stocks with exposure to U.S. manufacturing, industrial reshoring, and domestic energy have seen small, speculative bumps. However, major indices remain flat as investors weigh:

- The feasibility of such large investment flows

- The risk of extended tariffs raising input costs

- Uncertainty around consumer spending as inflation stays high

Traders say the market appears to be treating the $20 trillion claim more as political messaging than actionable economic guidance.

Bonds

Treasury yields initially ticked higher on expectations that such a capital wave could drive inflation or accelerate economic growth. But yields later stabilized as analysts dismissed the figure as unrealistic in the short term.

Currencies

The dollar showed little reaction. Currency desks noted that massive investment inflows would normally strengthen the dollar, but without credible details, the claim did not meaningfully move FX markets.

Options flow

Unusual Whales–tracked flow shows options traders focusing more on inflation-sensitive sectors and tariff-exposed names rather than broad bets on an economic boom.

The market’s general stance: wait and see.

What it means politically

Trump’s projection underscores an effort to reframe the economy as improving ahead of the 2026 election. With cost‑of‑living worries dominating voter concerns, the administration is banking on reshoring announcements, investment pledges, and affordability messaging to shore up support.

However, as polls show more Americans blaming the president for high prices, analysts say the economic narrative may prove difficult to reset unless inflation cools and job growth accelerates.

Bottom Line

As Trump’s messaging turns more optimistic, investors, economists, and voters continue to grapple with whether the U.S. is headed into a genuine investment boom or a period of slower, more uneven growth. For traders, the disconnect between rhetoric and data has created a highly reactive market where options flow and sector rotations can shift quickly.

Sign Up

If you want to track how markets are responding in real time, especially unusual options flow, daily catalysts, and how traders are positioning around policy shifts like these, sign up for a free account at Unusual Whales.

(Editor's note: This story was updated for clarity and content on Nov. 20, 2025)