Trump Says Income Tax Could Be Eliminated — Tariffs Would Replace It, Sending Markets into Unknown Territory

Trump Floats Eliminating Income Tax Entirely

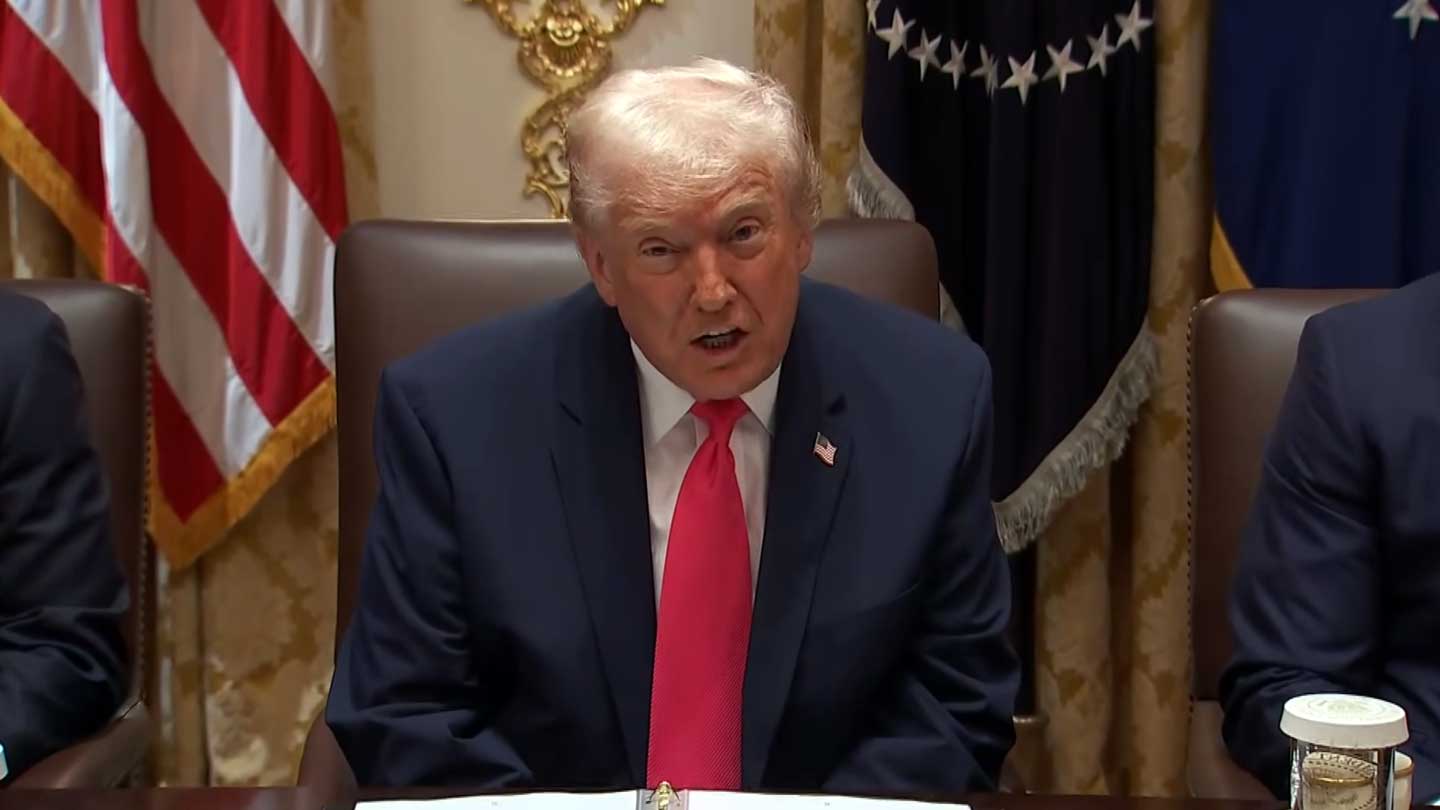

Donald Trump said he is considering a dramatic shift in U.S. fiscal policy: eliminating income tax and paying for the government with tariff revenue.

He told service members during a call that tariffs are bringing in “so much money,” the country might not need income taxes at all.

The comment marks one of the most aggressive suggestions yet from the administration’s trade-funded revenue agenda. And it comes as tariff collections remain historically high during the ongoing reshaping of global supply chains.

Watch President Trump claim tariffs may eventually eliminate income tax:

What This Means for Markets

Removing income tax and replacing it with tariffs would fundamentally reshape consumer spending, government revenue stability, and corporate input costs.

Tariffs are, by design, inflationary. They raise the cost of imported goods. Eliminating income tax could temporarily boost disposable income, but higher consumer prices could absorb that benefit quickly.

This creates a push-pull environment for equities: more cash in consumer pockets versus higher prices across retail, electronics, autos, and discretionary goods.

Expect increased volatility across sectors tied to trade, imports, and domestic manufacturing.

Do you want to see how to make more plays? Do you want to find gains yourself?

Unusual Whales helps you find market opportunities through our market tide, historical options flow, GEX, and much, much more.

Create a free account here to start conquering the market with Unusual Whales.

Options Market Impact

A proposal this extreme will pull options traders into risk-on / risk-off cycles rapidly.

Short-term, expect rising implied volatility as traders price in uncertainty around:

- consumer demand

- inflation expectations

- tariff intensity

- potential retaliatory trade actions

- fiscal policy sustainability

Directional bias will shift quickly depending on whether markets interpret the proposal as stimulative or destabilizing.

Straddles and strangles may become attractive around major tariff or tax announcements.

High-beta names could see heavier flows than usual, especially those with large China or import exposure.

Stocks to Watch Through the Unusual Whales Lens

Here are high-impact tickers to monitor, with Unusual Whales links for options flow and market data:

Domestic Manufacturing & Semiconductors

More tariffs could accelerate “onshore tech manufacturing” narratives, but higher consumer prices could also weigh on downstream device demand.

Cloud & Enterprise Spending

Income-tax cuts could unlock more business spending, while tariff-driven inflation could reduce budgets. Expect whipsaw movement in options chains.

Retail, Apparel, Consumer Electronics

Heavy importers face increased costs if tariffs rise further. Watch for abnormal options flow and higher put activity.

Shipping & Logistics

Tariff regimes often redirect global shipping routes. Volume spikes in these tickers tend to precede broader market shifts.

Structural Impact: A New Fiscal Regime?

Trump’s suggestion signals a potential long-term ideological shift: a tariff-funded government rather than one built on income tax.

Such a pivot would:

- intensify trade-based inflation

- shift the tax burden subtly onto consumers

- create revenue volatility tied to global imports

- introduce higher geopolitical risk into budget planning

For markets, it means a new era of unpredictability.

For options traders, it means opportunity — especially in volatility-driven strategies.

Final Thoughts

Replacing income tax with tariffs would be one of the largest fiscal experiments in modern U.S. history.

Whether politically feasible or economically stable, the mere proposal injects volatility — and traders should be watching sector-specific options activity closely.

The next few months will reveal whether this is rhetoric or a real policy trajectory. Either way, Unusual Whales tools will show which tickers are reacting first.

Ready to track the flow and get ahead of the volatility?

Create a free Unusual Whales account to track options flow, volatility trends, whale trades, and macro shifts:

https://unusualwhales.com/login?ref=blubber