U.S. Seizes Venezuelan Oil Tanker — Risk Signals for Energy and Geopolitics

U.S. Seizes Venezuelan Oil Tanker, Escalating Geopolitical Tension

The United States government has taken control of a Venezuelan oil tanker by enforcing existing sanctions. U.S. officials say the vessel was violating restrictions related to Venezuela’s state oil company and was being used in ways that circumvent international or U.S. policy. The seizure is significant because it directly targets energy infrastructure and supply chains tied to a geopolitical rival.

Given Venezuela’s role as a major crude exporter — and of particular quality barrels sought by certain refiners — this action represents a sharpening of enforcement and a potential escalation in energy-related geopolitics.

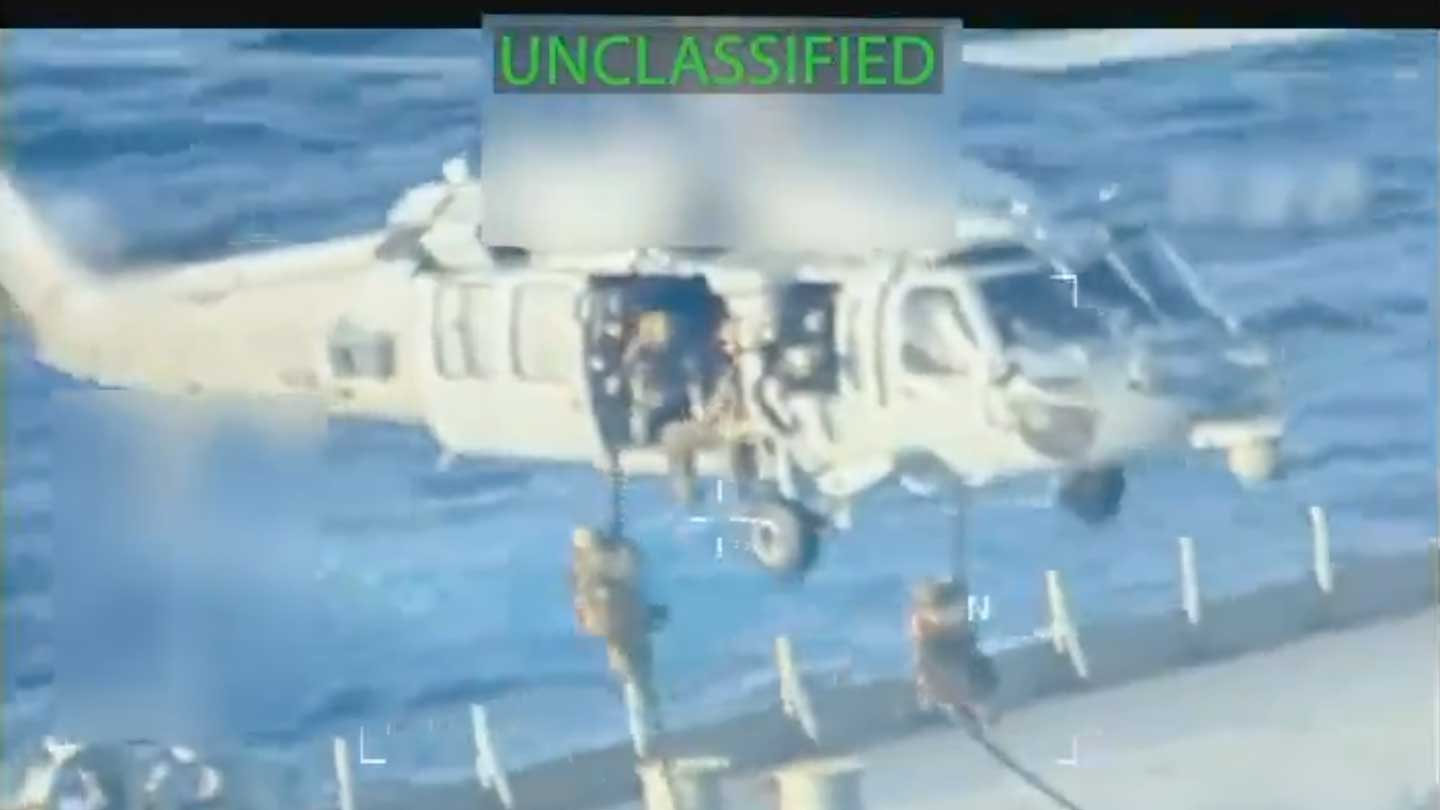

Today, the Federal Bureau of Investigation, Homeland Security Investigations, and the United States Coast Guard, with support from the Department of War, executed a seizure warrant for a crude oil tanker used to transport sanctioned oil from Venezuela and Iran. For multiple… pic.twitter.com/dNr0oAGl5x

— Attorney General Pamela Bondi (@AGPamBondi) December 10, 2025

Why This Matters — Geopolitical Risk Meets Commodity Markets

Energy Supply Risk and Price Sensitivity

Seizing a vessel carrying crude or related products introduces new uncertainty into global oil markets. Even if immediate physical supply disruption is limited, the perception of risk can be enough to drive price spikes or volatility. Traders watch for risk premiums whenever geopolitical tension intersects with commodity flows.

Emerging Markets and Risk Premiums

Actions against Venezuela — itself navigating sanctions, domestic economic stress, and political isolation — could push energy buyers to reconfigure supply chains. That dynamic creates uncertainty in global crude logistics, potentially shifting pricing benchmarks and regional spreads.

Risk Sentiment in Broader Markets

Energy prices influence inflation expectations, transportation costs, and corporate earnings for energy and industrial firms. A sudden uptick in oil price volatility can ripple into equities — especially sectors tied to consumer discretionary spending, travel, logistics, and manufacturing.

What Traders & Risk Managers Should Watch

Energy Equity and Options Flow

Energy stocks — including upstream producers, refiners, and oil-service names — could see increased volatility and directional flow as markets reprice risk. Watch for rising implied volatility, rising put volumes on names sensitive to crude price reversals, or spikes in call interest if traders bet on higher prices.

Commodity Price Action and Hedging Demand

Brent and WTI benchmarks may see reactive moves if markets price geopolitical risk into spreads. Traders often hedge energy exposure using volatility structures or cross-commodity strategies — a sign of shifting risk sentiment.

Correlation Across Markets

Higher energy prices can depress consumer discretionary demand and lift commodities and inflation-expectation plays. Watch for covariance shifts: energy vs consumer staples, energy vs transport equities, and energy vs inflation breakevens.

Macro Risk Appetite and Safe-Haven Flow

Tighter geopolitical conditions often undermine risk appetite: equity markets may see an uptick in protective positions, volatility hedges, and demand for safe assets if uncertainty rises.

What to Monitor on Unusual Whales

- Energy sector tickers — track unusual volatility, skew changes, and shifting flows as traders digest geopolitical developments.

- Volatility indexes and sector spreads — measure risk repricing across energy, industrials, credit, and commodities.

- Hedging signals — rising put activity or unusual hedging in sensitive sectors often precedes broader repricing.

Unusual Whales tools — options flow history, volatility trend analysis, and market-tide indicators — can help detect structural shifts at an early stage.

Sign up for a free Unusual Whales account to start conquering the market.