Congressional Committees and Conflicts in Stock Trading

Introduction

Congressional committees are specialized sub-organizations within Congress that handle, form, and approve new legislation that is deemed to be under that committee’s jurisdiction.

In the previous Congressional trading reports, the trading behaviors of the House and Senate were explored, now it’s time to break down the trading behaviors of the specific committee members. This report will focus on stock trades specifically.

TL;DR

- Hundreds of millions of dollars have been exchanged on the stock market by members of Congress Committee since January 2020

- Certain Committees and members have outperformed the market by a significant margin

- This report shows which sectors were preferred by each committee, party and branch, oftentimes huge trade amounts could be attributed to one or two members.

- Certain individual committee members and even committee chairs and ranking members have made returns in the hundreds of percent on investments in companies that operate within their committees’ jurisdiction

- This report highlights many of these trades and other unusual instances!

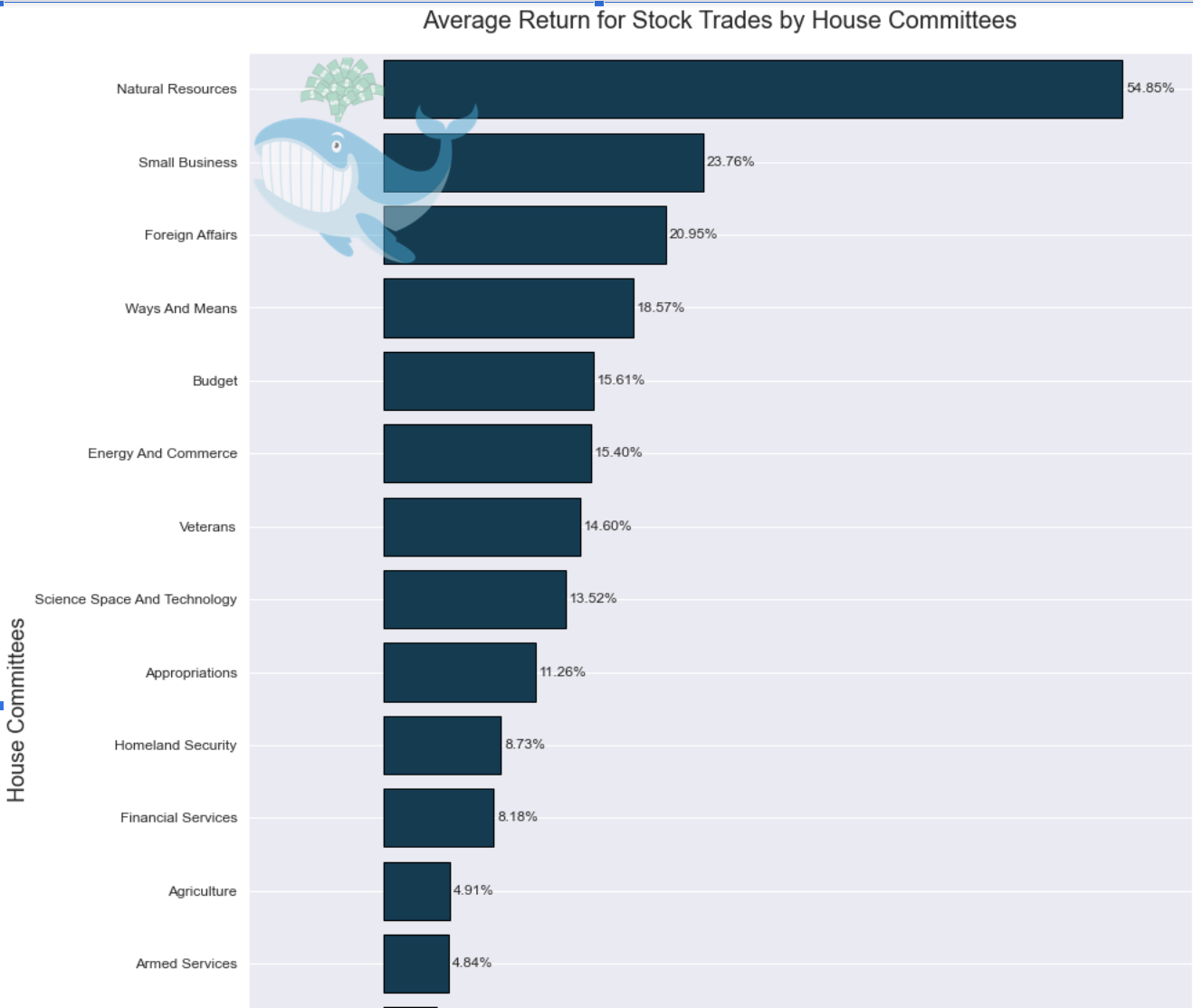

Each committee’s overall return isn’t the complete story. Certain members perform better than others, and each member performs differently in relation to the sector they are trading. Here are the committee’s overall average return on stocks:

This report will look at the sectors different committees have traded in. What’s a conflict of interest? The senate rules (rule 37 paragraph 7) state that “an employee on the staff of a committee employed for more than ninety days in a calendar year shall divest himself of any substantial holdings which may be directly affected by the actions of the committee for which he works.” A committee member, who has knowledge of, and a say in, upcoming legislation and industry knowledge within their jurisdiction may be considered to be trading with a conflict of interest.

Data and Methods

- The data is limited to congress investment disclosures from January 2020 to August 26, 2022

- The results only include members of Committees in the 117th Congress, its term starting in January 2021

- To approximate returns, the following assumptions were made:

- For any stock sale the closest previous purchase disclosed was used to calculate percent change in closing price

- For any stock purchase disclosed that did not have a corresponding sale disclosed, the closing price on August 26, 2022 was used to calculate the percent change.

- Data Limitations:

- This report is limited to stock transactions, not including options and other securities.

- It doesn’t account for longer held assets bought before January 2020 or before the member took office, since we are taking the most recent buy or sell dates, therefore these calculations are conservative estimates and can’t accurately paint a picture of each member’s full financial portfolio

Results

Here’s how Committee Members have performed since 2020 across the different sectors:

Committee members made a number of trades across sectors. To start, let's look at the number of stock transactions they made.

Some of these returns do raise interest in terms of jurisdiction and sector overlap, specifically, the House Natural Resources Committee averaging about 230% on 19 separate stock buy disclosures. The Senate Energy and Natural Resources committee’s returns in the Electronic Technology, Energy Minerals, Producer Manufacturing and Process Industries sectors, are also interesting, especially in relation to the congressional semiconductor report.

Alan Lowenthal - member of the Natural Resources House Committee - has disclosed sixteen different investments, fifteen made by his spouse, and one disclosed jointly, in the company Sunrun. Sunrun is a provider of photovoltaic solar energy generation systems and battery energy storage products. Averaging 261% across the sixteen investments. He is the chair of the Energy and Mineral Resources (EMR) Sub-committee . The jurisdiction of the EMR includes the “planning for and development of energy from solar and wind resources on land belonging to the United States, including the outer Continental Shelf.” (Source)

Similarly, Debbie Wasserman Schultz - another member of the House Natural Resources Committee as well as the House Oversight Committee - has disclosed investments in Patterson-UTI Energy, which provides land drilling and pressure pumping services, directional drilling, rental equipment and technology to clients in the United States and western Canada. Her investments in Patterson yielded a 57% return.

Bill Hagerty, has only disclosed stock buys on 3 separate occasions, since joining the senate, he mostly invests in other securities not tracked in this report.

Senator Jerry Moran, disclosed purchasing Halliburton Company, on March 10, 2020, and is as of the time of this report, up over 276%. Moran is a member of the Appropriations Committee, Banking, Housing, and Urban Affairs Committee, Commerce, Science, and Transportation Committee, and Health, Education, Labor, and Pensions Committee.

Senator Shelley Capito - member of the Senate Appropriations and Commerce, Science, and Transportation Committees - has bought Microsoft on four different occasions, averaging 73.6% returns.

Senator Bill Casidy - a member of the Energy and Natural Resources, is up 58% since March 9th, 2020 in an investment his spouse made in Phillips 66, an energy manufacturing and logistics company, you may recognize from its many gas stations. .

Don Beyer - a member of the Ways and Means and the Science Space and Technology Committees - has the highest return from a single trade of all of congress, from his investments in Daifuku, a Specialty Industrial Machinery company. He has disclosed multiple investments in Daifuku, here is a graph of his impeccable timing.

Conclusion

As Congress Committees write and introduce new legislation that is supposed to improve the circumstances, practices, and address concerns within specific industries and jurisdiction, this report shows that some members have personal incentives when writing these bills and are profiting with advanced knowledge of legislation affecting industries and companies within their jurisdiction. These trades at the very least provoke doubt and concern over possible conflicts of interest and raise questions as to whether or not legislation is being written with the best interest of American citizens in mind. Unacceptable.

The state of trading by committee members serves as a clear message as to why our elected officials should be banned from trading stocks. Unfortunately, legislators have yet to take the steps necessary to make a change.

Join the discussion on our Discord or on Twitter @unusual_whales or read more of our congressional stock trading coverage at /i_am_the_senate. And as always, follow the flow!