Unusual Options Activity in Academy Sports and Outdoors, Inc. (ASO), Futu Holdings Limited (FUTU), and Lumen Technologies, Inc. (LUMN)

Unusual Options Activity in Academy Sports and Outdoors, Inc. (ASO)

Today, December 10, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today inn Academy Sports and Outdoors, Inc., which opened at $46.09.

- There were 3,500 and 5,000 contracts rolled out on the $43.5 strike and $45 strike call options, respectively expiring today.

- These contracts were rolled into 5,000 and 2,500 contracts on the $44.5 strike calls, traded at a spot price of $1.12 and $1.13, with a bid-ask spread of $1.05 - $1.50.

- As these orders are uneven, it can be interpreted these contracts were traded as part of a greater strategy.

These orders come after Academy Sports and Outdoors, Inc. reported a record third quarter 2021 results.

Yesterday, there was 1,408 volume on this chain, and with open today 1,299 contracts remained. Additionally, per the above orders, there will be more volume into today and Monday the open interest be looked into again.

To view more information about ASO's daily flow breakdown, click here to visit unusualwhales.com.

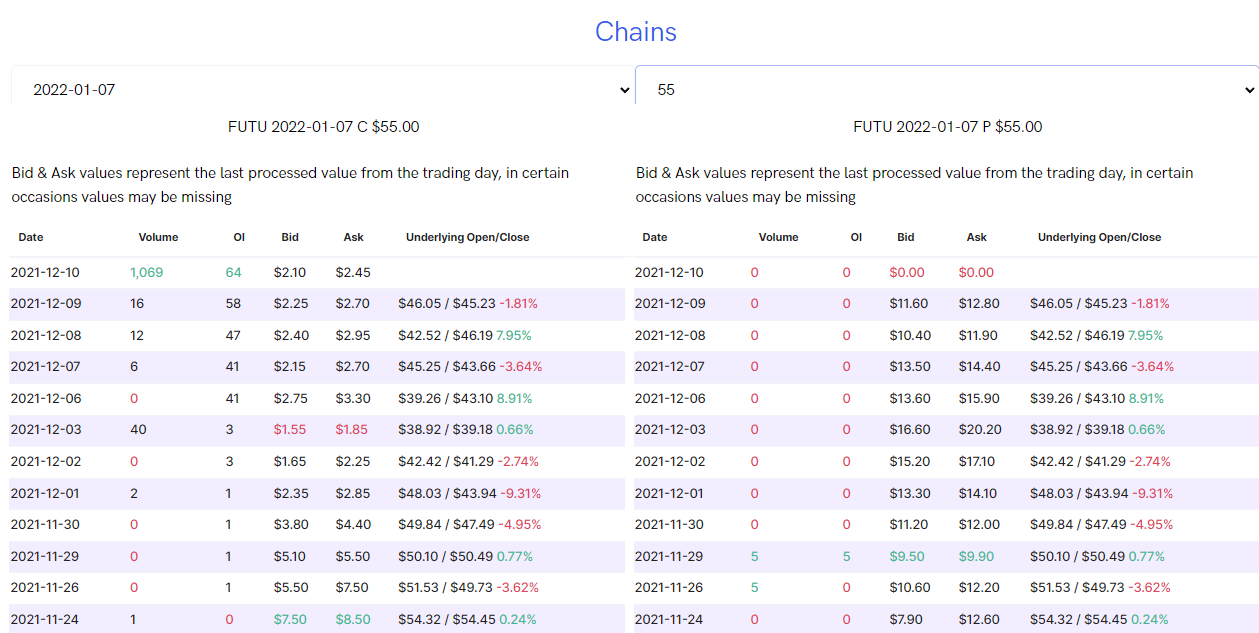

Unusual Options Activity in Futu Holdings Limited (FUTU)

In the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Futu Holdings Limited (FUTU), which opened today at $45.68.

- There were 1,000 contracts traded on both the $55 strike and $60 strike calls for January 7th, 2021.

- Of note, all of these orders were opened at the ask, yet the bid-ask on $55 strike calls were wide, $1.85 - $2.55 at time of first order.

- Additionally, these orders came in at 09:34 EST, when $FUTU was trading at around $46.22. As of this writing, approximately 10:45 EST, $FUTU is now trading at $44.36 after a large gap down.

These orders come after Futu Holdings Limited news revealed $DIDI will be delisting in the U.S.

55% of the premium traded at these premium levels are in bullish bets, with 96.4% as ask-side orders, and 51.4% are in call premiums.

To view more information about FUTU's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Lumen Technologies, Inc. (LUMN)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Lumen Technologies, Inc. (LUMN), which opened at $12.18.

- There were 8,000 contracts traded on the $12 strike put option, at the ask, dated for February 18th, 2021.

- Significantly, these orders were cross trades, where a broker executed the trades by matching buy and sell orders for the same security across different clients’ accounts and reported them on an exchange.

- Therefore, it cannot be adequately ascertained what specific directional position, if any, these traders were taking by entering into these contracts.

These orders come after Neha Gupta of TipRanks reported “on additional risk factors they observed within Lumen Technologies, Inc..

96.8% of the premium traded at these premium levels are in bearish bets, with 98% as ask-side orders, and 98.8% are in put premiums.

To view more information about LUMN's flow breakdown, click here to visit unusualwhales.com.

Give the Gift of Flow this Holiday Season!

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.