Unusual Options Activity in Aflac Incorporated (AFL), Snap Inc. (SNAP), and Rivian Automotive, Inc. (RIVN)

Unusual Options Activity in Aflac Incorporated (AFL)

Today, November 22, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Aflac Incorporated, which opened at $55.76.

- There were 17,600 contracts traded on the $45 strike put option, bought to open at the ask, dated for February 18th, 2022.

- Additionally, there were another 17,600 contracts traded on the $60 strike call options, sold at the bid, and for the same date.

- These contracts altogether represent a synthetic short, approximately 3,520,000 shares and $1,992,000 in premium traded.

These orders come after Kody Kester of The Motley Fool established that:

“Aflac reported third-quarter revenue for the three months ended Sept. 30 of $5.24 billion, which was a 7.6% year-over-year decline in revenue compared to the year-ago period. This was 2.2% short of analysts' consensus revenue estimate of $5.36 billion..”

As of this writing, Aflac Incorporated has had 18,949 puts traded, which is roughly over 3,158% greater than its 30-day call average.

To view more information about AFL's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Snap Inc. (SNAP)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Snap Inc. (SNAP), which opened today at $51.52.

- There were 31,452 contracts traded on the $44 strike put option, dated for December 3rd, 2021, sold at the bid.

- These contracts represent approximately 3,145,200 shares and $755,000 in premium traded.

These orders came after Nikolaos Sismanis of TipRanksInvest opined that Snap Inc.:

The disappointing part was management's guidance, which pointed towards revenue growth between 28% to 32% year-over-year to $1.165-$1.205 billion. This pace implies a considerable deceleration for the company, and it is certainly frustrating since it implies profitability will not scale as fast as previously expected..

76.9% of the premium traded at these premium levels are in bullish bets, with 67.4% as bid-side orders, and 78.5% are in put premiums.

To view more information about SNAP's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Rivian Automotive, Inc. (RIVN)

Finally, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Rivian Automotive, Inc. (RIVN), which opened at $123.88.

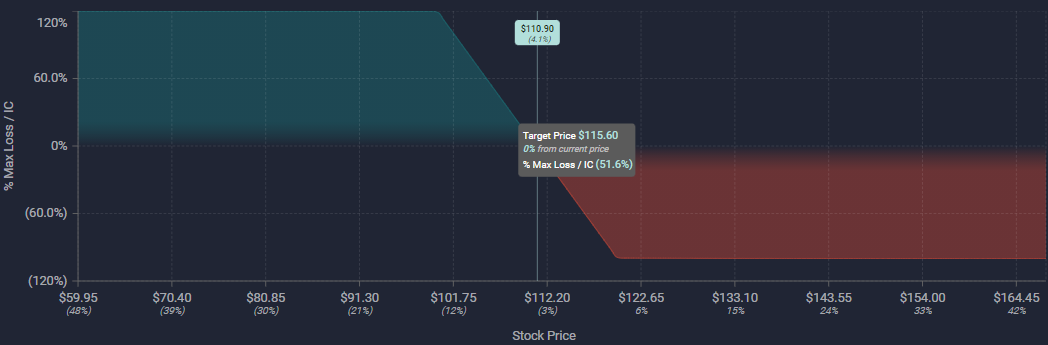

- There were 995 contracts traded on the $100 strike call option, sold to open at the bid, dated for December 3rd, 2021.

- Additionally, there were another 995 contracts traded on the $120 strike call option, bought to open at the ask, and for the same date.

- These contracts altogether represent a call credit spread, approximately 199,000 shares and $3,700,000 in premium traded.

These orders came after Daniel Foelber and Howard Smith of The Motley Fool opined that Rivian Automotive, Inc. “won't grow into its current valuation with Amazon as its only customer.”

To view more information about RIVN's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.