Unusual Options Activity in AGNC Investment Corp. (AGNC), Blackstone Inc. (BX), and Apple Inc. (AAPL)

Unusual Options Activity in AGNC Investment Corp. (AGNC)

Today, January 11, 2022, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in AGNC Investment, which opened at $15.32.

- There were approximately 10,000 in volume on the $15 strike put option contract, bought to open at the ask, dated for February 18th, 2022.

- These contracts come just ahead of AGNC Investment paying out its dividends on February 9th, 2022.

These orders come after Rich Duprey of The Motley Fool explained:

Why AGNC Investment Ended Up Losing All Its Gains in 2021

The February 18th, 2022 $15 strike put option is the most traded chain thus far today, with now over 10,300 volume.

Of note, the floor trades that came about were after significant volume from otherwise unspecified traders.

Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

On the Unusual Whales blog is a report on floor traders' performance. Here is a snippet:

More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.

To view more information about AGNC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Blackstone Inc. (BX)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Blackstone Inc. (BX), which opened today at $115.77.

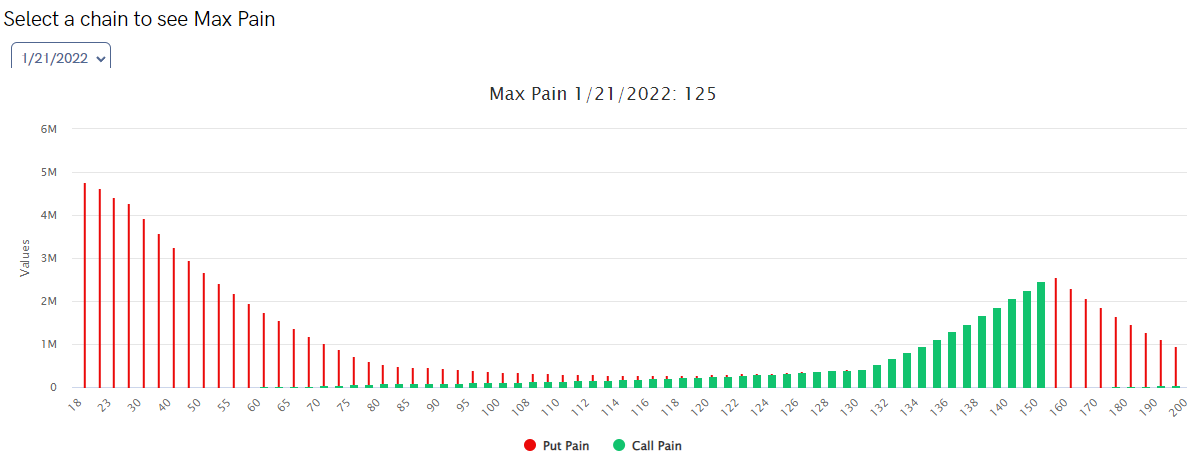

- There were 2,522 contracts traded on the $108 strike put option, dated for January 21st, 2022.

- These trades were detected using the new Unusual Whales Hottest Chains & Tickers panel, seen here.

These orders come after Krystal Hu of Reuters reported that Pentera, a startup who has just raised over $150M in startup funding, has had its “automated penetration testing technology has been used by over 400 enterprise customers globally, including Blackstone Inc BX.N, according to the company.”

52.6% of the premium traded at these premium levels are in bullish bets, with 62.1% as ask-side orders, and 50% are in call premiums.

To view more information about BX's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Apple Inc. (AAPL)

Finally, and again in the NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Apple Inc. (AAPL), which opened today at $172.32.

There were a series of trades across a variety of chains, all whose order sizes were greater than the chain’s open interest, implying they were all bought or sold to open, not closed:

- 9,506 $172.5 strike put options, dated for February 11th, 2022, bought to open at the ask.

- 5,495 $170 strike put options, dated for February 4th, 2022, sold to open at the bid.

- 3,110 $172.5 strike call options, dated for January 28th, 2022, bought to open at the ask.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest. Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase). Be mindful! Trades without the briefcase emoji might still have been bought or sold to open!

- Additionally, there were 3,177 contracts traded on the $175 strike call option, dated for January 14th, 2022, traded at the ask, which would be considered out of the money, weekly expiration contracts, hence why these are noteworthy after recent uncertainty surrounding tech stocks.

- However, these orders were not greater than the open interest on the chain, so it cannot be ascertained whether they were closed or otherwise.

56.28% of the premium traded at the $30,000 levels are in bullish bets, with a great majority of betting being in call premiums. Furthermore, the $5,000 premium levels are in bullish premiums at 53.46%, with over $42,900,000 in premium traded.

To view more information about AAPL's flow breakdown, click here to visit unusualwhales.com.

Have you read the the Unusual Whales Congressional Trading in 2021 Report yet?

Here is the TL;DR:

- Hundreds of millions of dollars have been exchanged on the stock market by our elected officials in 2021 alone

- In just equities, Congress bought and sold nearly $290 million throughout the year.

- In 2021, Congress beat the market!

- This report shows which sectors were preferred by each party and branch, oftentimes huge trade amounts could be attributed to one or two members.

- Big legislative events (such as the Infrastructure Bill getting passed by the Senate) were often preceded by politicians trading in the sectors affected. There were tons of unusual trades where politicians made millions of dollars.

- Congress has 45 days to disclose trades to the public, sometimes they are late and you can see a list of late disclosures here!

- Some politicians held securities in the sectors they vocally expressed support for (such as Senators holding cryptocurrencies while drafting crypto regulations).

- The report highlights many of these and other unusual instances!

Go check out the full report here, and you are encouraged to read through and share your thoughts on Twitter and the Discord community.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.