Unusual Options Activity in Airbnb, Inc. (ABNB), Luminar Technologies, Inc. (LAZR), and Hanesbrands Inc. (HBI)

Unusual Options Activity in Airbnb, Inc. (ABNB)

Today, December 01, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Airbnb, Inc., which opened at $174.01.

There were 1,688 contracts traded on the $170 strike put option dated for December 3rd, 2021, bought to open above the ask.

These orders come after Keith Noonan from The Motley Fool reported Airbnb, Inc.

“posted revenue growth of roughly 67% year over year in Q3, and sales were 36% higher than in the pre-pandemic Q3 of 2019. Despite some ongoing pandemic-related headwinds, Airbnb posted best-ever revenue for a quarter. Net income also surged 280% year over year to reach a record $834 million, and it seems clear that the business has a long runway for continued sales and earnings expansion.”

73.2% of the premium traded at these premium levels are in bullish bets, with 92.4% as ask-side orders, and 71.6% are in call premiums.

To view more information about ABNB's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Luminar Technologies, Inc. (LAZR)

Again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Luminar Technologies, Inc. (LAZR), which opened today at $16.50.

- There were 9,346 contracts traded on the $16 strike put option contract, dated for December 10th, 2021, bought to open at the ask.

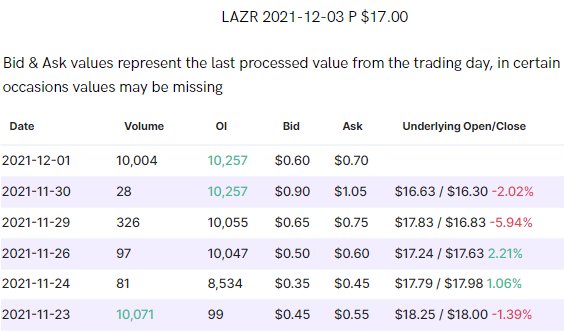

- Additionally, there were the same set of 9,346 contracts, but on the $17 strike put option, sold to close for December 3rd, 2021.

- Therefore, it may be intuited that this entity rolled down the strike of their position, from $17 to $16, as the volume nearly matched the open interest on the $17 put strike chain, and the volume of approximately 10,000 is above the open interest of 1,100 on the $16 strike put chain.

These orders come after the Trefis Team investigated if Luminar Technologies, Inc.:

"So, is LAZR stock likely to rise further in the coming weeks and months or is a correction looking more likely? Per the Trefis machine learning engine which analyzes historical stock price movements, LAZR stock only has a 37% chance of a rise over the next month (21 trading days).”

As can be seen, on November 23rd, 2021, the aforementioned position was opened, at an approximate ask of $0.55. Today, that position was closed for the bid, which was approximately $0.55 to $0.60, as well.

To view more information about LAZR's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Hanesbrands Inc. (HBI)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Hanesbrands Inc. (HBI), which opened at $16.51.

- There were 2,852 contracts traded on the $16 strike call option, at the ask, dated for January 21st, 2022.

- Additionally, there were another 2,852 contracts traded on the $17 strike call option, also at the ask, dated for December 17th, 2021.

- It is a consideration to be made that the $17 strike call positions were sold closer to the ask, and that this these options are a part of a diagonal spread.

These orders come after BNK Invest reported: “A bullish investor could look at HBI's 29.2 RSI reading today as a sign that the recent heavy selling is in the process of exhausting itself, and begin to look for entry point opportunities on the buy side.”

As of this writing, Hanesbrands Inc. has had 57,724 calls traded, which is 2,220% greater than its 30-day call average.

To view more information about HBI's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.