Unusual Options Activity in American International Group, Inc. (AIG), Laboratory Corporation of America Holdings (LH), and Krystal Biotech, Inc. (KRYS)

Unusual Options Activity in American International Group, Inc. (AIG)

Today, October 28, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in American International Group, Inc., which opened at $58.82.

There were 15,000 contracts traded on the $60 strike call option, sold to close at the bid, dated for October 29th, 2021.

Additionally, there were 7,500 contracts traded on the $60 strike call option, bought to open at the ask, dated for November 5th, 2021.

Finally, there were another 7,500 contracts traded on the $64 strike call option, sold to open at the bid, for the same date.

Altogether, these contracts represent approximately 1,500,000 shares and $1,230,000 in premium traded.

Note well, American International Group, Inc. reports its earnings after the closing bell on November 4th, 2021.

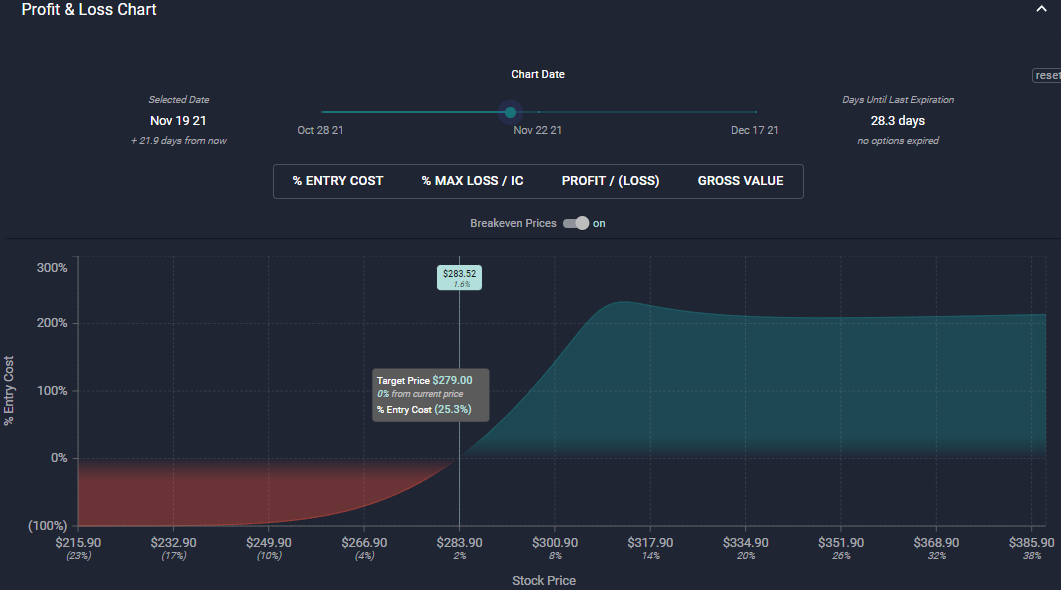

Visualized above is the current standing strategy’s profit and loss chart at its new expiration of November 5th, 2021. As the open interest on the October 29th, 2021 $60 strike call option contracts was 16,500 as of this morning’s open, it is safe to intuit that these trades were rolled into the November 5th, 2021 expiration, but split into a call debit spread with the $60 strike call options bought to open and the $64 strike call option sold to open.

To view more information about AIG's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Laboratory Corporation of America Holdings (LH)

Again, in the NYSE, we saw unusual or noteworthy options trading volume and activity today in Laboratory Corporation of America Holdings (LH), which opened at $286.14.

There were 2,023 contracts traded on the $290 strike call option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were another 2,000 contracts traded on the $310 strike call option, sold at the bid, and for November 19th, 2021.

Altogether, these contracts represent a diagonal calendar spread, approximately 402,300 shares, and $1,740,000 in premium traded.

These orders come in after RTTNews reported on Laboratory Corporation of America Holdings’s earnings report:

“For the year, adjusted earnings per share is now expected to be between $26 and $28, higher than previous view of $21.50 to $25, and up from last year's $23.94.”

As of this writing, LH has had 5,116 call volume, which is approximately 863% above its 30-day mean.

To view more information about LH's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Krystal Biotech, Inc. (KRYS)

Finally, in the Nasdaq Global Market Composite (NasdaqGM), we saw unusual or noteworthy options trading volume and activity in Krystal Biotech, Inc. (KRYS), which opened at $53.35.

There were 2,500 contracts traded on the $50 strike put option, bought to open at the ask, dated for December 17th, 2021.

Additionally, there were another 2,500 contracts traded on the $25 strike call option, sold to open at the bid, and for the same date.

Altogether, these contracts represent a put debit spread, approximately 500,000 shares, and $5,305,000 in premium traded.

These orders come after Krystal Biotech, Inc. (KRYS) announced that the last participant has completed the 26-week dosing period and 30-day safety follow up visit in the GEM-3 study.

As of this writing, KRYS has had 5,191 put volume, which is approximately 998% above its 30-day mean.

To view more information about KRYS's flow breakdown, click here to visit unusualwhales.com.