Unusual Options Activity in Annaly Capital Management, Inc. (NLY), Bilibili Inc. (BILI), and Congressional Trading in War Stocks

Annaly Capital Management, Inc. (NLY) opened at $7.18 had contracts traded on the $7 strike put option contract for April 14th, 2022. Bilibili Inc. (BILI) opened at $22.01 had repeated orders on the $15 strike put options dated for Dec 16th and July 15th, 2022. Read the Unusual Whales War Report!

Unusual Options Activity in Annaly Capital Management, Inc. (NLY)

Today, March 11, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Annaly Capital Management, Inc. (NLY), which opened at $7.18.

- There were a series of contracts traded on the $7 strike put option contract for April 14th, 2022, bought to open at or near the ask with a bid-ask spread of $0.25 to $0.39 thus far today.

- The volume on this chain thus far has been 10,293 contracts traded and the open interest was approximately 3K as of this morning’s open. Therefore, we may intuit these contracts are being either bought or sold to open, not being closed.

- Additionally, these orders come after the Motley Fool reported that Annaly Capital’s CEO David Finkelstein stated on the fourth-quarter earnings call: "We have substantial liquidity with $9.3 billion of unencumbered assets, up $500 million year over year."

A tip from the flow: When viewing alerts in the Unusual Whales flow, you can click the order’s option contract expiration to open another panel which has three additional charts and a table to take a deeper dive into the company’s overall intraday options volumes, the chain’s bid-ask pressures, and historical volumes and open interests.

As noted, we may intuit these contracts are being either bought or sold to open due to the volume being greater than the chain’s open interest--not contracts being closed.

To view more information about NLY's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Bilibili Inc. (BILI)

In the NasdaqGS, there was unusual or noteworthy options trading activity in Bilibili Inc. (BILI), which opened today at $22.01.

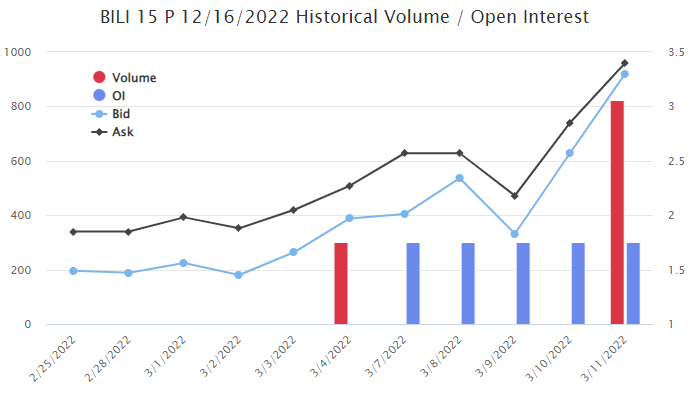

- There were a series of repeated orders on the $15 strike put options dated for December 16th and July 15th, 2022. The majority of these orders were traded at their asks on their respective chains.

- These orders come after continued speculation surrounding Chinese stock delistings from U.S. markets.

A tip from the flow: When viewing alerts in the Unusual Whales flow alerts page, you can click “Link to flow” to view chain’s activity in the overall options order flow, as seen here:

A tip from the flow: The ! emoji means the volume of the chain is greater than the open interest on the chain itself.

There was 300 volume on this chain on the 4th, which has been maintained until today, in which more volume on the chain came in at the amount of 823 contracts traded, surpassing the 300 open interest, implying some of these orders are to open.

However, be mindful, 300 of these could indeed be positions being closed from the original set from the 4th. Open interest is not in and of itself an indication for an entry or an exit, only a number of contracts being held open into the day from previous days.

To view more information about BILI's flow breakdown, click here to visit unusualwhales.com.

Have you read the Unusual Whales War Report?

In this report, we uncover how Members of Congress have invested in stocks that are now benefiting from Russia's war on Ukraine.

Just two of the findings in this report:

- House Democrat Alan Lowenthal, who sits on the House Committee for Natural Resources and chairs its Subcommittee on Energy and Mineral Resources, has been buying and selling Sunrun Inc. stocks ($RUN), an American provider of residential solar panels and home batteries, for a looong time now. His most recent $RUN purchase was on January 14, 2022.

- House Republican Andrew Garbarino is the one that bought Tellurian Inc. stocks ($TELL), which saw a 57% increase since Russia invaded Ukraine. He actually bought $TELL twice, the first buy on October 4, 2021, and again on January 14, 2022. Rep. Garbarino sits on the House Committee on Homeland Security and its Cybersecurity, Infrastructure Protection, and Innovation subcommittee as Ranking Member and its Emergency Preparedness, Response, and Recovery subcommittee.

You can check out all of these trades and more in the table in the report.

As Congress expresses its disapproval of war and support for Ukraine, it might be good to also divest from war stocks during this time.

There will be continued reporting on unusual trades by Congress and perceived conflicts of interest at www.unusualwhales.com.

Please make sure to visit and read the full report.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.