Unusual Options Activity in Atlassian Corporation Plc (TEAM), Energy Transfer LP (ET), and Alibaba Group Holding Limited (BABA)

Unusual Options Activity in Atlassian Corporation Plc (TEAM)

Today, December 03, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Atlassian Corporation Plc, which opened at $368.95.

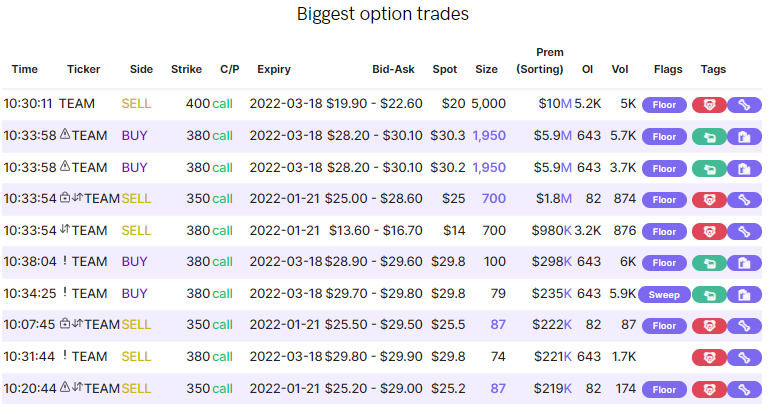

There were over 4,000 contracts traded on the $380 strike call option dated for March 18th, 2022 bought to open at the ask, representing over $12,102,000 in premium traded.

As seen, there also have been 5,000 contracts sold on the $400 strike call option, dated for March 18th, 2022.

Therefore, it might be considered that these orders were a part of a kind of spread, such as call debit spread or ratio spread, which we have previously reported on in greater detail.

These orders come after Anthony Di Pizio of The Motley Fool reported:

Electric vehicle powerhouse Tesla (NASDAQ: TSLA) has crushed the S&P 500 this year, and so has software-tools developer Atlassian (NASDAQ: TEAM). Here's why they could do it again in 2022.

To view more information about TEAM's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Energy Transfer LP (ET)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Energy Transfer LP (ET), which opened today at $8.35.

There were 1,000 contracts traded on the $7 strike call option, dated for January 20th, 2023, bought to open above the ask.

These orders come after Nikolaos Sismanis at TipRanks reported:

Still, the company's operations have recovered notably, with distributable cash flows currently covering the 7% yield quite well. Further, capital returns are likely to grow notably going forward.

81.6% of the premium traded at these premium levels are in bullish bets, with 81.8% as ask-side orders, and 89.9% are in call premiums.

To view more information about ET's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Alibaba Group Holding Limited (BABA)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Alibaba Group Holding Limited (BABA), which opened at $118.

There have been continuous trends of sold calls and purchased puts this morning in Alibaba Group Holding Limited, such as the short $110, $115, and $120 strike call options, dated for December 3rd and 10th, 2021, and March 18th, 2022, seen below.

There has been considerable action with regards to stocks in China. For instance, we reported unusual options activity in DiDi Global Inc. (DIDI), after it announced it has begun preparations to delist in the U.S. and will start work on a Hong Kong share sale, the company announced on its Weibo account.

As of this writing, Alibaba Group Holding Limited has had 265,848 puts traded, which is 2,689% greater than its 30-day put average.

To view more information about BABA's flow breakdown, click here to visit unusualwhales.com.