Unusual Options Activity in Avis Budget Group, Inc. (CAR), ProShares Bitcoin Strategy ETF (BITO), and McDonald's Corporation (MCD)

Unusual Options Activity in Avis Budget Group, Inc. (CAR)

Today, October 22, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Avis Budget Group, Inc. , which opened at $167.19.

There were 1,000 contracts traded on the $160 strike put option, at the ask, dated for November 19th, 2021.

Additionally, there were another 1,000 contracts traded on the $140 strike put option, at the bid, for the same date.

Altogether, these contracts represent a put debit spread and approximately 200,000 shares and $1,325,000 premium traded.

These orders come after BNK Invest’s reports revealing noteworthy options activity in May 2022.

As seen, bearish premium still accounts for 90.3% of the options chains and the November 19th, 2021 expirations being the most popular at these premium levels.

To view more information about CAR's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in ProShares Bitcoin Strategy ETF (BITO)

Again, in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in ProShares Bitcoin Strategy ETF (BITO), which opened at $41.26.

There were 3,500 contracts traded at the ask on the $45 strike call option, at the ask, dated for December 17th, 2021.

Additionally, there were another 3,500 contracts traded on the $44 strike call option, also at the ask, for the same date.

Altogether, these orders represent approximately 700,000 shares and $1,700,000 premium traded.

These orders come in after reports from Ivan Castano, revealing that: “This is already one of the three largest ETFs of all time,” 3iQ Digital Assets’ President Chris Matta said as BITO hit $600 million in trading volumes. “There is lots of demand.”.

Of these premiums, 82% of the contracts traded have been in bullish premium, with 83.6% being in ask-side orders, and 96.4% being in call premium.

To view more information about BITO's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in McDonald's Corporation (MCD)

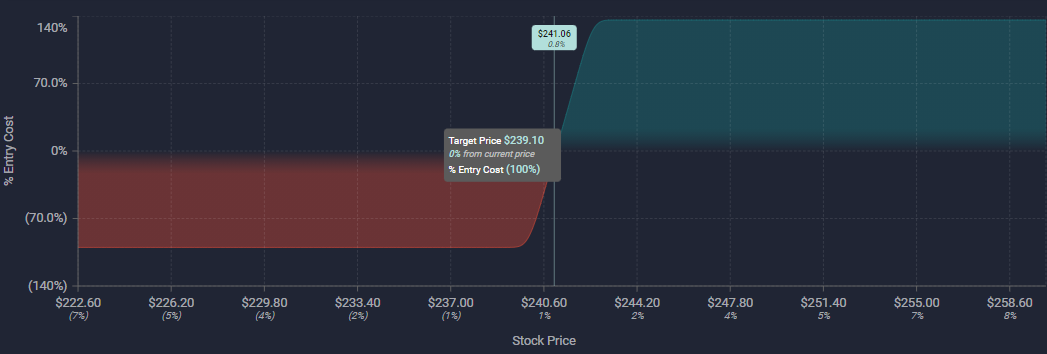

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in McDonald's Corporation (MCD), which opened at $240.71.

There were 1,750 contracts traded on the $240 strike call option, at the ask, dated for October 29th, 2021.

Additionally, there were another 1,750 contracts traded on the $242.5 strike call option, at the bid, for the same date.

Altogether, these orders represent a call debit spread and approximately 350,000 shares and $866,000 premium traded.

These orders come after reports by The Motley Fool’s James Brumly, who opined that McDonald's Corporation is rated by Interbrand as:

“the ninth-most valuable brand of 2020, jibing with other, similar rankings that peg its golden arches as one of the world's most recognizable logos. That's huge for a restaurant chain in constant competition with other chains”.

As seen, this is a bullish strategy with a limited upside, due to the selling of the $242.5 strike call contracts.

To view more information about MCD's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.