Unusual Options Activity in Baidu, Inc. (BIDU), Dell Technologies Inc. (DELL), and Luminar Technologies, Inc. (LAZR)

Unusual Options Activity in Baidu, Inc. (BIDU)

Today, November 16, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Baidu, Inc., which opened at $171.91.

There were 2,000 contracts that were ordered and then cancelled, which is a perfectly nominal occurrence.

The orders were processed again as such:

- 2,000 contracts traded on the $192.5 strike call option, bought to open at the ask, dated for December 3rd, 2021.

These contracts represent approximately 200,000 shares and $364,000 in premium traded.

These orders come after Baidu, Inc. reported its Q3 earnings.

Trades that are struck through have been cancelled for one reason or another.

Trades can be modified or nullified for a variety of reasons, and per the SEC:

for the maintenance of a fair and orderly market.

Exchanges can erroneously send more trades than were actually placed, especially during times of high volume.

This is a normal occurrence.

66.1% of the premium traded at these premium levels are in bullish bets, with 71.3% as ask-side orders, and 94.7% are in call premiums.

The primary bullish strike traded is the $192.5 strike option chain; however, the most premium traded is on the $170 strike, in which bearish trades are ahead as compared to bullish, with approximately $1,012,161 bearish to $868,020 bullish premium traded.

To view more information about BIDU's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Dell Technologies Inc. (DELL)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Dell Technologies Inc. (DELL), which opened today at $56.75.

There were 4,000 contracts traded on the $57.5 strike call option, dated for November 19th, 2021, bought at the ask.

Additionally, there were another 4,000 contracts traded on the $60 strike call option dated for December 17th, 2021, sold at the bid; however, the volume on these contracts was not greater than their open interest, so it cannot be ascertained whether these were opened or closed today.

These contracts represent approximately 800,000 shares and $636,000 in premium traded.

These orders come prior to Dell Technologies Inc. reports its earnings on November 23rd, 2021 after the market closes.

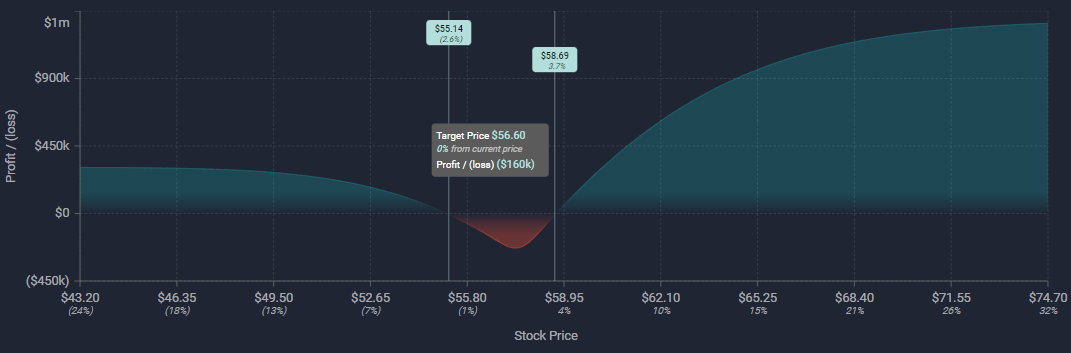

It cannot be ascertained if the short side calls on the $60 strike were in fact sold to open, but if they were, this is how the strategy would be visualized prior to the short side expiration, on November 18th, 2021.

To view more information about DELL's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Luminar Technologies, Inc. (LAZR)

Finally, and in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Luminar Technologies, Inc. (LAZR), which opened at $21.48.

There were two separate orders of 2,500 on each leg traded on the:

- $18 strike put option, bought to open at the ask, dated for November 26th, 2021.

- $20 strike put option, sold to open at the bid, for the same date.

These orders, if they were indeed traded as part of a strategy, represent a put debit spread, approximately 1,000,000 shares and $609,000 in premium traded.

It is worth noting that additional orders could have been traded as a part of a greater strategy in addition to the two legs reported above.

Furthermore, these orders come after Luminar Technologies, Inc. positive reports of its Q3 earnings report.

74.1% of the premium traded at these premium levels are in bullish bets, with 56.8% as bid-side orders, and 63.7% are in put premiums.

To view more information about LAZR's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.