Unusual Options Activity in Baidu, Inc. (BIDU), Skyworks Solutions, Inc. (SWKS), and Sunrun Inc. (RUN)

Unusual Options Activity in Baidu, Inc. (BIDU)

Today, November 01, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity in Baidu, Inc., which opened at $166.73.

There were 2,000 contracts traded on the $182.5 strike call option, bought to open at the ask, dated for November 19th, 2021.

Altogether, these contracts represent approximately 200,000 shares and $394,000 in premium traded.

These orders come after reports from Yingzhi Yang and Brenda Goh of Reuters that Baidu, Inc. has named Luo Rong, former chief financial officer (CFO) of tutoring firm TAL Education Group, TAL.N as its new CFO..

As seen, bullish premium accounts for 72.3% of the options chains, with 62.9% of ask-side orders and 79.7% being in calls.

To view more information about BIDU's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Skyworks Solutions, Inc. (SWKS)

Again, in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity in Skyworks Solutions, Inc. (SWKS), which opened at $167.31.

There were a total of 450 contracts traded on the $160 strike put option, bought to open at the ask, dated for November 5th, 2021.

Additionally, there were another 450 contracts traded on the $165 strike put option, sold at the bid, and for the same date.

Altogether, these contracts represent a put credit spread, approximately 90,000 shares, and $268,000 in premium traded.

These orders come in after John Ballard of The Motley Fool reported that Skyworks Solutions, Inc.:

As seen, bullish premium accounts for 64.1% of the options chains, with 55.1% as ask-side orders, and 66.1% in put premiums.

To view more information about SWKS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Sunrun Inc. (RUN)

Finally, and again in the NasdaqGS, we saw unusual or noteworthy options trading volume and activity today in Sunrun Inc. (RUN), which opened at $58.59.

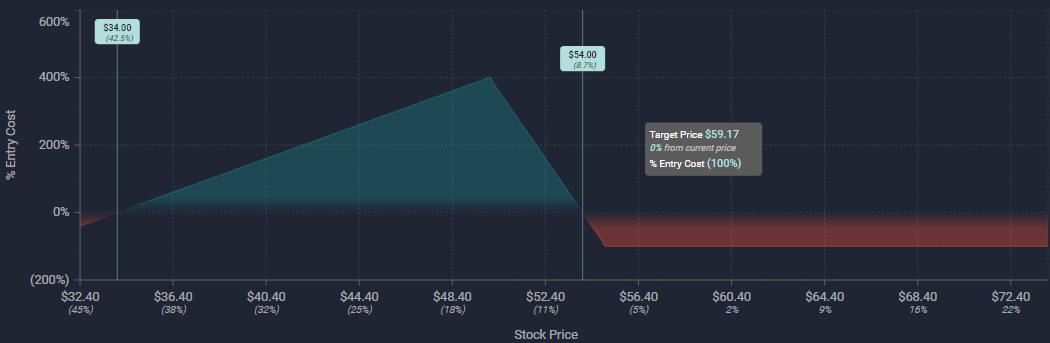

There were 4,000 contracts traded on the $55 strike put option, bought at the ask, dated for November 19th, 2021.

Additionally, there were 5,000 contracts traded on the $50 strike put option, sold to open at the bid, for the same date.

Altogether, these contracts represent: a ratio put debit spread (with a maximum profit achieved at the $50 spot price at expiration), approximately 900,000 contracts and $1,147,000 in premium traded.

These orders come after BNK Invest’s report revealing that Sunrun Inc.’s low point in its 52 week range is $37.42 per share, with $100.93 as the 52 week high point.

This strategy would cost $400,000 at the time of entry to open, with a maximum loss of $3,400,000 if and only if $RUN’s stock price collapsed to $0 by expiration, and a maximum profit of $1,600,000 if $RUN ends at $50 at expiration.

To view more information about RUN's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.