Unusual Options Activity in Bausch Health Companies Inc. (BHC), Uranium Energy Corp. (UEC), and ContextLogic Inc. (WISH)

Unusual Options Activity in Bausch Health Companies Inc. (BHC)

Today, March 17, 2022, in the NYSE, there was unusual or noteworthy options trading activity in Bausch Health Companies Inc. (BHC), which opened at $23.01.

- There were two sets of 7,500 contracts traded on the $20 strike call options dated for March 18th, 2022 and April 14th, 2022. Of note, the original orders were canceled, seen in the image below, and these were marked as floor trades.

- The March 18th, 2022 contracts had a bid-ask spread of $2.81 to $3.35 and traded at a price of $3.25; the open interest on this chain was approximately 31.5K.

- The April 14th, 2022 contracts had a bid-ask spread of $3.40 to $3.80 and traded at a price of $3.70; the open interest on this chain was approximately 51.3K.

- Therefore, it cannot be known whether these orders were being opened today or rolled, but the size and premium traded was noteworthy.

- Additionally, these orders come after Zacks reported that shares of the drugmaker had lost 10.23% over the past month. This has lagged the Medical sector's loss of 1.34% and the S&P 500's loss of 5.01% in that time.

Please note, trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market. Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

As of this writing, Bausch has had 33,276 calls traded, which is 145% greater than its 30-day call average.

To view more information about BHC's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Uranium Energy Corp. (UEC)

In the NYSE, there was unusual or noteworthy options trading activity in Uranium Energy Corp. (UEC), which opened today at $4.00.

- There were sweep-to-fills traded on the $7 strike call options dated for May 20th, 2022.

- The overall volume on this chain has been approximately 7.9K and the open interest on the chain is 1.8K; therefore, it may be intuited that these orders are being either bought or sold to open, not to close.

- The spot price of these orders were at $0.25 and the bid-ask range on the chain at the time was $0.15 to $0.25.

- Additionally, these orders come after Motley Fool explained why uranium has been taking a hit as of late

As stated, these orders were marked as a “sweep”. An options sweep (or sweep-to-fill) occurs when a broker splits an order into many parts in order to get the best possible pricings currently offered on the market.

- These orders can often be filled across multiple exchanges and the broker will continue to fill the order lot by lot, always for the best possible price, until the order is completely filled.

- Sweeps might stand out because they imply some entity (or entities) wanted to enter specific options contracts regardless of their price, as they were focused only on having their entire bulk order filled as quickly as possible. While the magnitude of sweeps might stand out, each one must be investigated thoroughly to understand what the sentiment of a trader is as compared to the overall flow.

Finally, these orders were also spotted on the NEW Unusual Whales hottest chains tool. As seen, the contracts had an acceleration factor of 0.87, implying there was a rapid increase in trading activity over open interest on this chain.

To view more information about UEC's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in ContextLogic Inc. (WISH)

Finally in the NasdaqGS, there was unusual or noteworthy options trading activity in ContextLogic Inc. (WISH), which opened today at $1.77.

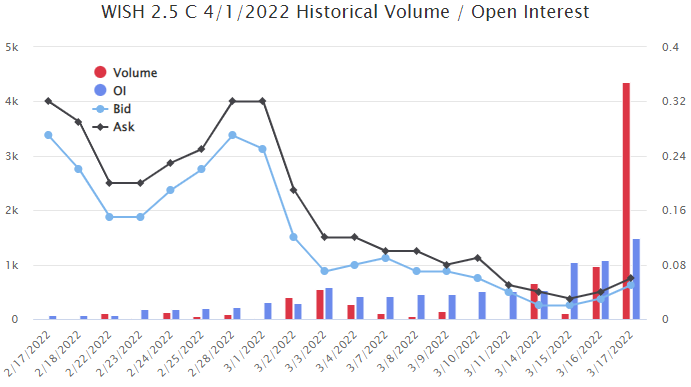

- There were 1,764 and 809 contracts traded on the $2.5 strike call option dated for April 1st, 2022; this chain has a bid-ask spread of $0.04 to $0.05 and represents a 23.8% price difference from ContextLogic’s underlying stock price, having opened at $1.77 today.

- The overall volume on this chain has been approximately 3.7K, so therefore it may be intuited that these orders are being bought or sold to open, not to close.

- Additionally, these orders come after the Motley Fool laid out “5 Red Flags for Wish's Future”.

Again, these orders were also spotted on the NEW Unusual Whales hottest chains tool. However, be mindful, as the bid-ask range on this chain is so tight, it cannot be necessarily known as to whether they were indeed bought or sold.

There was not enough open interest so that today's volume could be closing these contracts, so it may be intuited that the excess volume today are being bought or sold to open, not to close.

To view more information about WISH's flow breakdown, click here to visit unusualwhales.com.