Unusual Options Activity in Box, Inc. (BOX), Intel Corporation (INTC), and Del Taco Restaurants, Inc. (TACO)

Unusual Options Activity in Box, Inc. (BOX)

Today, December 07, 2021, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Box, Inc., which opened at $26.28.

- There were 3,000 contracts sold to close on the $28 strike call option dated for January 21st, 2022.

- These contracts were rolled out to a further expiration for March 18th, 2022.

These orders come after Demitri Kalogeropoulos of The Motley Fool explained “Why Box Shares Rose 8% This Week”.

As of this writing, Box, Inc. has had 6,329 calls traded, down from December 1st’s volume of 20,086, but still is 253% greater than its 30-day call average

To view more information about BOX's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Intel Corporation (INTC)

Within the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Intel Corporation (INTC), which opened today at $54.66.

- There were 1,000 contracts traded on the $59 strike put, sold to open at the bid, dated for January 14th, 2022.

- There were an additional 1,000 contracts traded on the $54 strike put contract for the same date.

- Altogether, these contracts represent a put credit spread, a bullish strategy, and approximately $1,157,000 in premium traded.

These orders come after Nivedita Balu and Chavi Mehta of Reuters reported that Intel Corporation “shares surge on potential windfall from Mobileye listing”.

65.1% of the premium traded at these premium levels are in bullish bets, with 59.5% as ask-side orders, and 75.7% are in call premiums.

To view more information about INTC's flow breakdown, click here to visit unusualwhales.com.

Looking Back at Unusual Options Activity in Del Taco Restaurants, Inc. (TACO)

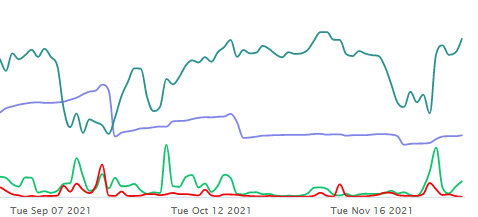

Finally, on November 29th, 2021, in the Nasdaq Capital Market (NasdaqCM), we saw unusual or noteworthy options trading volume and activity in Del Taco Restaurants, Inc. (TACO), which opened at $40.03.

We are reporting on these contracts as Richika Biyani at TipRanksrecently reported "Jack in the Box to Acquire Del Taco Restaurants For $575M"

As we know, somebody always knows. And on the Unusual Whales blog we regularly report on such potential insider knowledge.

The contracts traded on the 29th were a series of $10 strike call options, bought at around 11:56 EST. These were not significant in their premiums, as the contracts themselves were only $0.15 - $.30 in their spot prices.

However, the volumes upon them were considerable, and out of the money by a significant degree (at the time, Del Taco Restaurants, Inc. was trading at $7.77).

While any trader or entity can take any position at any time for a variety of reasons, these were noteworthy and significant, and just another proof that somebody always knows.

Today, December 07, 2021, Del Taco Restaurants, Inc. is trading at $12.55.

69.3% of the premium traded at these premium levels are in bullish bets, with 59.8% as ask-side orders, and 74.1% are in call premiums.

To view more information about TACO's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.