Unusual Options Activity in BP (BP), Guess, Inc. (GES), and Freeport-McMoRan Inc. (FCX)

Unusual Options Activity in BP (BP)

Today, February 08, 2022, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in BP, which opened at $33.46.

There were a series of orders in the number of 20,713 contracts traded, each with their respective sizes and volumes greater than the open interests on their chains:

- $35 strike call options dated for June 17th, 2022 bought to open above the ask at $1.53 with a bid-ask spread of $1.36 to $1.41.

- $34 strike call options dated for April 14th, 2022 bought to open above the ask at $1.27 with a bid-ask spread of $1.12 to $1.17.

- $39 strike call options dated for April 14th, 2022 bought to open at the ask at $0.24 with a bid-ask spread of $0.22 to $0.25.

- $27 strike call options dated for April 14th, 2022 sold to open below the bid at $0.32 with a bid-ask spread of $0.35 to $0.38.

- And finally, another set of $27 strike put options sold to open at the bid, but instead of June 17th, 2022.

Of note, a $40 strike call option dated for June 17th was canceled: trades that are struck through have been canceled for one reason or another. Trades can be modified or nullified for a variety of reasons, and per the SEC: for the maintenance of a fair and orderly market. Exchanges can erroneously send more trades than were actually placed, especially during times of high volume. This is a normal occurrence.

These orders come after RTTNews reported: “BP Q4 Profit Surges On Prices; Sees Flat Production In FY22; Plans Dividend, Buyback”.

Additionally, these orders were first found via the Unusual Whales Options Flow Alerts page:

Of interest, these orders were marked as “floor”. Floor traders work on the floor of an exchange. When a floor trader executes a trade, exclusively for their own account, it must be reported on an exchange by the "floor" tag.

Click here to read about floor traders' performance. Here is a snippet:

“More interestingly, we found that floor traders do not bet on crazy far OTM calls. Instead, most of the purchased weekly calls are ~10% ITM, with about a 40% chance to turn a profit. And when it comes to OTM calls, nearly half of these trades end up making gains and roughly a third of them can hit 50% and above.”

To view more information about BP's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Guess, Inc. (GES)

Again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Guess, Inc. (GES), which opened today at $21.76.

There were 1,250 contracts traded for each leg of the order and they were all dated for June 17th, 2022:

- Two sets of $25 strike call options bought to open at the ask of $2.45 with a bid-ask spread of $1.75 to $2.45.

- Two sets of $30 strike call options bought to open at the ask of $1.27 with a bid-ask spread of $0.60 to $1.30.

- The open interests on these chains were 66 and 4 respectively, so we therefore can intuit these contracts were all opened.

A tip from the flow: Trades appended with a briefcase emoji can be intuited as bought or sold to open. This determination is made if the size of the trade was greater than the chain's open interest.

Only trades that can be positively identified as being bought or sold to open will be marked as such (with the briefcase). Furthermore, just because these orders were indeed opened, it cannot be absolutely known whether these calls were sold to open or bought to open.

These orders come after RTTNews reported: “Legion Urges Guess Board To Remove Co-Founders Over Allegations Of Sexual Misconduct”.

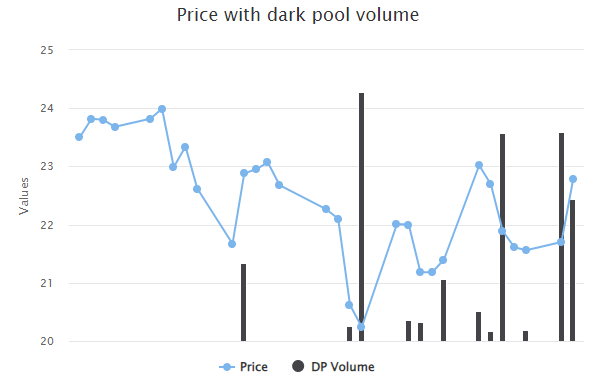

Yesterday saw a historical high of 358,489 transactions on the dark pool, which was approximately equal to a previous high on the 2nd; only January 21st saw more volume at 427,506 transactions. Today, already, 243,200 dark pool transactions have taken place.

To view more information about GES's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Freeport-McMoRan Inc. (FCX)

Finally, and again in the NYSE, we saw unusual or noteworthy options trading volume and activity in Freeport-McMoRan Inc. (FCX), which opened today at $39.17.

- There were cross orders on the $41 and $43 strike call options dated for April 14th, 2022 traded at their ask prices.

- The size of the $41 strike orders was 3,000 contracts and the $43s were 2,500 contracts traded.

Additionally, these orders come after our previous reports on unusual options activity in Freeport-McMoRan.

70.9% of the premium traded is in bullish bets, with 75.6% of the premium traded is in calls, with 84.2% as ask-side orders.

The put call ratio for Freeport-McMoRan is 0.553, which is bullish.

A tip from the flow: The put/call ratio (P/C) is put volume divided by call volume. Put/call ratio is important and can be an indication of sentiment shifting. A P/C greater than .7 means more puts are being bought than calls, so the trend is getting bearish. A P/C of .7 to .5 is becoming more bullish. (This distinction is made because more calls are often traded than puts, so a P/C of 1 is outside of the median.)

To view more information about FCX's flow breakdown, click here to visit unusualwhales.com.

For more information on unusual options activity, subscribe to the Unusual Blog or visit unusualwhales.com.